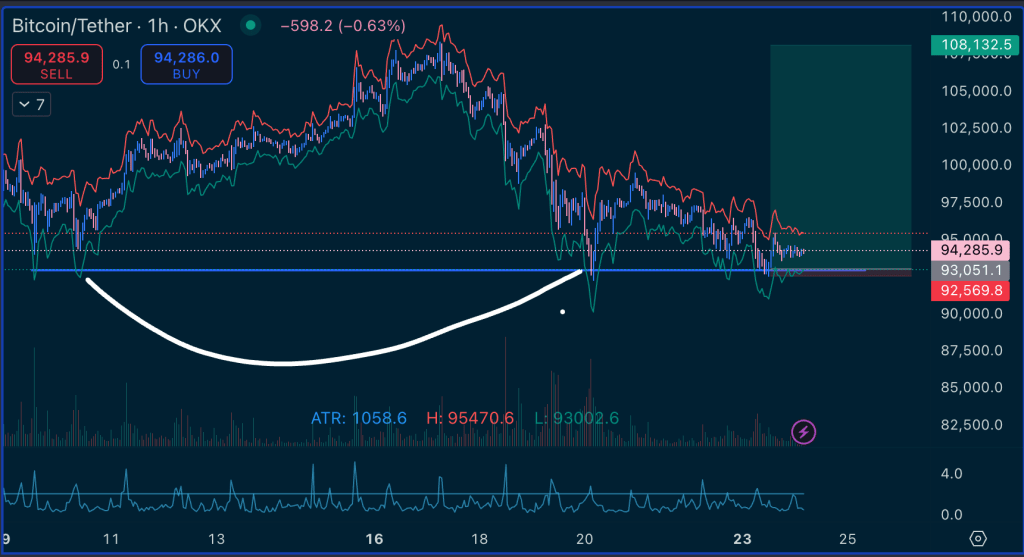

I’m trying to move to trading styles that aren’t so demanding of my attention, that I can blend with my scalping experience to put massive weight on. I’ve been playing with singles especially Bitcoin lately, which is a very competitive market. I’ve found some tools like Coinglass liquidation heatmap that have given me quite a lot of edge combined with ATR Stops. If I can find confluence on ATR stop and an obvious liquidation target in the heatmaps, those trades almost always work out. Here is a trade I have open right now that took me days to find. I had traded PCE and took the profit, so I’m trying to get the move a second time. US is pessimistic, so this is a fade playing against the emotion in the market. The response to the Fed’s shift on the dot-plots is probably over-blown and PCE came in cool, so we have a good catalyst but it’s a fade so you’re trying to catch a falling knife with weight on the trade and no risk/drawdown if you’re wrong. Blending scalps with large moves on the high time-frames is surely the way to profit. If you can stomach holding risk, these kinds of trades can be game changing. But if you’re wrong, you have to be able to cut the risk and never make an error in managing that.

If it goes against you, close it.

If it goes against you, close it.

If it goes against you, close it.

You can see the level under 93000 on the ATR stops indicator highlights an area that could run, and the liquidity from that area is likely to run the market the other direction. The liquidation heatmap shows our target areas.

The problem I’m finding is that I will be eyeing that target area, but I’ll want to take the trade early so I don’t miss it, and that causes un-necessary loss if I chose to hold any drawdown at all on an entry.

If you’re playing off of these liquidation concepts, you have to be there to enter heavy. I’ve been trying to focus on trading really heavy again, and it means active trading entries to ensure you don’t rip up your account. Well I still am having problems holding onto gains because I’m entering before the target incase it runs off without me. I’m watching the catalysts and time of day, but _eventually_ I get the target entry that I was watching and all I did along the way was shred my account with 1000 papercuts. Once I started to find safe entries, I could take them and set the stops to break even fast which would let me enter early without risk, but you have to be dilligent and the entry quality is only okay, they’re better to take off as scalps instead of holding them until you finally get the target entry.

This style of trading seems to have a lot of edge, but it takes patience. I’m so used to trading NYSE live where you’re watching the data and responding to it real time, you don’t need to have a plan until minutes before the session and then you just execute on that. Or there is a catalyst and your job is just to scan and evaluate the market response. It’s a fast, instant, and real time experience. Where as trading bitcoin on higher timeframes is mostly patience. I can’t believe I can trade bitcoin at all – it’s the worst market, but once you try to play the way your competitor would, it gets a lot easier. That’s different than indices where you’re generally not worried about being competed out, because you’re looking for inefficiencies intraday that are repeatedly exploitable.

This is processing experiences and losses. It’s going well – I feel like I can’t lose because I keep finding big trades that make up for the losses on the way. The goal should be to reduce the impact of the losses now. I held drawdown I shouldn’t have, so if I can tune that, this new system should turn profit consistently. I have to figure out a good way to alert that’ll wake me up, because some of these trades are taking 4 or 5 days to play out, but they offer enough upside that it’s worth sitting on my hands and waiting.

Leave a comment