The idea from the start of this journey was to learn by direct experience so that I would understand how a trader thinks and sees the world. I needed to be a trader to get that. And now I have it – it’s time to stop. I learned a lot more life lessons than I expected along the way – it’s been amazing. But it’s time for change.

Out of the isolation, and back to the world and life. I’ve seen the insanity of maya up close and personal. I’m starting to meditate in the mornings instead of filling my head with the macroeconomic picture and price data. It’s honestly great. I’m happy to be making this shift – I feel like kissing the ground after riding the risk-raft for years. I took SOOOOO much risk on, I had a contract get cancelled that I was banking on being a couple years, and it took me around 9 months to get from resume building (I built an agent to help) to working my first day.

I’ve given this a lot of thought. I had recently spent some time testing strategies for early morning NYSE open trades (6:30am-8:30am PT.) My intent was to get in a rhythm for work days to get a trade in before closing shop and getting on at work. I checked for profitability and can see I’ve got the skills to play the intraday seasonality. But I have come to the conclusion that splitting my focus isn’t a good idea anymore. I will actually stop day trading completely for the foreseeable future.

When you have a team and an organization that have hired you, you owe your best thinking to them. I have taken huge risk on in the last 4 or 5 years to gain all of this incredible knowledge/skill. it makes me really appreciate being in the job market and finding a dream role. I chose to go back to the job market – I’m going to give everything I’ve got to it.

The best thinking I do is in the shower often, or overnight while I’m sleeping. That’s where I’m often solving hard problems. If I’m trying to read the markets and also think about work, then my attention isn’t fully in either problem spaces and I won’t be effective at either. If I’m waking up early to take shots at open, then my attention is already spent by the time I start work and I’ve given up some sleep.

I’ve gone through this, tested it etc. At past jobs I would wake up and trade open, and I’d have very effective work days. But they weren’t the BEST work days – it is sub-optimal. Your mental real-estate is limited, our working memory is limited, our attention is limited, so if you’re splitting your days, you have less to dedicate to each piece.

I know a lot of people do it – HumbledTrader on YouTube is someone who lives in Vancouver and trades NYSE open before a workday. I think software can be demanding – you want to have the space to hold the context. And that’s something you don’t want to compromise on.

I’m closing one chapter of my life here. I spent 15k or 20k hours of screen-time learning how to trade effectively on small time frames. Trading on small timeframes was important to be able to get a lot of experience fast. In four years I’ve culminated decision making ability in the top percentile. I have it for life. I can step back and put it to use in positioning as an investor.

The plan was never to be a day trader for life. I got sucked in by how good of a game it is. It’s a very good game. It reminds me a bit of Magic the Gathering.

I’ve been through the market cycle and I’ll be able to manage our investments better than most any financial advisors. I no longer need to grind daily in the markets and it’s detrimental to do so for me.

I really put everything I had into this – years of learning. It was an amazing experience that taught me about all areas of life and especially self-management and risk-management.

I started to port some of the self management concepts I used in trading to improve my performance by shaping my behaviour, and I’d like to continue down this road. I want to take everything I learned that it takes to be that top percentile trader, and apply it to becoming peak at other areas in life. I think my relationship with Ash is demonstrable proof that applying the skills learned in trading to all areas in life yields results. Going through those cycles of review/reps on experiences just starts to sort of “happen” and you adjust. I remember I used to get irritable or dissociate and not communicate. I don’t even recognize myself anymore relative to a past self. I’m imperfect but I’m willing to work with what’s in-front of me and work with it.

The work I’m going to be doing is very interesting to me. I can just give my mind to that completely now. I can see when to pull out of the markets and when to go bargain hunting – those skills are for life and I’ll do well with them. Day trading is too hard/competitive – the markets shift and change and maintaining consistency is not worth the input for me anymore. The idea for me is that I’m making a conscious change to go back to work in an office after years of the “torture” of near-total isolation. And I’m so appreciative of this, and I will embrace it fully. The isolation that comes with day trading is not good for me _at all_ and so instead I want to bring all of the things I learned to my life in new ways. Create experiences with people. Contribute effectively to society and an organization instead of just sitting in the echo chambers of isolation with a news feed filled with war and strife.

A good example of how I can “port” some of the learnings from trading is here:

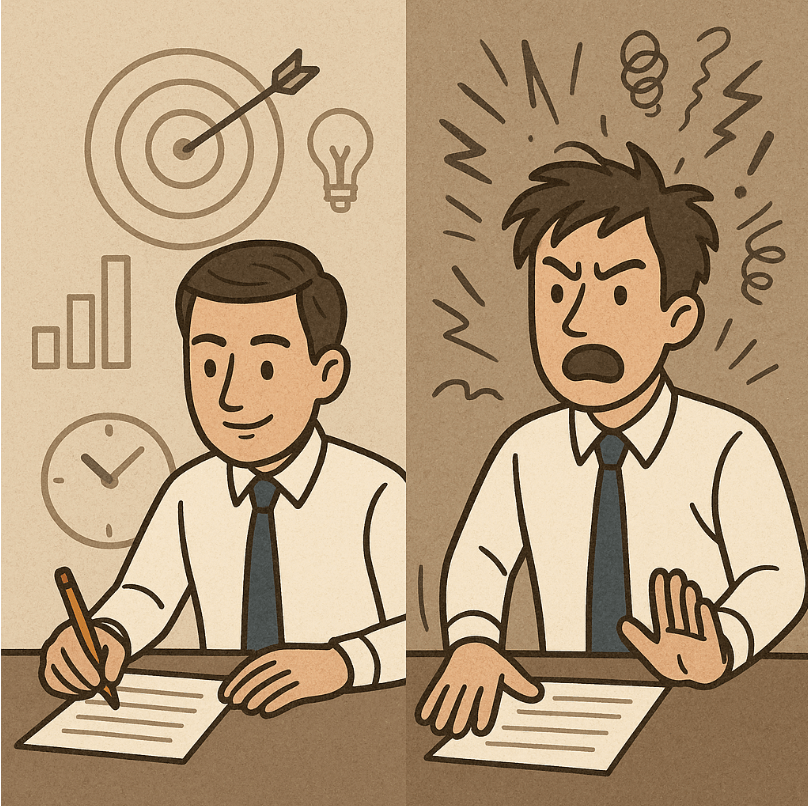

I started to port the behaviour modification research I did to more general areas of my life. So I started to build a deck of cards this week that encapsulate what are effective behaviours and the outcomes. The fundamental concept is that your thinking brain isn’t great at changing a behaviour and sticking to it. Writing a checklist or reminder to stick to a behaviour isn’t very effective. Instead you can tap into your limbic system more directly to use fear/greed to “get it through your head” – even if you’re tilted seeing the emotional tone and non-verbal cues helps to grab your attention and you can make immediate adjustments to your behaviour. Here is “plan and prepare” instead of “react and distract.”

These will work even better if you can inject yourself into them more, give them more emotional tone that works for you. Like, put your face through an “old filter” and use it on all of the negative outcomes so that it really hits home. You’ll see yourself being unhealthy, it’ll really jab into your mind. For me, these work so much better than words.

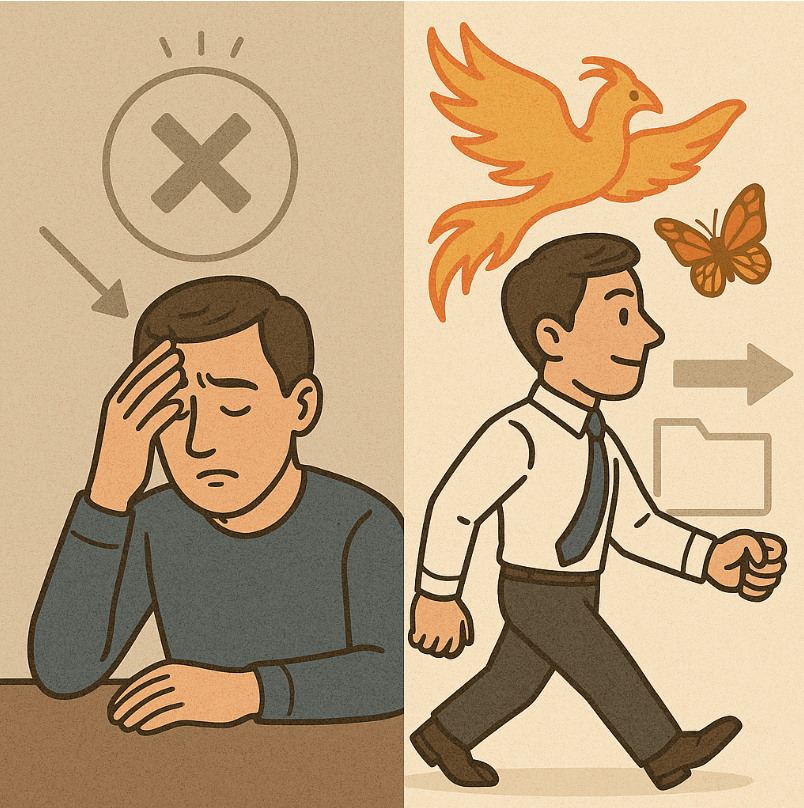

I’ve studied the Mahayana lojong practices that come from Atisha’s Lamp (see: Chogyam Trungpa – Training the Mind and Cultivating Loving Kindness, or Pema Chodron – Start Where You Are.) These focus on slogans, like “don’t talk about injured limbs (other’s faults.)” You can reflect on these slogans, and pick one up every day, but unless you connect those with outcomes if you do them, and outcomes if you don’t, they may not end up influencing your behaviour. You’ll get caught up one day, and you might start shit talking someone because you’re all activated. If you can sit with a picture of the outcomes of if you do or don’t, you can get the space to change your behaviour. And if you don’t, at least you’ll have the tools and concepts to do reps on the failure.

That’s what this one is – “reflect and reps” instead of “moving on to the same mistake.” Hard to show that – I’ll iterate on some of these.

These are crafted just for me, and they’re based on fundamental truths I know about performance. They’re going to be on my desk, and it will ensure it’s always front of mind, and that I’m practicing good behaviours. Check lists don’t work, they are not good tools for reinforcing and shaping behaviour. Putting all of the time I would be spending honing my trading craft into building myself into the most excellent engineer I can is just as satisfying, and the game is every bit as hard and rewarding as being a top notch trader.

A part of my role is to influence the culture around me, as so I’ll work to embody these concepts (amongst others I have on deck) and see if I can’t become the pinnacle of a performant software person.

I’ll manage my portfolio, but I don’t want to be shooting at intraday moves, it’s way too hard and requires way too much mental capital that I could spend on building myself and the people directly around me up.

Leave a comment