This is intended to be a playbook entry, but it’s hard for me to synthesize a strategy as there are so many components that come into the decision making. I made a shift this year towards trading liquidity concepts. I found a few tools: ATR stops, and Coinsquare liquidity heat maps. Either of these will show you where the big target areas are. I’m sure I’ll come back and refine this artifact but this is probably the most significant breakthrough in my trading I’ve had in a while and it has had a massive impact on my performance, win rate, position sizing, and entry quality. A few refinements left in my behaviour and I think I’ve got a very reliable stack of alpha to play on.

Timeframe for these types of setups is 12-48hr windows where you’re planning to execute a trade. You have to factor in all of the context on top of the trade, so what’s the macro, who’s there. Make a count of for and against points to be able to grade the setup to know how hard you should enter, but for these plays you’re going to be targeting max allocation with razor thin stops.

The entry is scalp skill – so you need to be seasoned to make this work. You need a plan and you have to wait for the trade to come to you. Here is the one I closed today. Thanks to my brothers in the k-xs discord for their support. Gains, Nova, Mark, Javi ATC, Flex, Branly, so many of you guys keep the fire. Persistence and dedication to the task is in focus: learn to beat the market. And then when we do, do something good with it. I’m hoping that this life provides me the vehicle to make a mark on this earth and I’ve got some wild aspirations that will hopefully one day change people’s lives. But I have to succeed first. Altruism is nothing without power and money.

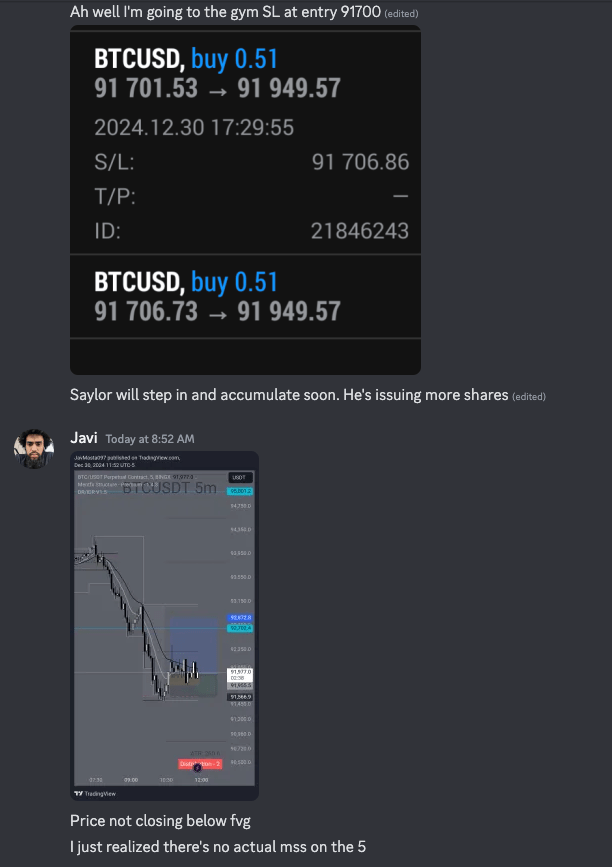

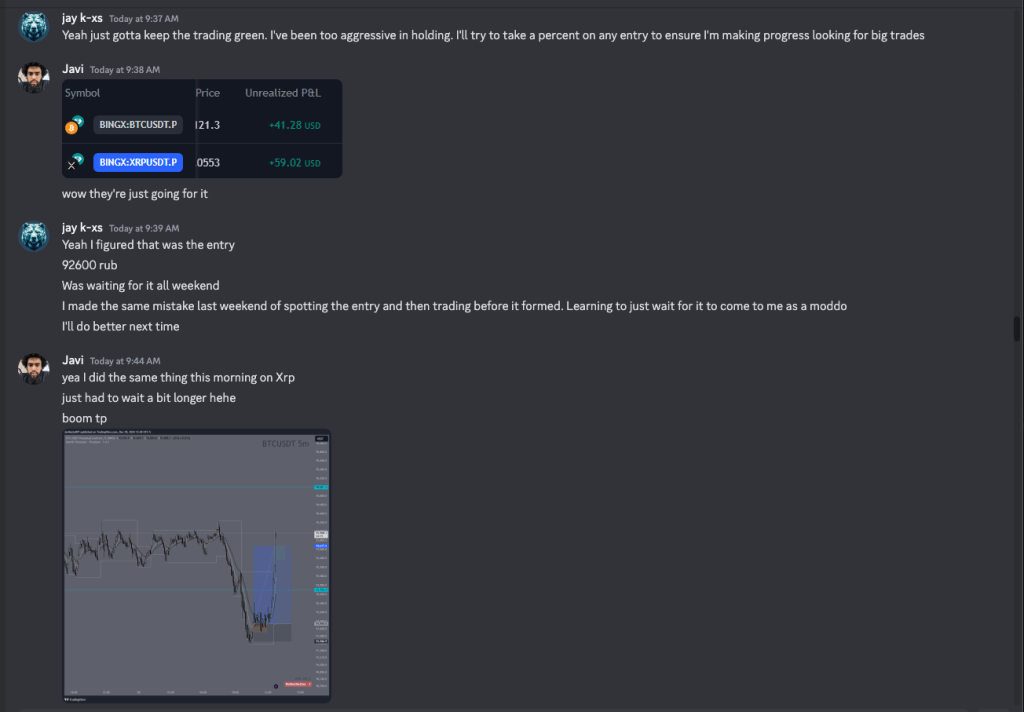

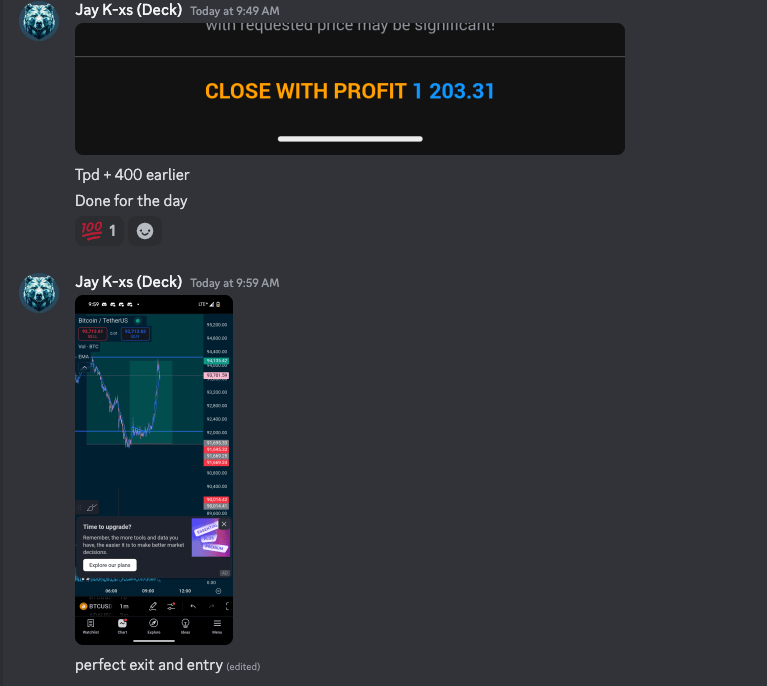

This bitcoin trade we spotted the liquidity run under 92600 which was where I was watching, I got on this hard when I saw it, went to the gym. I enter in two so that I can take a partial to cover a risk and the next trade once I get the move, and then the rest can run risk free. Do this same thing multiple times: catch a pop, take partial, leave some to run. You have to be really aggressively exiting positions to put huge weight on the entries, so I literally set the stoploss at entry ASAP and then just go do something else. I went to the gym.

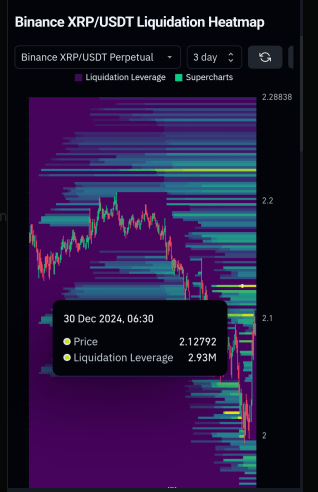

I had drove to see my friend and I was analyzing XRP with Javi on ATC’s discord and we caught this short:

I had to meet my friend at the peak so I only paper traded it (“play trade”) – I the 5 minute window to get the entry was when I was with him so I just let it go because you can’t put risk on like that with that weight late in the trade. It would have been fine to enter but you don’t know what the market will do, you have to be dilligent. I sat on the sidelines and watched it drop.

Even though I didn’t take the trade because I was busy, I was still executing. Still going through the motions. Living life, and attacking the markets. I had only hopped on XRP because Javi told me he was shorting it and I thought it’d go higher first.

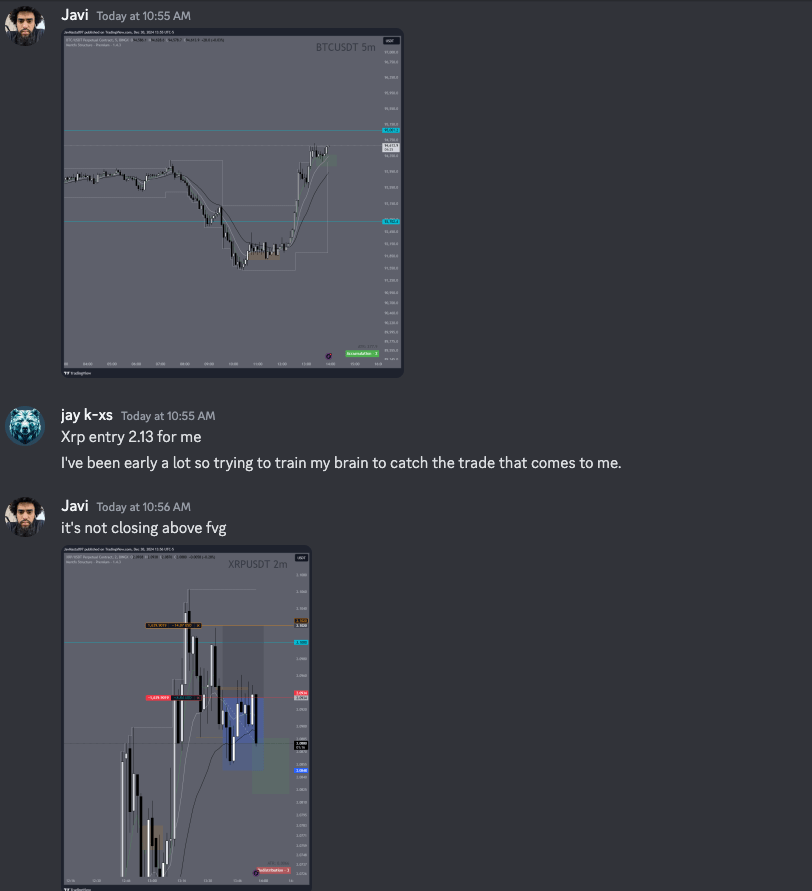

It’s easier with someone else to see the things you do wrong. He shorted XRP – I said it will go higher first, let’s get that short:

You have to wait and just catch it, the trade falls into your lap. Coinglass liquidity map has 2.13ish as a level, so we’re looking for a run through that area, and you catch it on the way back to ensure you’re “on the right side of the V.”

I have been consistently showing the most beautiful trade executions. It makes me immensely happy to see.I keep landing them too. This is a boost for myself for good behaviour, encouraging the things that really work. It requires patience, preparation. The hard part is self management – waiting to enter. Because I anticipated a trade, I’ll take 2 or 3 shots at it to get the trade that sticks. You can’t waver on the risk management here or you will fail.

*Cut the trade if it doesn’t go with you right away – you’re missing something.*

These are big boy trades, put all of the weight on them when you see them. Be aggressively patient and wait for it. It takes days to find the moment to enter. But you know right away, that’s it, this is it. Swing the bat hard, all in.

Every trade is unique, the context you hold in your head is unique. It gets harder and harder to describe. That is why a trader is deemed “proprietary.”

Leave a comment