(Dev notes: AI Written – Gemini Flash2 Thinking. This is how my trading is evolving.)

Okay, let’s be real. For a long time, I thought “trading” meant being glued to the screen, refreshing charts every five seconds, and reacting to every little blip. You know the drill – that frantic, heart-pounding, adrenaline-fueled dance with the market. Turns out, that’s just a recipe for stress, bad decisions, and probably a lot of lost money. I’ve learned the hard way that actively “trading” is a surefire way to get your emotions completely tangled up with your portfolio, and trust me, that’s not a fun place to be.

These days, I don’t really “trade” in that sense anymore. Instead, I’ve shifted my focus to something I call “plan and scan.” Sounds a lot less intense, right? That’s the point.

See, the problem with traditional “trading” is that you’re constantly trying to make something happen. You’re searching for setups, forcing trades, and feeling like you have to be doing something, all the time. It turns your portfolio into a constant source of anxiety. Did it go up? Celebrate (briefly, because it might go down!). Did it go down? Panic! What should I do?! It’s exhausting.

My shift came when I realized that if I viewed “trading” as the activity, I was always going to be chasing something. But what if “planning and scanning” were the actual activity? What if the execution of the trade was just a natural consequence of that work? Suddenly, the pressure was off.

Now, my “trading day” (if you can even call it that) looks completely different. It’s more about strategy and observation. I spend time planning out potential scenarios, identifying levels of interest, and setting up alerts. I scan the markets, sure, but it’s a patient scan, like waiting for the right fishing spot to become active. I’m not forcing the fish to bite.

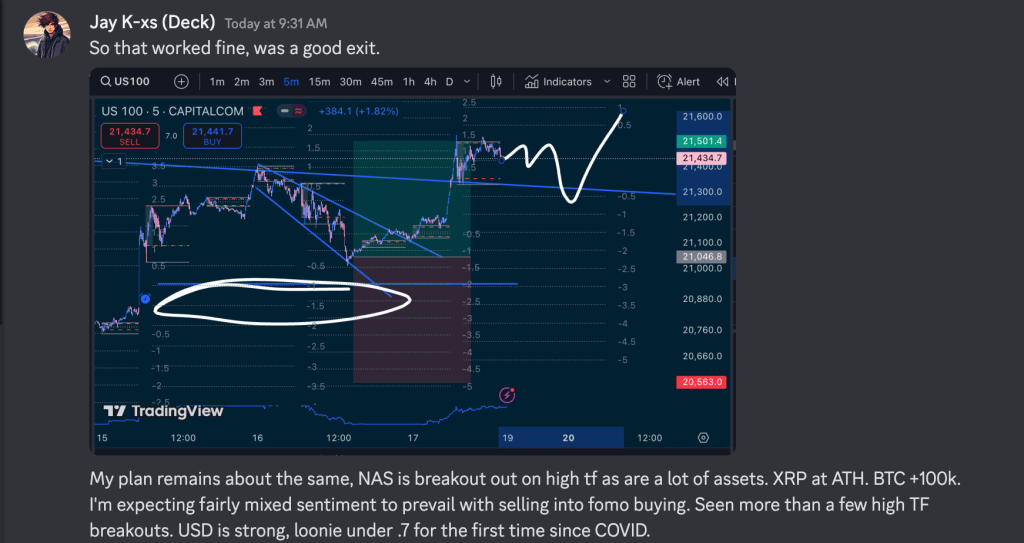

Think about it. After the recent CPI data dropped, I knew I wanted to see how the Nasdaq (US100) reacted. I had my levels in mind, my potential entry triggers, and my risk parameters all mapped out. But I didn’t just jump in the second the data came out. I waited. And waited. Actually, it took a couple of days. Days where I did other things, lived my life, and didn’t obsess over charts.

Then, boom. The setup I was looking for finally materialized. Because I had already done the “planning and scanning,” the entry was almost automatic. I knew my size, I set my stop loss to a point where I was comfortable risking nothing (yes, literally zero risk after the initial move went my way!), and I let it run.

That’s the beauty of this approach. The actual “trading” part – the clicking of the button – is the least stressful part. It’s just executing the plan. The trades “come to you” because you’ve positioned yourself to be in the right place at the right time, not because you were frantically chasing every flicker.

From there, it’s all about risk management. Once the trade moves in my favor, I move my stop loss to break-even. Risk gone. Seriously. And then, honestly, I just let the trade breathe. I’m not constantly fiddling with it, second-guessing myself, or getting caught up in the small bumps along the way.

The best part? My time “trading” has gone down to practically zero. I spend a little time planning and scanning, and then I let the market do its thing. No more late nights staring at charts, no more waking up in a cold sweat wondering what happened overnight. It’s freeing.

So, if you’re finding yourself stressed and emotionally drained by the constant rollercoaster of active trading, maybe it’s time to take a step back. Stop trying to force things. Embrace the “plan and scan” mentality. Let the setups come to you. Your portfolio, and your sanity, will thank you for it. Trust me on this one.

Leave a comment