dec4 2024 – this one is hand written and I haven’t proof read it fully yet. I had claude check it over but it might have an error or two still.

“All of the most important life lessons I’ve learned from the markets.”

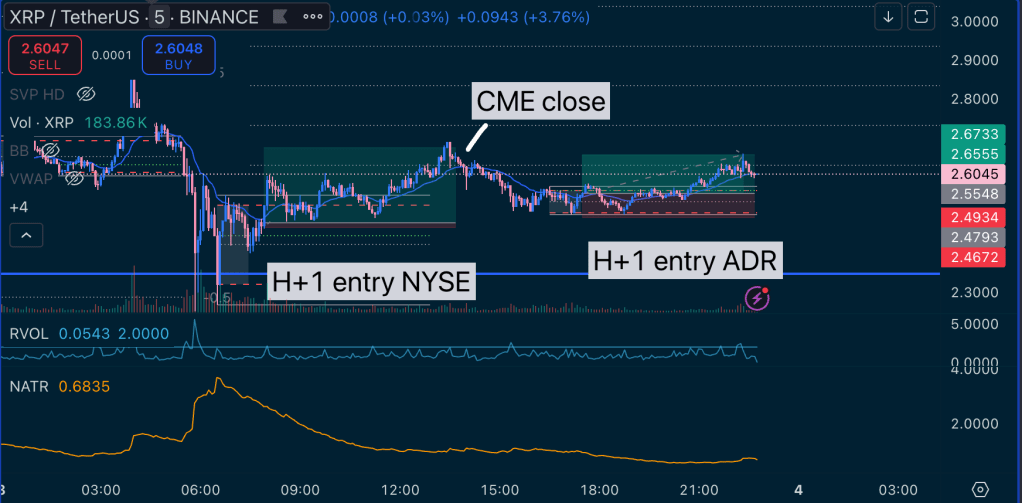

I started to trade some crypto this week on live prop, testing some new concepts. It has me reflecting back over the last 4 years. Examining a couple wins today, I can see there is absolutely nothing in my trading practice that looks anything like it did 4 years ago. Here are a couple trades, including all of the indicators used to enter these positions.

The more I go down this road of trading, the less stuff I have on my chart, and the more non-price context I’m using.

These trades are forward testing to prove edge in preparation for intraday trading. I’ve got probably a couple weeks of edge as option OI flows into crypto, and less mature markets show me alpha that’s not getting mined out.

Let’s wheel back 4 years and see where we came from.

It was the 2020 crypto bull-run. I took about 12k Canadian and started to Google “how to trade.” I was trading spot crypto as it was mostly an unregulated “poker table.” Traders usually will stumble on a regurgitation of the same basic nonsense that’s been floating around for decades. Chart patterns, bad indicators. Fibs. Elliot waves. I’m a smart guy and was successful at many things in my life. I thought surely trading would be no different.

My plan was to quit my job, employ machine learning/DRL, and then retire in 6 months. I bought a book called “Machine Learning for Trading,” found a mentor (Loxx on TradingView,) and started to digest everything I could. I learned concepts like “Alpha” – the term for your returns over a benchmark (eg buy and hold.) And I learned how to quantify it using statistics. I learned how to build models, built a rig to train models, and got to work.

I had traded up 12k CAD to something like 0.6BTC on spot. I thought I had all of the knowledge and experience. I could put a line on a chart and point at it and the price would stop there. I could throw some lines on a chart and predict the price would move a certain way. I seemed to have some super-human psychic abilities. Really, what had happened was that the market had drawn in a bunch of unsophisticated retail traders, and they were worse than I was, and somehow I was able to eek out an edge consistently enough to fool myself into thinking that I had all of the skills to consistently beat the market, and now I was going to codify all of that knowledge, and I’d be able to retire in no time.

But things change. The crypto markets became more sophisticated. FTX and Alameda grew, Binance likely started to trade against its traders. Wallstreet quants started to take interest in BTC and institutional money flooded into the market. And then rate hikes started.

We all felt great. And then things change. While YouTube crypto gurus broadcasted “don’t sell, buy the dip” the whole way down, I started to check out and flipped whatever I managed to hold onto into a futures wallet. I think I managed to maintain most of my original investment. But now I was full time, burning through my capital, and obviously holding wildly unrealistic expectations of both my own ability, as well as how easy it is to find consistent Alpha.

My economics teacher used to tell this anecdote: “Two economists are walking down the street. One says ‘There is a $20 bill!’ The other says ‘No, there is no bill there.’” He didn’t even have to look. If there was an opportunity to make a quick $20, someone else would have already picked it up.

It took me years to really understand this aspect of trading. It is a near-0 sum game, and all participants are competing against each other for the same fleeting signal. The larger and more competitive the market, the more “mined out” it is. Every square inch of signal in the data that can be exploited, is exploited. As a human trader, you have to be better than the worst to eek out any edge. And the better players are still going to beat you. You’re playing against very smart AI built by teams with untold budget utilizing hybrid AI approaches and data you don’t even know exists in markets driven by forces that you don’t understand.

This is the worst part of trading. All of those people selling you information, whether it’s YouTube Gurus making ad revenue on their videos, or ICT selling “Smart Money Concepts” in a $30k course, these concepts and strategies are all absolute trash. Go find a money manager and ask him what he thinks about your ideas. Or just go watch some videos from SMB on YouTube – a prop desk that gives a lot of their edge away without asking for much apart from your application to work at their desk.

What I’m describing in my over-confidence in my ability is a decent example of the “Dunning-Kruger effect.” To say it bluntly, incompetence cannot recognize itself. A beginner is very likely to over-estimate their skill and experience. Good trading is good losing, and it requires absolute humility and respect for the market. Things change. Your edge today is a liability tomorrow. Trading requires extreme consistency in self-management and adaptability.

In my early experiences, I found success because my competition was worse than I was. A euphoric rush into the markets meant that loads of people watched bad traders on YouTube, picked up questionable concepts, cut a few videos showing only their wins, and those ideas spread like wildfire. And they worked as long as you weren’t the person FOMOing on a run or panic selling on every drop. Even if you were not at all sophisticated, as long as some dipshit was out there trying to trade your triangle breakout or buying at the same fib as you, your trading strategies from 1901 would probably work.

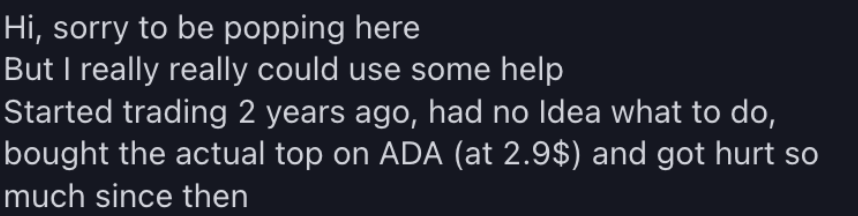

But someone was out there coming in right at the top. I remember Ash and I sold ADA at $3, someone less sophisticated was on the other end of the trade. Here is a message I got via TradingView a long while ago that had the other side of the trade.

As long as someone is out there that’s worse than you are, you can win. Know your opponent. After that time, it was a dark, dark winter. I burnt through all of my savings, and with the help of leverage, I shredded my account. I went back to work, and suddenly had to manage my attention in a way that I hadn’t needed to before. Almost as soon as I started working, I shredded the last bits of my account with high leverage futures.

We call this “tuition.”

Depression. Despair. Loss. Insanity. Mental breakdowns. It all comes crashing down fast and hard. Yet the 10s of thousands of hours of screen time had left me with a lot of gold. I started to get a bit more formal, I started to take time to write about every loss, filling up pages and pages with analysis and review. I couldn’t win, but I could process my experiences. The market would turn, money would flow in, and the whole k-xs crew would be up nearly 24 hours a day trading trading trading when conditions turned. It became very clear to me very quickly that RSI, and MAs and all of that trash has nothing on TIME.

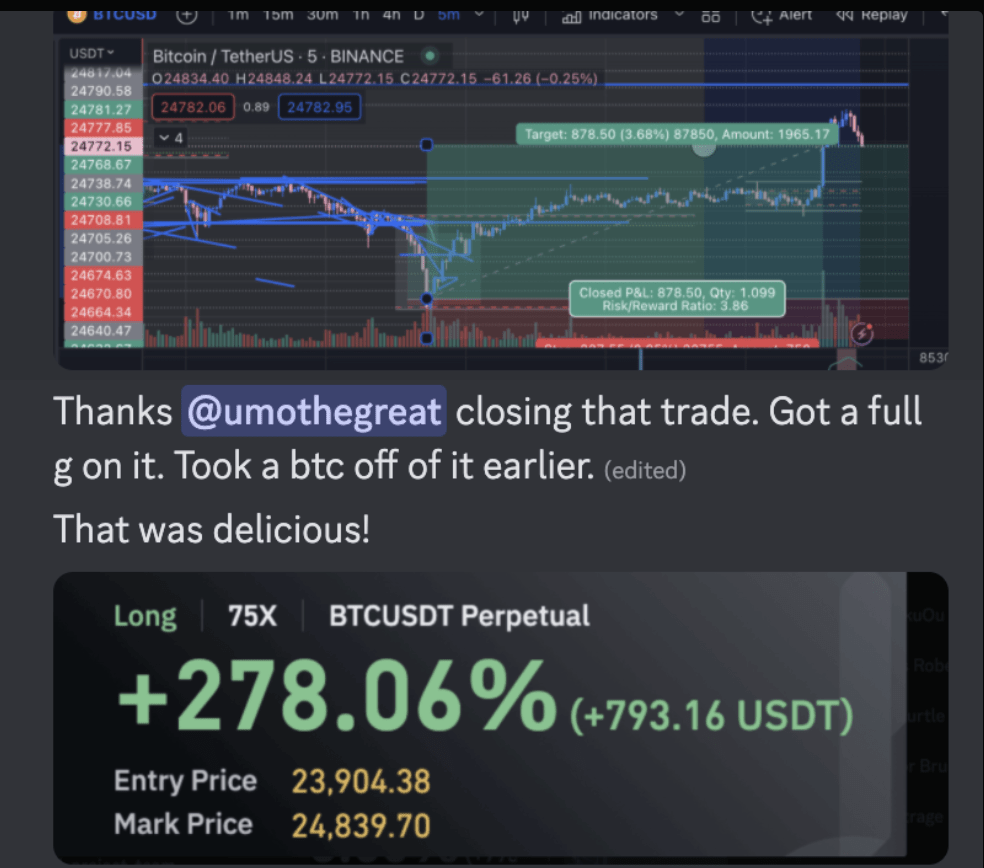

Time, above all else, was the determining factor in our success. It was very clear to me that when conditions were good, we would all post win after win after win. Didn’t matter the market, if capital was flowing in, we had the skills to capitalize with extreme precision. It felt easy through those periods. And it was so obvious – everyone was suddenly raking in trade after trade in profit. My buddy ATC held a 99% winrate trading with little more than a chart through some of those periods. It was clear to me that all of that screen time provided edge to us, but it took patience to wait for periods that would yield. And months could go by without any tradable conditions.

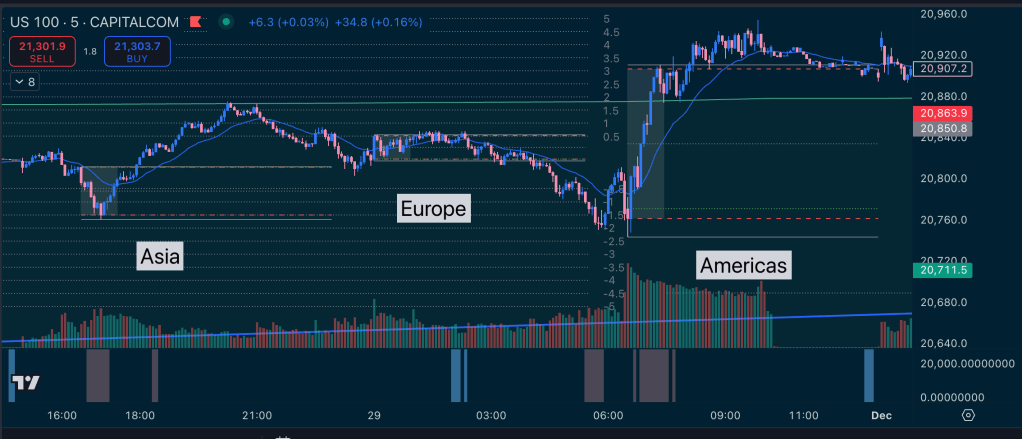

I continued to study time, both within the scope of a day, as well as the macro factors, especially the rate narratives, as I saw the market moved in ways and at times that I couldn’t comprehend yet, and I saw a lot of really good traders get absolutely decimated through these shifts. You can see the trade below is both utilizing the market session time to find entry after open, and is also using the broader market condition context to find a safe and confident entry with honestly just absurd levels of risk for the account size.

After surely demolishing any trace of value from crypto futures, I realized I was going to have to tighten up my burn rate to log enough screen time to get to consistency. I started to shift away from crypto as Canadian regulations started to make it nearly impossible to trade derivative instruments in crypto. I found cheap $100 prop accounts and just kept buying challenges over and over and over. I thought I had consistency so many times. I’d get funded and be so over confident I’d blow the funded accounts within days if not hours.

I had a long, long, LONG stretch demolishing prop account after prop account. But my burn rate was controlled at least. Now I had a new issue I was discovering was at the root of my inconsistency: me. I was trading harder markets – especially NASDAQ/US100 CFDs – and those markets don’t let you have anything easy. My buddy Flex says “NASDAQ is the NBA and shit coins are the special olympics. Which are you going to compete in?” While the statement is incredibly politically incorrect, the heuristic is true: you’re in an arena and you’re competing against other players. If you trade illiquid immature markets, your competition is going to be a guy watching/trading concepts that are unsophisticated. If you’re playing against Blackrock and Vanguard, they’ll eat you alive.

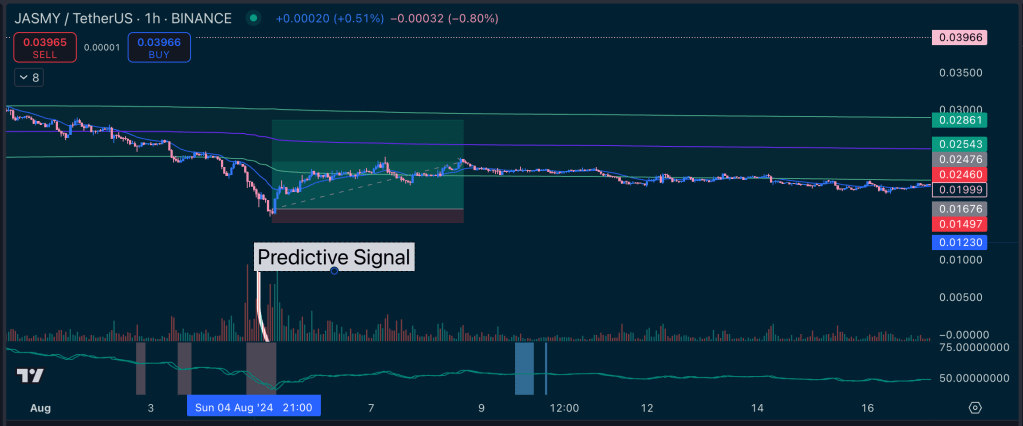

And for a long time, I was so stuck on the concepts I was trading. Most of my first 3 years of trading focused on a handful of ideas. I had read Ehlers a lot who is a signals engineer, and he described all of the issues with common indicators and gave out trading systems he promised would be better than $500k off the shelf automated systems. I started to focus especially on predictive indicators to find volatility expansion – the idea was simple enough, that if I could identify outlier expansion, I should be able to trade the retracement.

In theory, this is an extremely sound concept. Identify where outliers are in volatility, take the mean reversion trade. It works on the other side too, where contraction of volatility will generally precipitate an expansion. You know roughly when and where, and you just have to wait for it.

In practice, trading retracement/mean reversion is riddled with potholes and landmines. Remember I mentioned TIME as the most important indicator? Well, as intraday seasonality rolls with the hours, so do the patterns of expansion and contraction of volatility. It’s highly probable that volatility will drop on markets like US100/NQ (nasdaq afterhours instruments) and it’s highly probable that they see outlier volatility expansion at the start of the NYSE trading session. In reality, these predictive concepts end up falling apart very quickly simply because of the intraday seasonality that’s brought on by the 3 major market sessions – Americas, Europe, and Asia. And, depending on institutional interest, virtually every market that runs 23/5 or 24/7 will see the same intraday seasonality. I built alerts based on months of quantitative analysis to build a predictive strategy that works, and it ends up working really well but only rarely, because these outlier phenomenon become buried in the noise of the intraday seasonality.

At the year 2 or 3 mark, I abandoned the concept of focusing on retracement completely. I turned off all of the alerts, and shifted my attention to a different phase of the market: expansion.

In retail mostly bogus “smart money concepts.” the basic idea is that the market shifts through 4 phases. Consolidation, expansion, re-tracement and reversal. To go back to the volatility concepts, the idea is that reduction in volatility, and then the expansion is auto-correlated with a strong move. The longer and more stable the period of consolidation, the more explosive the price action. In theory, anyway, and these are anemic trading concepts that I don’t believe are anywhere close to sufficient to explain how and why the market moves. But it does somewhat hold up – there is a lot of research that tries to formalize the relationship. https://www.researchgate.net/publication/353506084_The_Price_Impact_of_Order_Book_Events_from_a_Dimension_of_Time

So I had a couple new vectors to focus on – specifically these new vectors were the areas that caused my strategy to fail often enough to abandon the quantitative approaches. (And I’m not even going into the DRL attempts, which were long, hard, painful cycles, utterly unfruitful.)

We had this observation that time of day was correlated to volatility contraction and expansion as observed in forward testing. I knew every day the alarms would trip to signal volatility changes. While I was trading around the clock a lot when I was full time, I heard a lot of other traders only trading 2 hours a day. I bumped into a supposed forex professional called M4st3r on youtube who produced a market-time centric indicator. The idea is quite simple: the first hour of the 3 geographic sessions draw a range in the first hour, and the rest of the market day is likely to stay inside that range on _most days._ There are some interesting characteristics of this that can generate trade signal late day, but observing the session movements day in and day out on all markets started to train my brain to recognize the intraday seasonality. I could see I was learning as I started to counter trade other traders on this “invisible” vector of OHLCV data that everyone seems to ignore: TIME.

Even in a competitive market like Nasdaq, you can see the 3 sessions have very stark, visibly obvious seasonality. The first hour – the white/grey box – will draw a range, and the price will tend to hang our that at the end of the hour. Some sessions the market will trend – it’s 10-20% of session. The rest will range. But you’ll see that there is an expansion quite reliably at the front of the sesisons, especially the America/NYSE session for these markets.

By pivoting towards capitalizing on expansions, and focusing on time of day, we now have a pretty good map to capture the move, and it only takes an hour or two to find most of the daily range. The only thing I needed to find was a strategy that worked reliably.

As markets shift and change, and macro factors come into play, the trick is to find confluence of factors. I looked a lot at macro head/tail winds in the indices, but I smashed my face on my keyboard day after day losing when the market would behave in ways I couldn’t predict or understand. Bitcoin ended up moving the way I expected on macro catalysts, and the indices virtually never would print the way you would rationally expect them to. There was other stuff happening and I didn’t have a mental model to cover it.

I started to study how brokers worked and uncovered a slew of “secret” information. The SEC have stated that they don’t want the public to understand how brokers interact with the markets, and that there isn’t any need for the public to know. As I came to learn about the dark and deep truths of how brokers and makers operate against the primary markets, I started to understand a lot of details that impact these markets. I started to see patterns that could help to explain the how and why the price and breadth interacted the way that they did. After a lot of frustration finding signals that worked beautifully and then would suddenly lose all predictive power, I found the intersection of option delta hedging and market breadth data that I started to use to characterize the market session and be able to more or less quantify how breadth and price would interact before open bell.

I now have roughly 3 playbooks that I’ll pick plays from depending on the hidden context in the market. And we’re all promising each other in the k-xs pod that we’ll move out of focusing on indices and start chosing the markets intentionally depending on the context. I spent so many months only trading nasdaq, and now I know to look at the catalyst, check the response, and then pick the right markets to find the move. I made some errors this month trying to shift into different trading styles on a live account but I’m happy to say I have not blown any account limits on a live account, running for months inside the lines.

One of the best lessons I’ve learned this year is that every trade is completely unique, no two trades are the same. There is no singular playbook, no one setup that works. You need to have all of this context and screentime to be able to quantify and categorize the dynamics before you even look at the price. The charts and indicators become the last thing that I look at. I remember when I consumed a bunch of SMB content that I was very frustrated they started with catalysts – I just wanted to be a chartist.

Now I study sectors, commodities, debt markets. I read the options chain data, track the interest, and I shift and change the markets that I choose to trade. I check the IV, monitor the breadth, find the catalyst, and _THEN_ the trade. And I never wanted to use a catalyst because it seemed annoying and I thought I was smarter. You are never smarter than the market. Be like water and stay humble.

Leave a comment