Named after Mike Bellafiore, co-founder of SMB, the Bella Fade is a scalp play that fades a trend break. The rules are fairly simple:

- Enter two lots on a trend break. Higher timeframes with better confluence on entry will produce better outcomes. Eg a symmetrical triangle breakout will produce better results than a 10 minute retracement. Lines should be clean and clear.

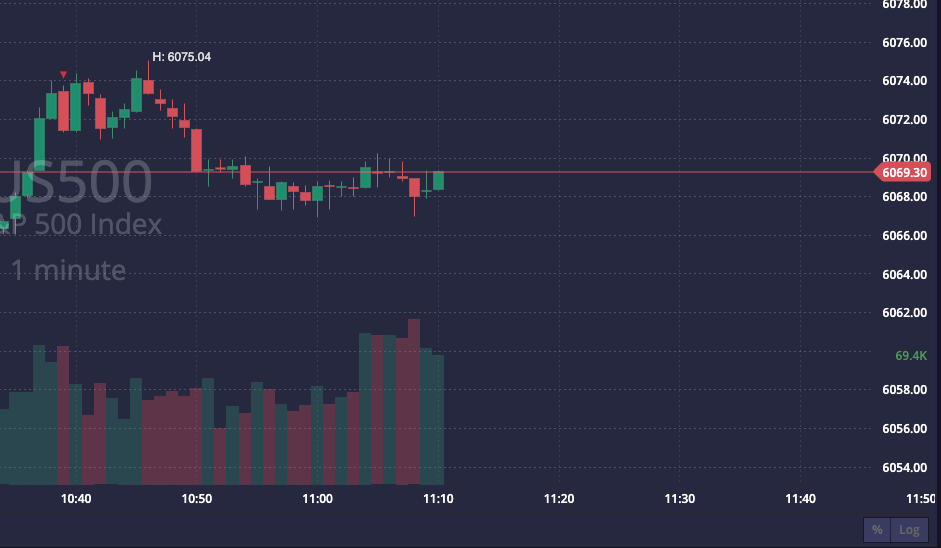

- Take one lot off at the first symptom of consolidation.

- Take the second lot off at the second symptom of consolidation.

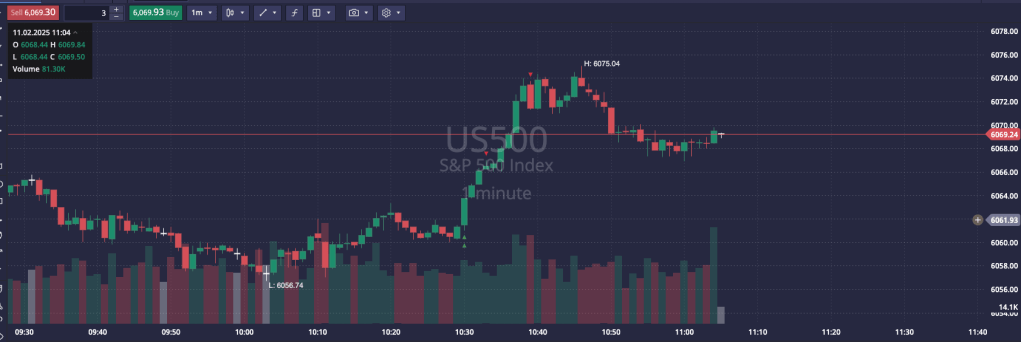

This aims to catch two legs of movement. Here is a broker image of entries and exits on a higher timeframe trend break, and you can see both exit points.

This is a scalp, you’re on 1m or 2m timeframe. Bet hard and close the trade fast if it goes against you. I’ve been forward testing this and am now trading it live, it works.

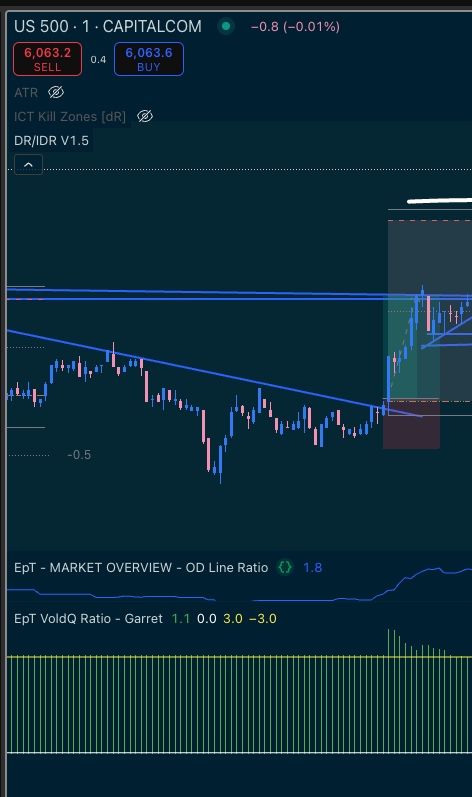

Confirming indicators:

In a negative gamma exposure environment, the trades are especially easy so fade downtrends to find the easiest setups. If you see the gamma exposure flipping, long the downtrend on break, and the market markers will do the work of lifting the price.

The hardest part of this setup is the time of day, because the trend break can come immediately before market session open.

You’ll see in the above example a trade I skipped simply because the time of day, but you just have to go for it – even if it’s a minute or two before market open, just swing at it. You have a high timeframe downtrend that breaks a minute before market open, swing the bat – it’s a strong setup, and it works with high probability.

What not to do:

A trend on a 1m chart is not a target for this trade, skip these breaks. Look for strong clear lines on higher timeframes, and treat them as scalps. 1m or 2m timeframe for entry/exit decisions, 5m or 1h for spotting entry.

Leave a comment