Still experimenting but leaving this as a seed for a more complete playbook entry.

Setup: Watch for a period of consolidation in a trending market. Check 1ATR, set stop entry order at 1ATR with fairly tight stop. Let it run the direction of the trend an ATR the other way.

Example of Nasdaq and Bitcoin

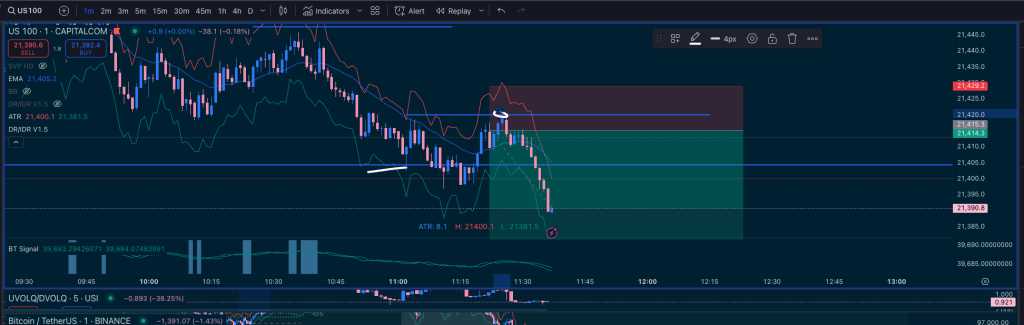

I tried a small test entry and it worked. 1:30pm ET entry on 1atr stop on 1m, shorted to new low of day.

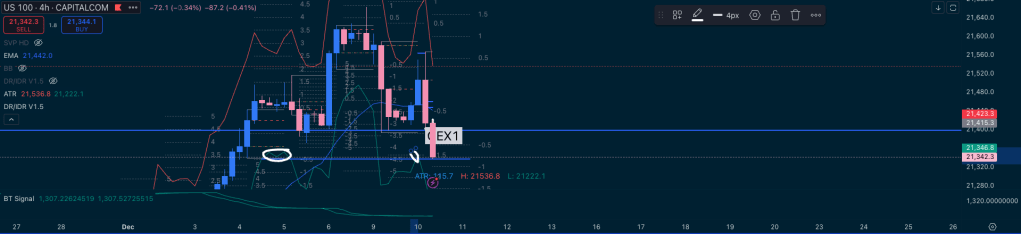

And here is another one. I entered this a little early – it sweeps the stops 1 atr from wicks on the descent, so I shorted into support.

I entered a little early – you can see the ATR stop is hit (shown in yellow line and circle.)

This trade ran too.

For exit criteria, you can start to look for high timeframe liquidity. Recent wick up has the ATR stop at the level the price halts – I took profit there.

Here is another example, post lunch. Enter on the ATR stop swipe. Clean and easy.

Study on high tf:

Can see the atr stop levels drawn at each peak, and the market comes back, stabs the liquidity, goes the other way.

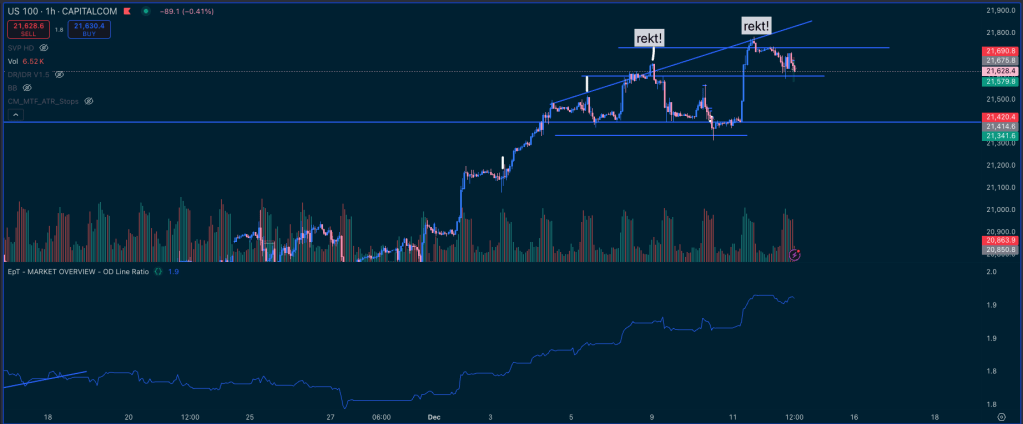

Offence/Defence ratio within tech (thanks to Epoch for the indicator) still indicating pressing more money into growth/risk than safer manufacturing-oriented assets but I’m seeing the market just squeezing both sides of the trade and broadening out here, assuming this is close to a local high, just waiting to see a shift towards defensives.

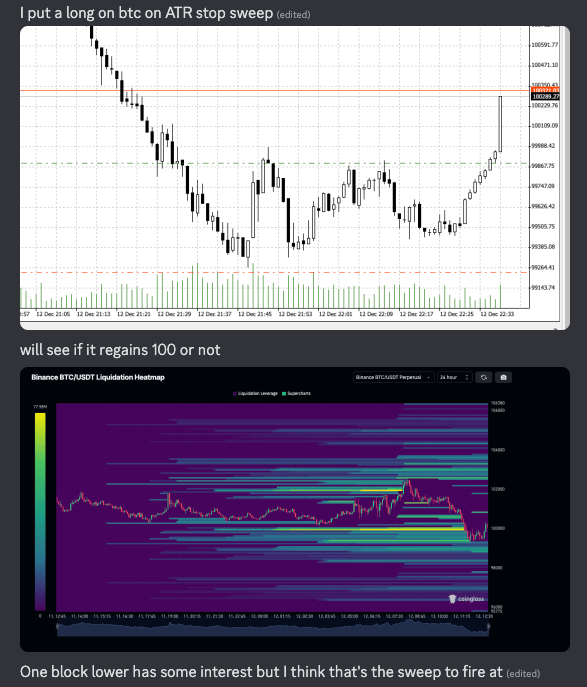

Verification w/ heatmaps:

Same idea here, high tf 1ATR stop block gets swept. Found a liquidation heatmap to help validate the perspective.

Leave a comment