(AI used in this. Dev notes: I have another article on marginal analysis – I wanted to make a more accessible post on the same topics. This one focuses on “flip trades” – betting harder after a loss to recover.)

Okay, deep breaths. It’s been a week. And you know what keeps popping into my head when things go south? Those shiny, tempting, utterly destructive ideas that whisper sweet nothings about getting back on track fast. I’m talking about the trading equivalents of walking into a lion’s den wearing a steak suit.

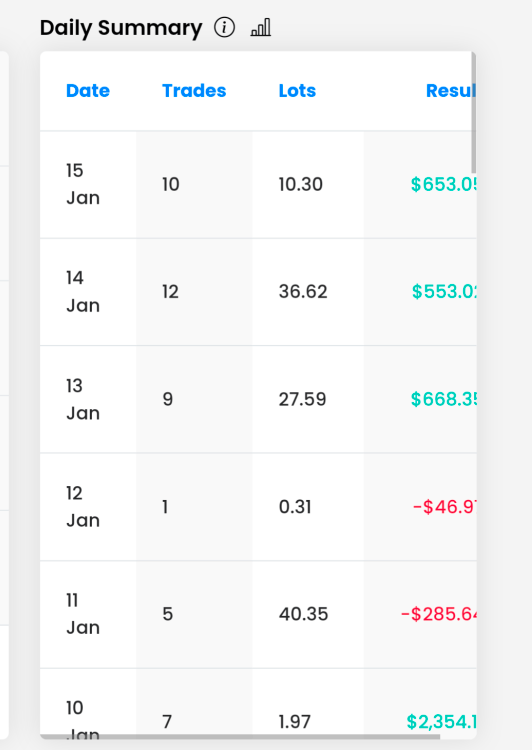

(Okay, none of this is true – I had a great week – but bear with me for the sake of the post. PnL for the last week or so.)

First up, the classic: The Martingale Strategy. Ah, roulette’s favorite child. The idea is so simple, it’s almost insulting to my intelligence. Lost a trade? No problem, just double your next bet! Eventually, you have to win, right? Think of it like this: you bet $10 on red, it comes up black. Okay, next bet is $20 on red. Black again? Fine, $40. $80. $160… See where this is going?

In theory, yeah, you’ll eventually land a win and recover all your losses plus a tiny profit (your initial bet). But let’s be real. This isn’t a casino with unlimited chips and no betting limits. My trading account does have limits. And imagine getting into a losing streak of, say, six trades in a row using this strategy. Your next bet needs to be 64 times your initial risk! That’s how you blow up an account faster than you can say “house always wins.” It completely ignores the fact that each spin of the roulette wheel (or each trading setup) is an independent event. Past losses don’t magically increase your chances of winning the next time.

Then there’s its slightly less obvious but equally dangerous cousin: Flip Trades. This is the “I gotta get my money back!” mentality in action. Lost a trade? The immediate urge is to go bigger on the next one to recoup those losses. It’s not always doubling like the martingale, but the underlying logic is the same: letting past performance dictate your current risk.

Let me paint a picture: I take a loss on a perfectly good setup. Frustration kicks in. I start seeing red (not literally, hopefully!). The next setup, maybe even a slightly less ideal one, comes along. But because I’m still smarting from the previous loss, I think, “Right, I’m going in bigger this time to make up for that mistake!” It feels like taking charge, like I’m not letting the market get the better of me.

But here’s the brutal truth: both these strategies are driven by emotion, not logic. They’re born from a desire to avoid the discomfort of losses, and they completely disregard the actual probabilities of the current trading opportunity. They treat the market like it owes you something. Spoiler alert: it doesn’t.

This is where the concept of marginal analysis comes in, and honestly, it’s the trading equivalent of a calming cup of tea after a rollercoaster ride of emotions. Marginal analysis is all about evaluating each individual trade on its own merits, as if nothing happened before.

Think of it this way: Imagine you’re flipping a coin. You flip heads three times in a row. What’s the probability of the next flip being tails? Still 50/50! The previous flips have absolutely no bearing on the current one.

That’s how we should be sizing our trades. Every single trade is a fresh opportunity. Did my previous trade win or lose? Irrelevant. What matters is:

- What is the quality of this current setup? Does it meet my predefined criteria?

- What is the potential reward?

- What is the potential risk?

- What is an appropriate position size based on my overall risk management plan for this specific trade?

See the difference? With marginal analysis, we’re looking at the current situation objectively. We’re not letting past results cloud our judgment or push us into impulsive decisions.

The temptation to martingale or flip trade often comes from fear and overconfidence. Fear of missing out on recouping losses makes us over-bet after a loss. Overconfidence after a win can make us think we’re invincible and justify increasing our risk. Both are dangerous traps.

The key takeaway I need to drill into my head is this: size your risk as if you’re a robot with no memory. Forget the last trade. Forget the winning streak. Forget the frustrating losses. Approach each new trade with a clean slate and ask yourself: “If this was the first trade I’ve ever made, what would be a responsible amount to risk?”

It’s boring, it’s disciplined, and honestly, it’s probably not as thrilling as the rollercoaster of trying to double your way out of a hole. But in the long run, it’s the only way to survive and thrive in this game. Martingale and flip trades are like quicksand – tempting to jump into, but incredibly difficult to escape.

So, diary, remind me of this next time I feel the urge to chase losses or get cocky after a win. Let’s stick to the boring but effective path of marginal analysis and treat every trade like it’s the only one that matters. My account balance will thank me in the long run. Now, if you’ll excuse me, I need to go find a calming cup of tea.

Leave a comment