Lesson: If you can scalp, you can always make money. Any day, any conditions. You can always scalp, it will always work, you will always make money. Big opportunities may be missed if you ignore the conditions, but you will always win if you scalp. Always. The further out in the future you go, the wider the spread of probable outcomes. Catching a 5 minute move is easy. Catching a 30 minute move is hard.

Today I caught a couple quick scalps – minutes. I scrubbed back over a couple weeks of trading and have found that I have more unrealized PnL lost than I do captured, which signals a major issue with my trading. I wrote another article up about how I was round tripping trades, and the solution to that was for longer duration trades to exit in partials at every spot I thought I’d see sellers.

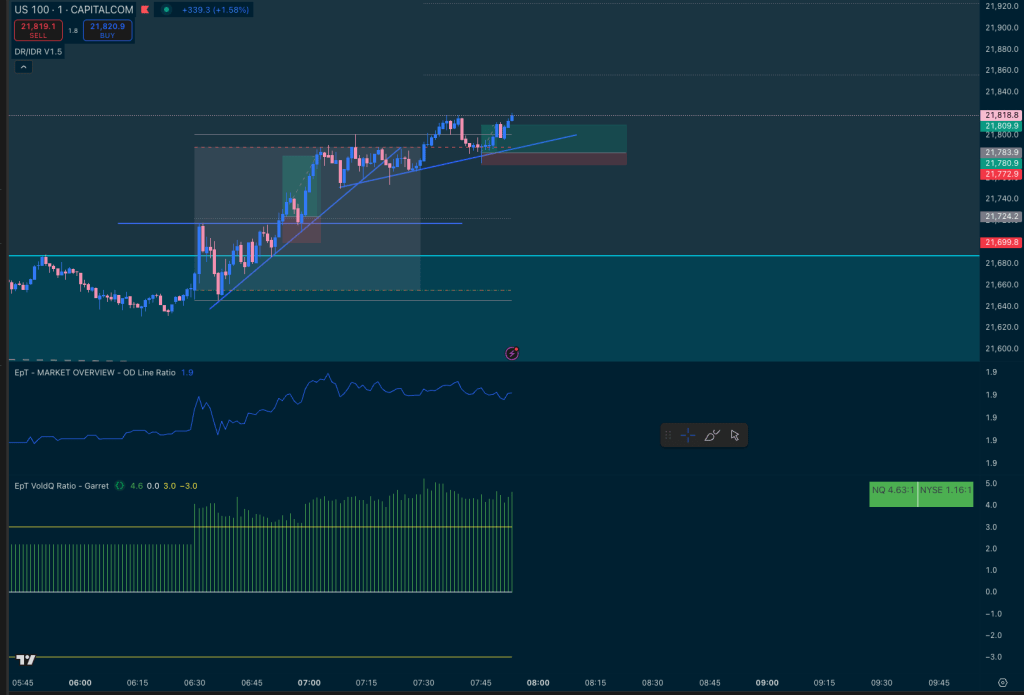

If you can find really clean entries consistently, then you’ve got the game won already, it’s just a matter of taking the profit off! Holding and hoping is not a good exit strategy and will butcher your account over time. I have so much sand at my feet from wins slipping through my fingers. So I made a conscious decision yesterday to switch to aggressive profit taking stance. I need to start by saying that it should be condition dependent – you likely want to be trend following on really strong days. Today is a good example where scalping is a worse strategy than trend following, with VOLDQ ratio staying over 3 the session – it’s likely to be a trend day.

If you want to trade a trend, you can still have a “scalping first” strategy by entering in 3 lots, and taking the first one or two at scalp targets (eg first sign of exhaustion. I use breadth for indices to spot divergence between the underlying markets and price.)

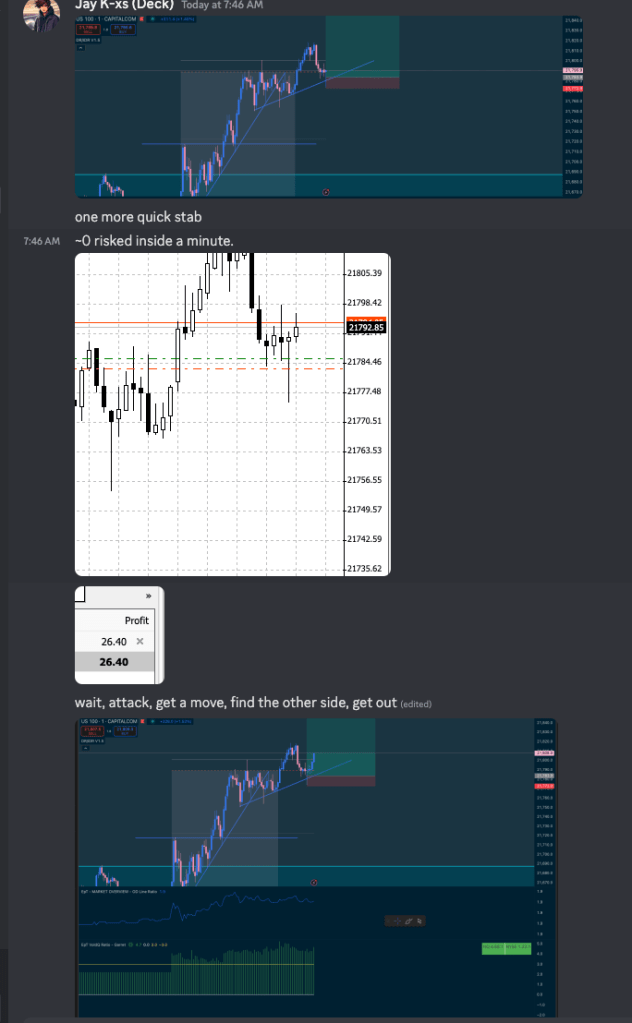

But by ensuring that you’re popping lots off on trades, you’ll never have to worry about periods of drawdowns – you only need to manage your psychology to ensure that you’re firing at extremely high quality entries. A good heuristic is “how fast can I 0 risk this.” If you are 0 risking a trade sub minute consistently, then you are getting the very best quality scalp entries. If you are 0 risking within 5 minutes, it means your entries can’t have as much weight, so a good target as a scalper is to write down each trade and then look back on your day to see which trades you 0 risked sub minute, and which you took drawdown on before being able to zip up the risk. You’ll see two scalps I took today. The first I added into for 12 contracts and took the profit quick on the move. The second entry was a sub-minute 0-risked position, waiting for the very last possible minute to enter. That one I should have held. Always aim to enter in pieces – if the entry is perfect make sure you rapid fire in 3 lots. This takes planning – set your position sizing at something like 10 units of risk and aim for 30 units of risk with fast profit taking. If I trade 1-3 contracts/lot on a usual entry, I’ll trade 5-10 contracts/lot on a session I’m trying to scalp. If I really see it, then I’ll be looking at 10-30 contracts/lot – that’s the once a month all the stars aligned A+ setup.

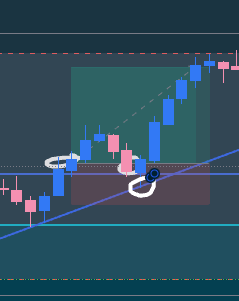

Rate each position quality as you enter. If you have a lot of screen time, you know how the market generally moves. The first entry I expected a wick to stab back down so I just improved my entry size by averaging. Often times if I do this I’ll actually close the original entry at b/e to shift the average entry lower in order to improve the risk/reward of the trade at the expense of size. But if you average into 3 entries and then close the worst two as soon as they hit break-even, then you’ve gotten a perfect entry that’s easy to hold for longer. For scalping this might be less important, you’re looking to get as many coins out of the coin box as you can in a short period of time so if you’re seeing the movement, you’re there and watching, so you can pull it off when you see fit, but take the worst of the entries off first so that the later entries are easy to hold if you decide you want to “hold and hope” with the last portions of the trade.

Can see one of the entries got a bigger lot, because I was snapping off the higher risk portions on the way up in the move. I’m just practicing this as a cornerstone of my practice, once I measure and see that I’m getting the best quality entries and my win rate is in shape, I can size these up quite a lot. But 15 minutes in and out and not being glued to the screen is what I’m aiming for.

The second trade I didn’t scale into hard enough – I was already mentally done but I saw the opportunity and couldn’t pass up taking a shot at it. I should have left this one on but you can see this one is zipped up to 0 risk within a minute. This is an extremely good example of an A grade scalp entry, confluence on DR high at the top of the hour, previous resistance as support, and a trend line. A wick drops through the trend line and I grab the entry immediately and close the risk up before the next one min candle closes. I think I only took 3 contracts on it, it warranted a lot more but I was getting gym close on when I saw it so my focus wasn’t 100% dialed in to take a big trade.

The refinement to this is that a trend day as shown, with outlier VOLD ratio and all the signals there to confirm the trend, you don’t want to be scalping, you want to maximally capitalize on the opportunity, so check the “weather report” in the breadth of the market, and be prepared for trend days. The scalping strategy ensures you can always net gains, but on trend days you will want to flip the script to add, not remove.

Leave a comment