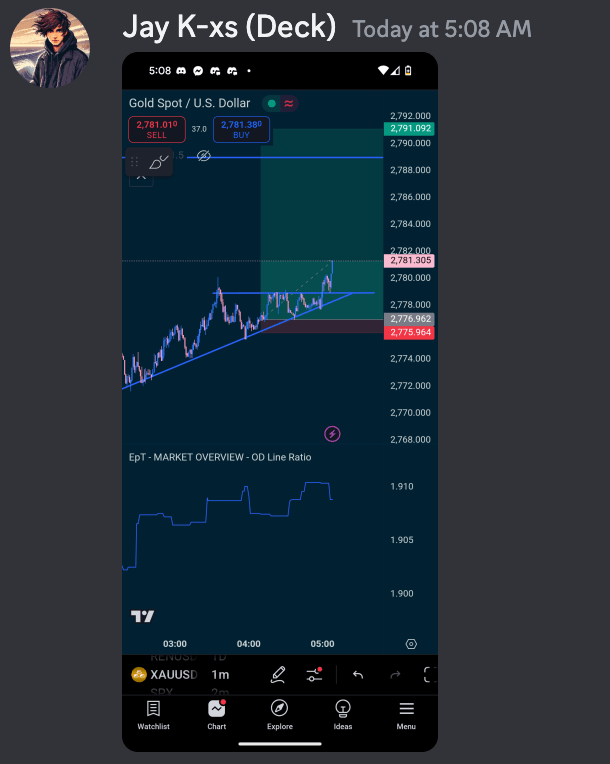

AI Written. I took a trade on Gold today which is a market I don’t usually touch day trading. It helped me understand that just taking a swing in another markets helps me broaden my thinking to match catalysts to markets. You can check the yields and dollar to validate ideas about macro moves and there are all kinds of opportunities based on big macro news. Yesterday Trump was streaming at WEF and mentioned meddling with the interest rates. Today the dollar and yields are rising, so I can see that the market may not be pricing interest rate drop, but the inflation and safety play on gold worked out. Expanding to other markets makes it possible to find opportunities and volatility instead of just trying to grind against whatever market you’re used to. This year I want to gain greater comfort in commods and forex and incorporate more sophisticated scanning with agents hunting catalysts+volatility. Less time trading means better quality trading.

—

Let’s be honest, day trading can feel like a high-octane rollercoaster. The adrenaline rush, the potential for quick gains, the constant challenge – it’s undeniably exciting. But beneath the surface thrill lies a critical truth that I, and many others, have learned the hard way: picking the right market to trade each day is just as, if not more, important than your actual trading strategy.

For a long time, I focused solely on honing my technical analysis, perfecting my chart reading, and tweaking my risk management. I thought, “If I just get my trades right, I’ll be golden.” Wrong. So, so wrong. I’d find myself staring at charts, any charts really, forcing setups in markets that were… well, dead. Flatlining. About as exciting as watching paint dry. And guess what? My account balance was often mirroring that lifeless market.

The epiphany hit me after a particularly frustrating week. I was trading small-cap stocks, bouncing around randomly, getting whipsawed left and right. My setups were technically “there,” but the market just wasn’t cooperating. It was like trying to surf in a puddle – no waves, just frustration and maybe a muddy face-plant.

That’s when I started thinking differently. I realized day trading isn’t just about finding trades, it’s about finding the right markets to trade within. It’s about recognizing where the action is likely to be each day. I began applying the same framework I used for individual trades – Catalyst, Setup, Trade – but to market selection itself.

1. The Catalyst: Where’s the Fire?

Think of a catalyst as the spark that ignites price movement. In individual stocks, it could be earnings, news releases, sector upgrades, or even just market rumors. When it comes to market selection, the catalyst is broader, but just as crucial.

Each morning, before the market even opens, my first question is: What’s driving the market today? Where is the energy?

- Economic News: Is there a major Fed announcement, inflation data release, or GDP report due? These can ripple through entire sectors and indices.

- Earnings Season: Are key companies in specific sectors reporting? Focusing on the sectors being impacted by earnings is often a goldmine.

- Geopolitical Events: Major global events can send shockwaves through specific markets – think oil during geopolitical tensions, tech stocks reacting to trade news, etc.

- Sector Rotation: Is there chatter about money flowing out of one sector and into another? Identifying these shifts can lead you to the hot sectors of the day.

If I can’t identify a clear catalyst, or if the market chatter is just… quiet, that’s a red flag. A market without a catalyst is often a market without direction, and direction is what day traders thrive on. Trying to force trades in a catalyst-less market is like fishing in an empty pond – you might catch something eventually, but it’s going to be a long, boring day.

2. The Setup: Liquidity and Volatility Are Your Friends (and Enemies)

Once I’ve identified potential markets driven by a catalyst, it’s time to look for the “setup” – the conditions that make a market tradable. For day trading, two things are paramount: liquidity and volatility.

- Liquidity: This is crucial. We’re talking about volume. You need enough buyers and sellers to ensure you can get in and out of trades quickly and at your desired price. Low liquidity markets are a day trader’s nightmare. Spreads widen, slippage becomes rampant, and you can get trapped in positions. I learned this the hard way trying to trade thinly traded micro-caps. Painful. Stick to markets with consistent, healthy volume.

- Volatility: Day trading is about capturing short-term price swings. Without volatility, there are no swings. A market that’s flatlining, even if it’s liquid, is useless for day trading. You want to see price action, movement, opportunity. However, excessive volatility can also be dangerous, leading to unpredictable whipsaws and stop-outs. The sweet spot is healthy, manageable volatility fueled by a clear catalyst.

My setup phase involves quickly scanning charts and order books for the markets potentially impacted by the catalyst. I look for volume surges, widening ranges, and stocks or sectors that are actually moving. If a market has a catalyst but no discernible volatility or volume, it’s still a no-go.

3. The Trade: Now You Can Actually Trade

Only after identifying a market with a clear catalyst and a solid setup (liquidity and volatility) do I even start thinking about individual trades. This is where your technical analysis and trading strategy finally come into play.

Within the chosen market, you can then apply your usual “Catalyst, Setup, Trade” framework for individual stocks or instruments. But now, you’re doing it in an environment that is actually conducive to day trading.

The Pain of Picking Wrong (and How to Avoid It)

Let me tell you, trading the wrong markets is like trying to fight a battle with a blunt sword in a muddy field. You’re working harder, exerting more energy, and getting nowhere. Here’s what happens when you ignore market selection:

- Whipsaws and False Breakouts: In low-volatility, directionless markets, you’ll get chopped up by random price swings. Breakouts fail, support levels crumble, and you’re constantly getting stopped out.

- Slippage and Wide Spreads: Liquidity dries up in uninteresting markets. You’ll pay wider spreads and experience significant slippage on entries and exits, eroding your profits before you even start.

- Emotional Frustration: Trading a dead market is demoralizing. You’ll second-guess your strategy, lose confidence, and potentially make impulsive, revenge trades to try and recoup losses.

So, how do you avoid this trap?

- Be Patient: Don’t feel pressured to trade every day or every market. If the conditions aren’t right, sit on your hands. The market will always be there tomorrow.

- Broaden Your Scan: Look beyond your favorite stocks or sectors. Scan across indices, sectors, and asset classes to see where the real action is brewing.

- Trust the Volume: Volume speaks volumes (pun intended!). Pay attention to where the volume is flowing. That’s where the day trading opportunities are likely to be.

- Practice Market Selection: Like any skill, market selection improves with practice. Start tracking markets, noting catalysts, and observing how different markets react to news and events.

Day trading is a challenging game. But by shifting my focus from just finding trades to proactively selecting the right markets to trade within, I significantly improved my results and reduced a lot of unnecessary frustration. Remember, you’re a day trader, not a market masochist. Pick your battles wisely, and you’ll be fighting on much more favorable ground.

Leave a comment