this article was written by the Pulse agents I built, but the article is based on ideas that I had been sharing on discord about my trading journey. The ideas are extremely close to my own thinking, Claude picked up pretty much all of the key ideas that I try to share so I thought this was worth publishing. The timelines are only for prop training, it took me about 4 years to find consistency month after month after month. I would guess most traders find profitability towards 5 year mark without a mentor at a trading desk coaching them. Most of the information available is not good that’s available describing trading and strategies. The scarcity of good ideas makes the process significantly more difficult.

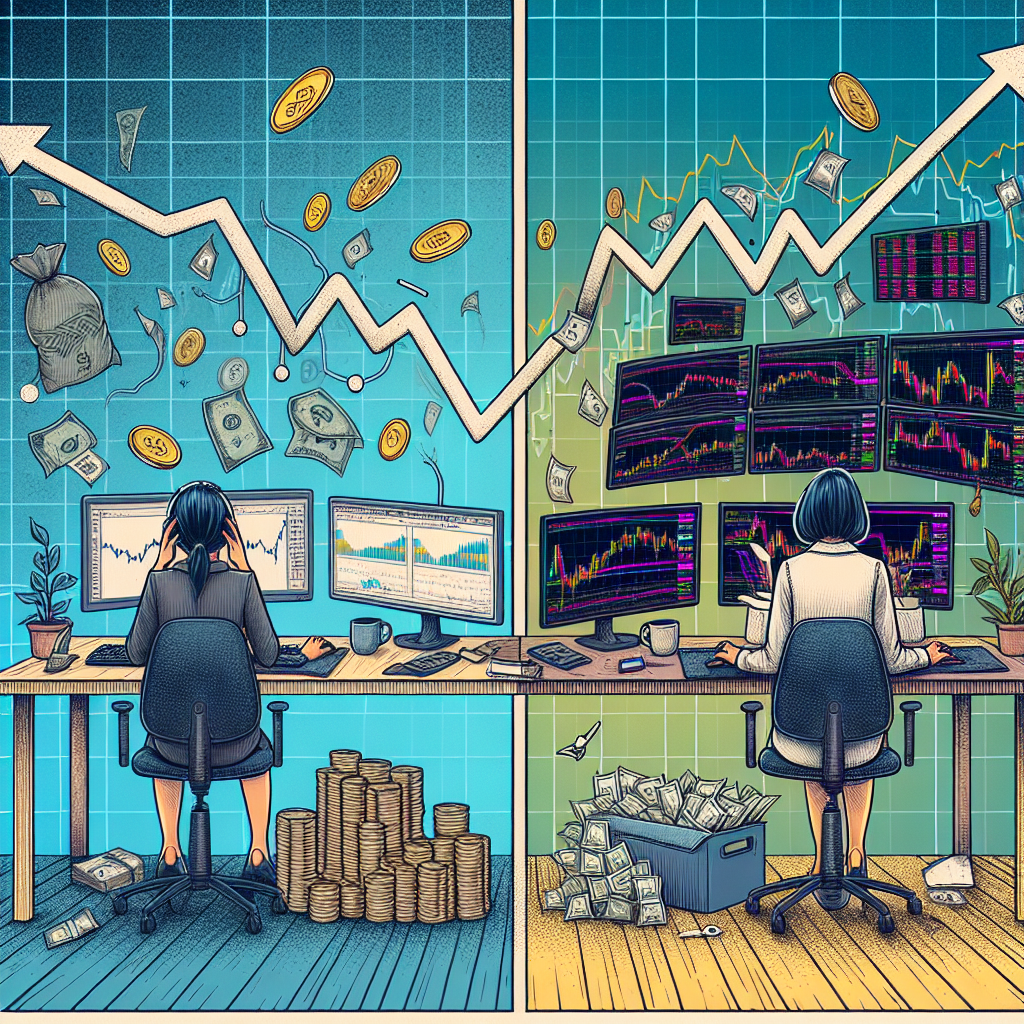

Trading is often romanticized as a quick path to riches, but the reality is far more complex and challenging. This article takes you on a riveting journey of one trader’s 1.5-year odyssey from wide-eyed novice to battle-hardened professional, culminating in their first significant payout. Buckle up, because this ride is filled with heart-stopping drops, exhilarating climbs, and invaluable lessons that will resonate with anyone brave enough to enter the trading arena.

The Brutal Baptism by Fire

Our protagonist’s trading career began like many others – with a heady mix of optimism and naivety. But the markets have a way of humbling even the most confident newcomers, and our trader was no exception.

“I still remember the sick feeling in my stomach as I watched my first funded account evaporate,” they recalled. “It was like watching a car crash in slow motion, but I was behind the wheel.”

The carnage didn’t stop there. Over the next few months, our intrepid trader:

- Blew through three funded accounts, each loss more painful than the last

- Failed three validation phases, coming tantalizingly close but falling short each time

- Lost approximately five $10,000 challenge accounts, a staggering $50,000 gone in what felt like the blink of an eye

These gut-wrenching losses align with the sobering industry statistic that around 90% of new traders lose money, often wiping out their accounts before ever tasting profitability. But our trader refused to become another statistic.

Forging Steel in the Fires of Defeat

Instead of throwing in the towel, our trader doubled down on education and self-improvement. They embarked on a relentless learning journey, treating each loss as a costly but invaluable lesson.

“I realized I had been trying to run before I could crawl,” they explained. “So I went back to basics and rebuilt my approach from the ground up.”

This educational odyssey included:

- Laser-focusing on equity index trading: By specializing in one area, they were able to develop deep expertise rather than being a jack-of-all-trades, master of none.

- Mastering the art and science of risk management: This proved to be the linchpin of their eventual success. “I learned that preserving capital is just as important as growing it,” they noted.

- Obsessive research and journaling: Every trade, win or lose, was meticulously documented and analyzed. “My trading journal became my bible,” they said.

- Developing a trader’s mindset: They worked on cultivating emotional discipline, learning to stay calm in the face of both wins and losses.

Harnessing the Power of Technology and Data

As their skills grew, our trader began leveraging advanced tools and data analysis to gain an edge:

- They developed custom indicators based on established research, fine-tuning them to their specific trading style.

- Options chain data became a crucial source of market insights, helping to predict potential moves in the underlying assets.

- Volatility and breadth indicators were incorporated to provide a more holistic view of market conditions.

“I realized that in today’s markets, you need every edge you can get,” they explained. “All the tools you need to win are out there, but you have to learn how to use them effectively.”

The Long and Winding Road to Profitability

Perhaps the most crucial lesson our trader learned was the importance of patience and perspective:

- They internalized that consistent profitability often takes 2-3 years of dedicated effort, not weeks or months.

- Their focus shifted from quick scalps to more substantial swing trades. “Scalpers can win, but you might as well bet on the swing for more significant gains,” they advised.

- Quality became more important than quantity. “I used to think I needed to trade constantly to be successful. Now I know that one great trade a year can be enough if you size it right.”

The Sweet Taste of Success

After 1.5 years of blood, sweat, and tears, our trader finally reached the promised land – their first significant payout.

“I’ll never forget the moment I saw that deposit hit my account,” they reminisced. “It wasn’t just about the money. It was validation that all the hard work and sacrifices had been worth it.”

This milestone came with some unexpected perks, like being allowed to purchase exclusive FTMO merchandise. “It might seem silly, but wearing that hat felt like I’d finally been admitted to an elite club,” they laughed.

Pearls of Wisdom from the Trenches

Our trader’s journey yielded some hard-won insights:

- Success is relative: “The top 1% trader makes $10M a year. Do you know that top 1% trader? Neither do I. Set realistic goals for yourself.”

- Grit is non-negotiable: “There were so many times I wanted to quit. But my determination left no other option but to keep going.”

- Health is wealth: “I learned the hard way that you can’t trade well if you’re not taking care of your body and mind. Regular exercise and meditation became as important as chart analysis.”

- Embrace the process: “Focus on becoming a good trader, not on making money. The money will come if you master the craft.”

- Stay humble: “The market has a way of humbling you just when you think you’ve got it all figured out. Never stop learning.”

The Road Ahead

With their first payout under their belt, our trader is far from complacent. They’re already exploring new frontiers:

- Researching opportunities in the volatile world of cryptocurrency trading, particularly in anticipation of potential bull runs.

- Refining strategies to profit in both bullish and bearish market conditions, ensuring adaptability to any market environment.

- Continuously developing and backtesting new indicators and trading systems, always seeking that extra edge.

Your Turn to Take the Leap

The journey from novice to achieving that first sweet payout is a testament to the challenges and rewards of professional trading. It underscores the critical importance of resilience, continuous learning, and maintaining realistic expectations.

While not everyone will achieve top-tier success, this trader’s story shows that with unwavering dedication and the right approach, it is possible to overcome the daunting odds and carve out your own success in the trading world.

Remember, trading is a journey of constant evolution and adaptation. Whether you’re just dipping your toes in the water or you’re waist-deep in the markets, stay committed to your education, manage your risks with iron discipline, and always keep a long-term perspective.

The markets will be there tomorrow, next week, and next year. Your job is to ensure that you’re still in the game, continuously improving, and ready to seize the opportunities when they arise. Who knows? Maybe in 1.5 years, you’ll be the one sharing your success story and inspiring the next generation of traders.