Here is to being a good loser! This is where the gold is – process your errors thoroughly. Pound on them until you shake every bit of gold out of them that you can.

Gave back some gains from yesterday and am very disappointed that I didn’t manage this better when I got surprised. Really threw me off – usually if a trade goes against me I don’t flinch – just close it and walk away. Taking the licks and lessons because I couldn’t make sense of what was happening.

I’m trading new strategies around order flow and having a really good success rate with much improved stats (+25% profit factor). I probably just undid some of that tho! I’ll walk you through the setup, and then the lessons I’m pulling out of the experience. I’m making sure I process this one because I broke my rules a bit and if I really chew on how this went sideways, I’ll be able to refine my thinking and playbook. These are new style, different times of day, different markets, so it’s expected that I’ll make some errors. I’m not happy with how I responded to the confusion though and I was thinking that I had gains I could bet because I was sure I was right, so I went hard on a trade going against me and gave too much back without necessity. I did post a win when I finally found the perspective, but there were details I missed and this was an excellent experience to learn from.

Setup/Context:

I had a great long trade on Saturday on BTC that worked perfectly, no draw down. Intraday shot clock. I’m kicking myself for not leaving it open in retrospect as you’ll see. I’m focusing on weight this week, getting heavy with trades, putting the risk on and managing it carefully. And I was confident from a good win so my psychology was tilted with over-confidence that I “have everything figured out forever and ever and can never lose again”. I saw a similar setup on Sunday on BTC to the downside.

I was looking for the upper liquidation zone to get hit, short it off of there and evaluate. I had just played the play the other way, and I had a confluence perspective on the entry.

The plan was as shown above, wait for the v at 1ATR stop level/liquidation block, enter it. Abort if it charged against me. I was confident, rating the position A to A+ for SUNDAY not Monday. No institutions, bots and retail weekend warriors battling, that’s it.

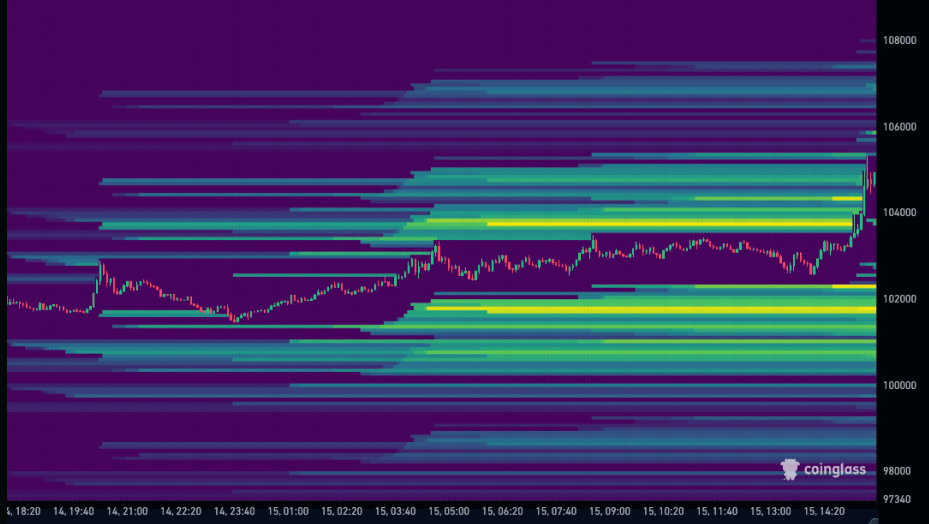

The coinglass liquidation heatmap below shows where orders are likely to be so I saw that level under 104k – the first yellow line. When the level hit, I was out for a walk with Ash and V, and I shorted it on my phone without a good check that everything was turning down. Hard to know whether to take it or leave it when your conditions for entry are met but you’re not in the chair and focused. I was waiting for it so my mental context was really dialed in, but if you’re not on the tooling, it’s hard to see and manage a trade relative to one click trading with all of the data in view in-front of you. Decision making with high levels of risk is dangerous, so I cut my planned position size in half based on the assessment of my conditions and state (distraction.) I know what happens when you trade while you’re distracted.

I was convinced I was still looking at Sunday afternoon liquidity without institutional interest anywhere close to the markets. There is no liquidity to trend the market. But when it broke, it ran the entire block. So I got snapped out of my entry.

I came back I found another area of interest, shorted it, and then it ran me out of that as well (better managed, took profit on 1/3rd, set SLs at entry). But then it broke up again at 4:30PM PT and I started to move the stop and re-entering a trade going against me (breaking rules.) And that steam rolled my position too! What was going on?!? I couldn’t take the hit and leave it alone because it wasn’t making any sense to me why the market was not behaving the way I had planned. All of the possible scenarios I had mapped out were exhausted, and the price suspended at some weird area in the liquidity perspective. There should be no-one there at this point who can move the price but it kept running!!

It didn’t make sense to me, and that tilted me. My discipline crumbled in a haze of confusion. The price halted after a very strong run up to new all time high at about 5:00PM PT as shown. On a Sunday, how can there be so much activity?? Then it dawned on me what was going on because I’ve seen this before in Equity markets. I’m not used to trading Bitcoin on the weekend with what I know today and it suddenly dawned on me what was going on.

Friday it was announced that MSTR was being added to Nasdaq. Late in the day. Asian instutions are asleep, it’s Friday night. They won’t respond to the news until Monday AM.

OH NO! It’s not Sunday! It’s Monday AM in Asia! I was dialed in waiting for this trade all day. Watching like a hunter in the bushes, and then Bam I saw it and I swung the bat, but I had totally lost the plot! I didn’t consider that the time context had _changed_ since I planned the setup/entry. The market moves so slow on the weekend, your decision making criteria between when you plan a trade and execute it might shift, but if you’re just mechanically working by a plan, you might miss that.

The worst part was that I mis-managed the trade and started breaking rules. I was out for a walk with Ash when the setup came together I was planning on playing which was short the 1ATR stops from the last high once the liquidity block runs, and ride it back down. But then Asian institutions come online, see the bullish catalyst, and respond to it while I’m trying to play a short on Sunday liquidity.

Lessons learned:

- Trade the trend+catalysts! Treat trades against the trend as scalps. But just trade the trend generally (or else size it down.)

- Make sure you’re on the right side of the V. High risk entries demand respect.

- If the trade goes against you, HIT IT! You’re missing something! It’s not a rule just for the sake of rules, you missed a clue!

- Move on to the next. I tried this too many times as it ran up. Every level of interest I entered, it went straight into profit and I didn’t just set the stop and walk away if it didn’t move. A+ trades go right away. If it’s not really A+, it will go against you.

- Trading against a catalyst is fine if you see it, but not if the market is about to come on and respond!

When I stopped and re-analyzed I finally found the perspective to play which was 4HR ATR in Asia open h1. Exit top of first trading hour and go do something else. Today is a new day! Just not yet for me in North America!

This is the first time in a while I’ve been tilted, like irked. I shut everything down and just walked away to ensure I didn’t make any bad decisions. I saw it, I took the shot, but I missed something. This is why I have rules to exit the trade if it goes against me IMMEDIATELY and look for something else. Trading this more predatory approach requires some fresh learning as it’s very different than trading NYSE intraday where you’re responding to data coming in – this setup took almost 12 hours to set-up and play out.

Leave a comment