Market Analysis

Equity markets in “Extreme Greed” territory as sidelined capital rushes in. Media is printing “soft-landing” for US, “hard-landing” for Canada as it fights with inflation.

I’m seeing more “temporal inflation” dialog again, just that the timing was off.

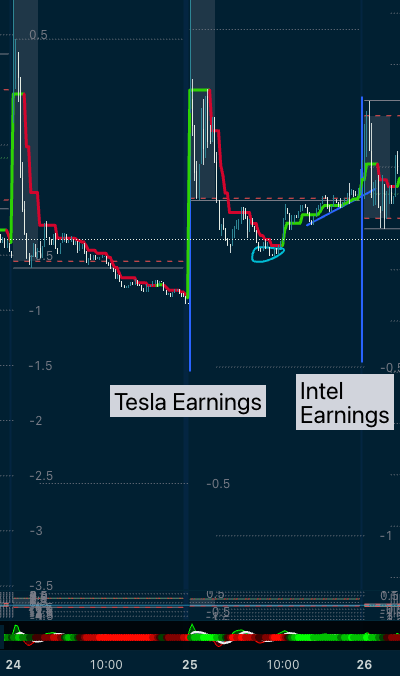

I’ve been playing the rally, but now that the media is starting to print it, it’s time to get a bit defensive. Intel and Tesla each dropped 10% on earnings reports.

I think earnings season will snap some sense back in the market but the media prints optimistic news. Brutal. Don’t get fleeced. Election season now, which is historically bullish as nobody wants the markets sinking while trying to get elected. Fed gets dovish in communications, pats themselves on the back.

Trading Plan

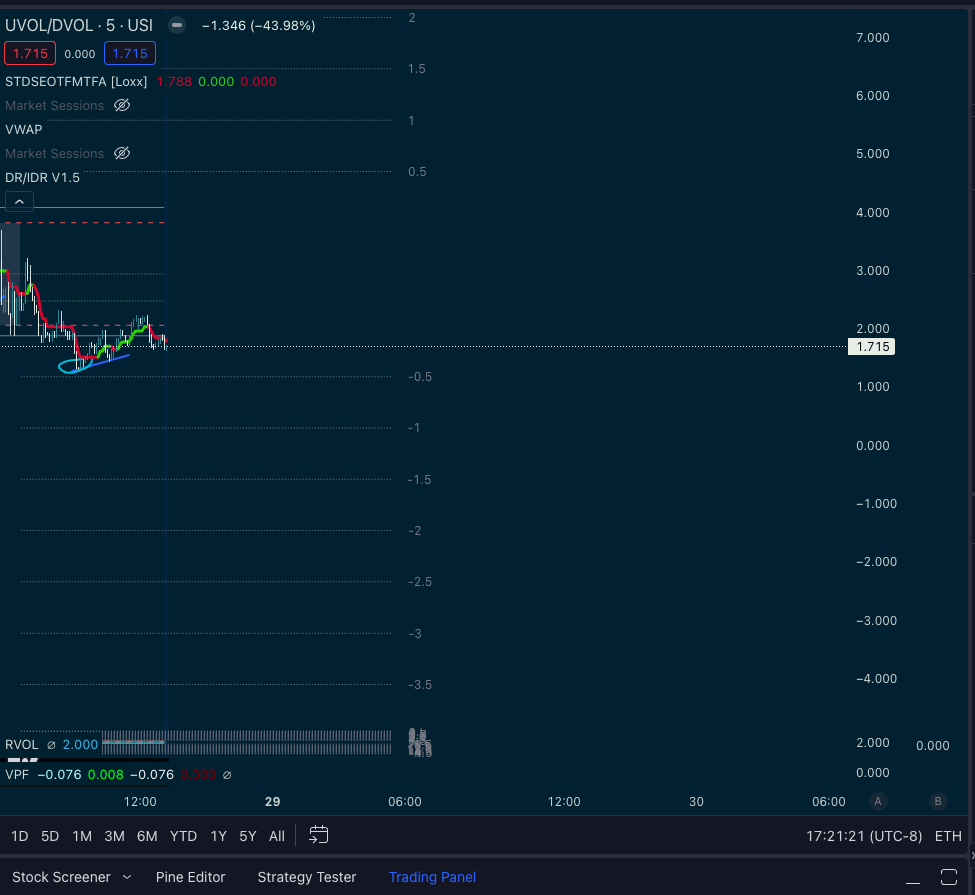

I’ve been taking trades in the afternoon a lot lately as the market is running. There has been a general cycle of buying end of day in NYSE hours, lifting through Europe hours, and then seeing NYSE exchange sell volume in the AM. I’ve highlighted lunch (12pm ET) here on NYSE VOLD ratio.

You can see a general drift up into the afternoon. On TSLA earnings report, the market sold into close and then TSLA dropped 10%. Intel had good earnings but bad guidance so repriced down the next day as well – you can see the sessions here.earnings were after the bell.

Today had another similar cycle of AM sell volume and a rise after lunch:

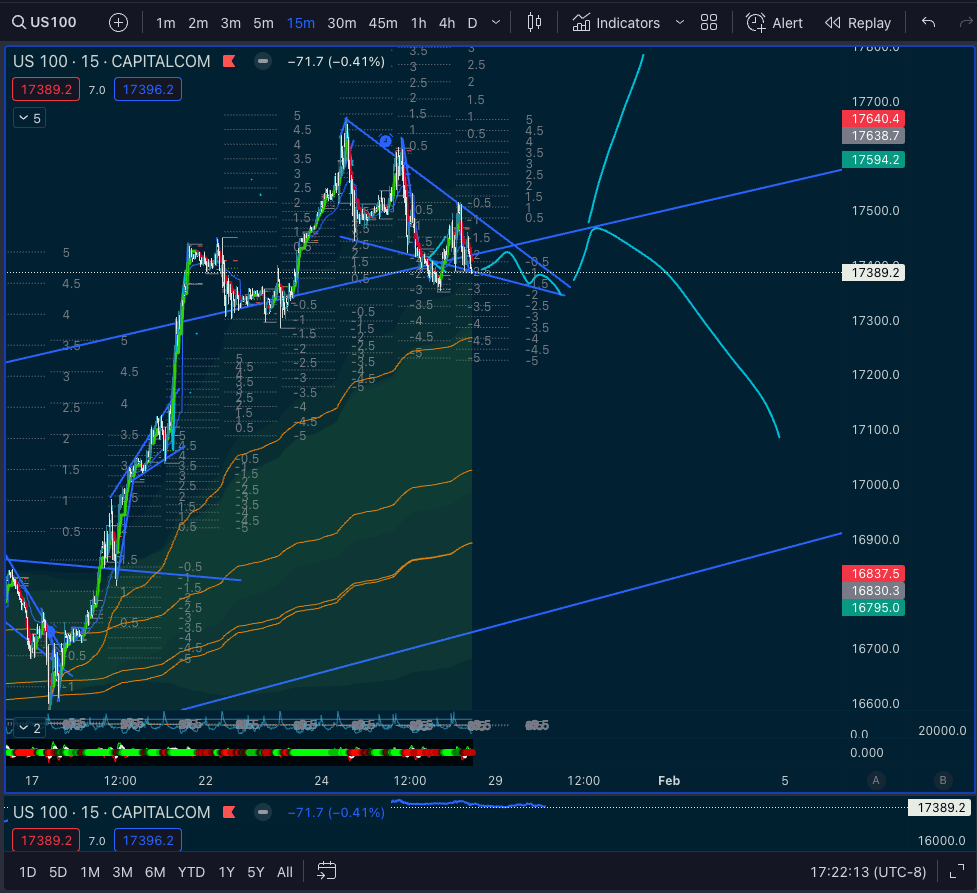

The price of indices doesn’t necessarily move with exchange volume, but it shows where the money is moving. VOLD has been steady slightly buy side, so I’m looking for a day that has a really low or high VOLD to make a large order to catch the next move. The setup on Nasdaq isn’t nice right now, pressing into the high timeframe trend in a wedge. You can see VWAP from different anchor points under the current price (CPI, PPI, etc.) The highest is of interest to me especially, and I suspect we’ll get close to it before volatility starts to increase again. Note that VWAP is anchored on the recent low apx Jan17.

I expect sunday Night into Monday’s session that Asia/Europe will lift the Nasdaq, NYSE session will sell in the AM, and maybe we’ll get a bounce up to try to hold for a run. If the run fails, I’ll trade it to the short side towards 17000. It might take until Tuesday to find clarity, I’ll try to avoid taking many trades until it’s very clear.

I don’t like trading this setup, I’ve seen it before. People will want to trade the head and shoulders on the sell side, but the high timeframe is stronger and will find buyers, so it’ll likely be a volatile mess. It’ll be hard to find an entry, but if we can get one, it should be good for a big move.

That’s my plan for next week. Hopefully we can ride the big move through the week if we get it.

Get it!

Leave a comment