Okay, let’s be honest, we’ve all been there. That glorious moment when you enter a trade, and BAM! Green flashes across your screen. Euphoria sets in. “This is it,” you think, “this is the one that’s going to pay for that [insert aspirational item here – new laptop, vacation, early retirement dream].” You start mentally spending the profits. You might even pat yourself on the back for your amazing analysis.

Then, slowly, agonizingly, the price starts to wobble. It retraces a little. “Just a breather,” you tell yourself, “it’ll push higher.” But the breather turns into a full-blown marathon in the wrong direction. Tick by tick, point by point, the beautiful green numbers dwindle, shrinking back towards the dreaded break-even line. And sometimes, if you’re really unlucky, it even dips into the red.

We’re talking about the infamous round trip trade. It goes into profit, makes you feel like a genius, and then… circles back, leaving you with nothing but frustration and the bitter taste of opportunity lost. And trust me, I know the taste well. Lately, it feels like I’ve been running a round-trip express train, watching thousands of dollars evaporate into thin air as trades that were gloriously profitable just moments before, slam back to break-even.

It’s soul-crushing, isn’t it? You were right about the initial direction! You nailed the entry! But somehow, you walk away with zero, or worse, a small loss due to commissions. It’s enough to make you question your entire trading strategy and consider taking up basket weaving. (No offense to basket weavers, of course, I’m sure it’s a very fulfilling hobby).

But before you throw in the towel and start researching yarn types, let’s talk about solutions. Because while round trips are an inevitable part of trading, we don’t have to be passive victims to them. We can fight back, adapt, and hopefully, start locking in some of that sweet, sweet profit.

The Root of the Problem: Greed and the Quest for “More”

Let’s be brutally honest with ourselves. Often, the round trip happens because of greed. We see the profit building and get fixated on maximizing every single pip. We think, “It’s going higher! I can squeeze more out of this!” And while aiming for big wins is admirable, it can blind us to the reality unfolding on the charts. We become so focused on the potential profit that we ignore the actual profit that’s already in our account.

This is especially true when you’ve had a string of break-even or slightly losing trades. You’re itching for a win, and when one finally comes, you want to make it a big win to compensate. This emotional pressure can lead to holding onto trades for too long, ignoring warning signs, and ultimately, riding that profit rollercoaster right back to square one.

Fighting Back Against the Round Trip: Strategies to Consider

So, how do we break this cycle of agonizing round trips? Here are a few strategies I’ve been experimenting with, and you might find helpful too:

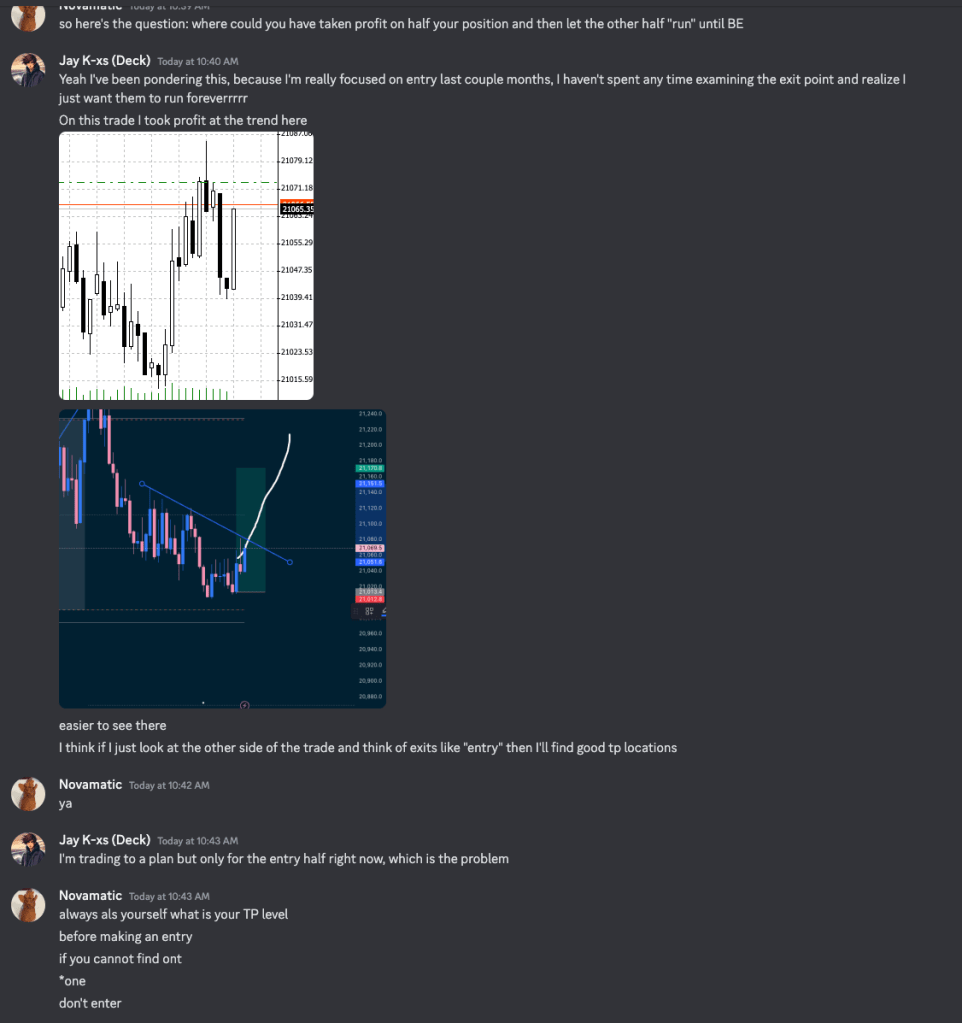

0. Find the Other Side of the Trade:

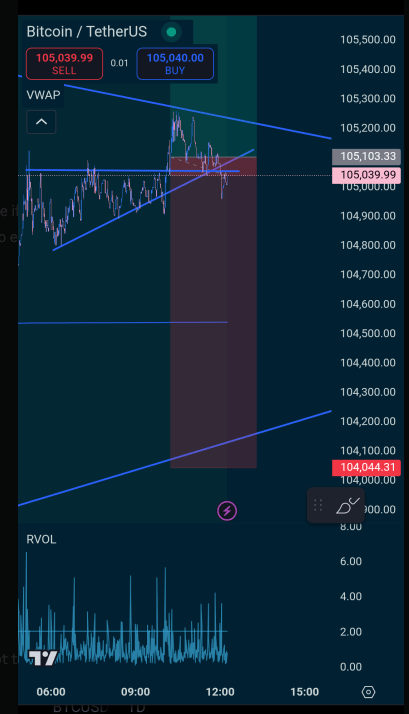

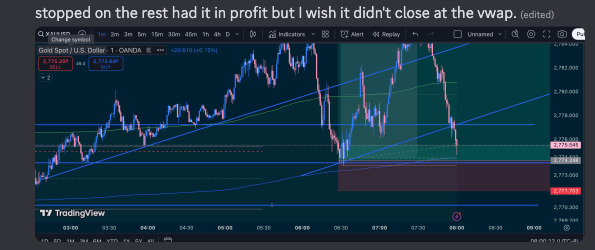

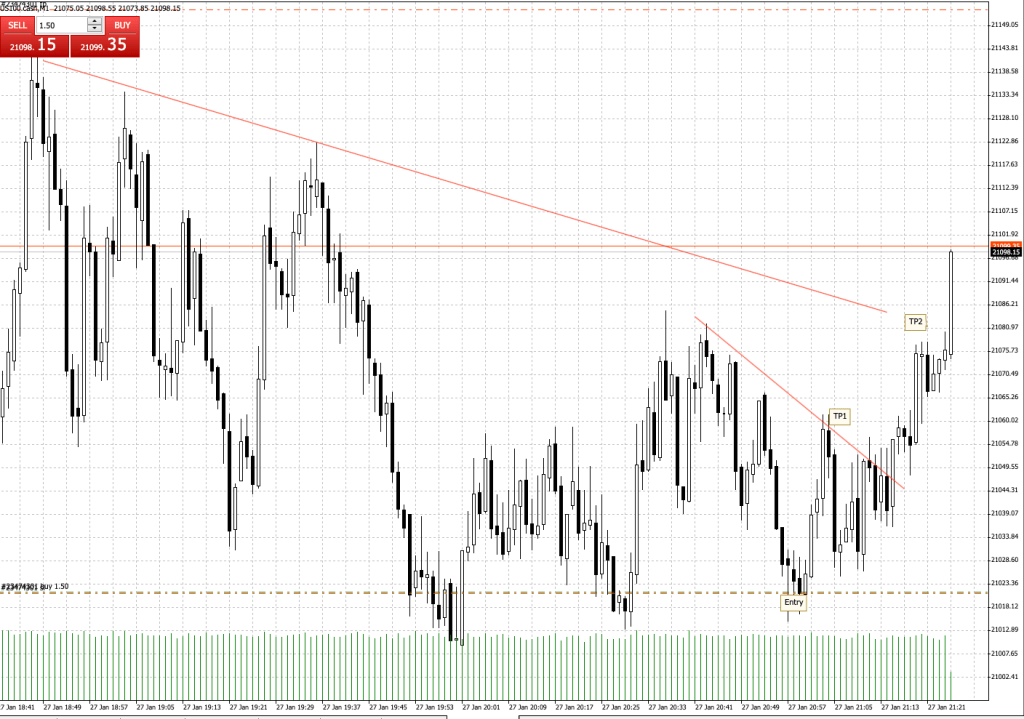

First stop is to actually HAVE a profit target! A lot of times I’m trading I’m so focused on the entry I don’t think about the exit criteria at all. So, assuming you split your trade into 3, then you can look for areas that you would consider entering the other side of the trade. Here is a trade I made that implemented this and it turned out un-stressful and successful.

1. The “Take Half and Run” Approach:

This is probably the simplest and most psychologically effective method. When a trade hits a predefined profit target (and this target needs to be realistic, not some moonshot dream), take half of your position off the table. Seriously, just do it. Lock in those profits. Reduce your risk.

Suddenly, the pressure is off. You’ve secured a win. The remaining half of your position is now essentially a “free trade” in terms of your initial capital. You can let it run, move your stop to break-even (or even slightly into profit), and see if it continues to move in your favor.

Even if the remaining half comes back to break-even, you’ve still banked profit on the first half. It’s a win-win. And psychologically, it’s a huge boost to see green in your account, even if it’s not the maximum potential profit.

2. Scaling Out in Stages:

Similar to taking half, but more gradual. Instead of one big profit-taking move, you could scale out in smaller increments as the price moves in your favor. For example, you might take 25% off at your first target, another 25% at the next, and then let the final 50% run with a trailing stop.

This approach allows you to capture profit at different levels and potentially ride a longer trend while still securing gains along the way. It requires more active management, but it can be very effective in capturing consistent profits.

3. The “Aggressive at the Start, Defensive Later” Strategy (Careful with this one!):

This is where the idea of doubling down comes in, but with a crucial caveat: don’t double down impulsively to chase losses. Instead, consider this: If you have a high-conviction setup and the trade immediately moves strongly in your favor, you could consider adding to your position slightly at a better price (after your initial entry).

The logic here is to capitalize on early momentum. However, this is a risky strategy and should only be employed with strict risk management. You need to be absolutely sure of your initial setup, and you should never double down if the trade goes against you.

Instead of doubling down to chase profits after they start fading, consider being more aggressive with your initial position sizing on high-conviction setups. This way, when the trade does move quickly in your favor, the profit is more substantial from the get-go. But again, this requires careful risk management and a solid understanding of your strategy.

4. Tighter Stop Losses and Realistic Targets:

Sometimes, the round trip happens because our stop losses are too wide, or our profit targets are unrealistic fantasies. Review your strategy. Are you giving your trades too much room to breathe, only to watch them breathe all the way back to break-even?

Consider tightening your stop losses (while still allowing for normal market fluctuations). And be honest with yourself about your profit targets. Are you aiming for home runs every time when singles and doubles are more consistently achievable? Adjusting your expectations and tightening your risk parameters can significantly reduce the frequency and pain of round trip trades.

5. Accepting Imperfection and Focusing on the Process:

Finally, and perhaps most importantly, accept that round trips are part of the game. You won’t catch every single pip of every single move. Trying to do so is a recipe for frustration and emotional trading.

Focus on the process. Focus on consistently executing your strategy, managing your risk, and making sound trading decisions. Celebrate the wins, learn from the losses (including round trips!), and keep refining your approach.

My Personal Journey (and Ongoing Battle):

I’m still working on mastering the art of avoiding the round trip. It’s a constant battle against my own psychology, against the allure of “more,” and against the fear of missing out. But I’m finding that consistently taking partial profits and having realistic expectations is making a real difference. It’s not always the most exciting approach, but it’s certainly less agonizing than watching those hard-earned profits vanish into thin air.

So, if you’re struggling with the agony of the round trip, know that you’re not alone. Experiment with these strategies, find what works best for you, and remember: profit in the hand is always better than potential profit that disappears. Now, if you’ll excuse me, I’m going to go back to my charts and try to implement some of my own advice… wish me luck! And please, share your own tips for dealing with round trips in the comments below – we’re all in this together!

Wisdom from the one like Novamatic:

Leave a comment