I want to call out some appreciation from the community I got today – thanks for the kind words again.

Thank you so much, means a lot to hear the feedback.

I’m pretty noisy when I trade – I write all of my decision making down along the way, wins and losses. You often don’t get to see the whole process that a prop trader takes in decision making so I really wanted to do this as I skilled up and make everything I do available for free to the public (k-xs.com and the discord.)

Had a good week, found my rhythm again after needing to re-calibrate a bit. US indices right now are difficult. My strategy is moving towards commodity trading in these conditions (silver bull run for example – today I caught like 6% on silver.) Oil is good for shorts on economic contraction.

For US indices, there are two periods that I’m focusing on: +5m entry for momentum based on Andrew Aziz‘s recent paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4824172

This strategy is yielding most days for me this week. The target time to enter is within a few minutes after collecting as much information as I can on correlates ontop of the macro context/news catalysts etc. Study your daily performance/seasonality here – I know for example Tuesday and Thursday are my best days, and almost all my gains are early prior to about 8:30am et. Friday generally I don’t win so I go into a Friday am session with caution. Quantifying your seasonality will help you be ready to make harder bets at the right times.

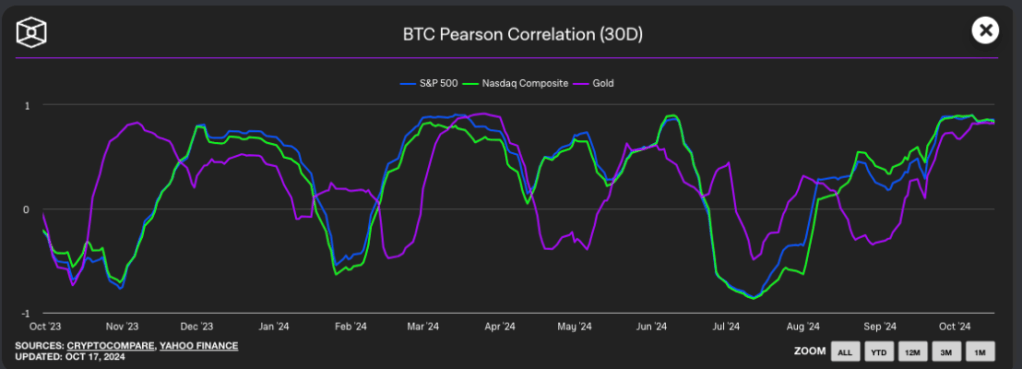

I’m also putting a lot more charts up – there is strong correlation on the Pearson 30d Correlation between equity, crypto and gold, so you can spot the real moves more easily by watching all of them together, and it becomes a lot more obvious where to exit as all of the markets will start to falter together.

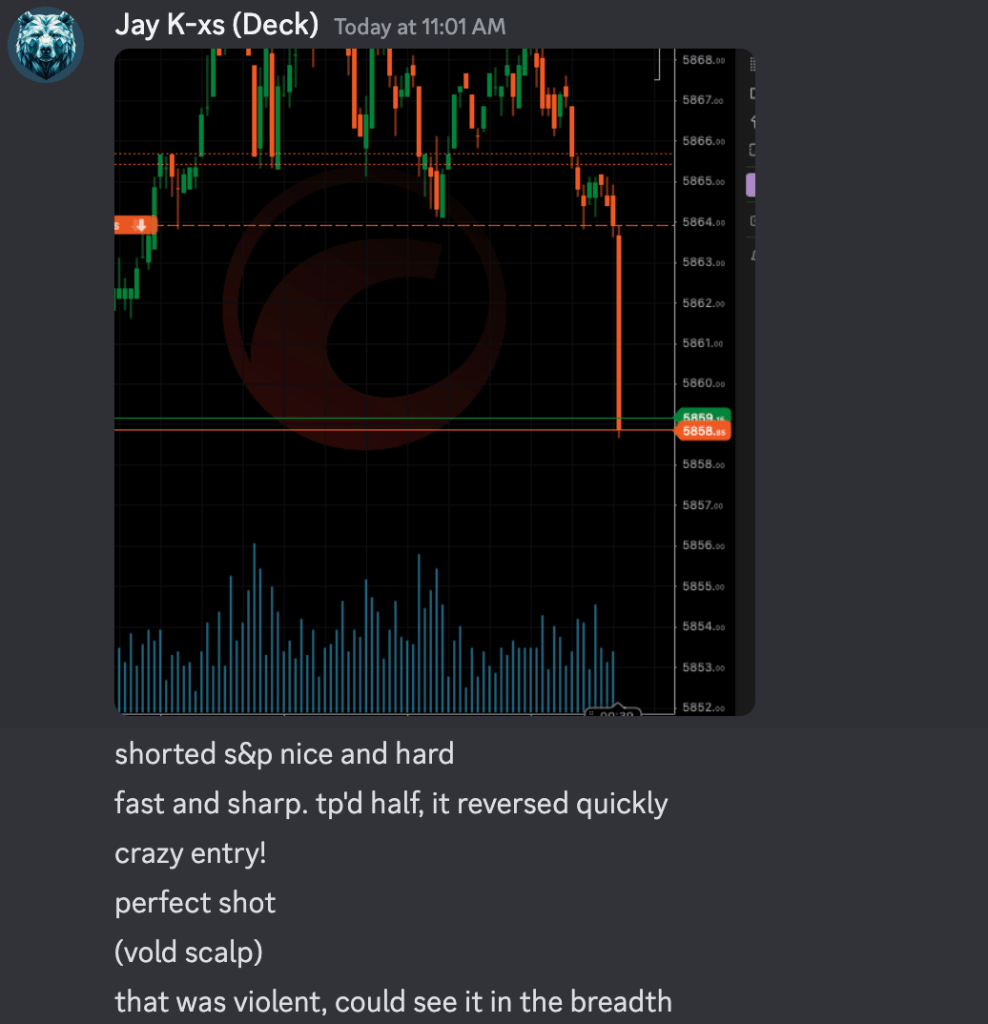

And of course, I’m still heavily invested in reading breadth/internals. You can find a few articles on VOLD etc, I stare at VOLD right from the first minute of the market open, before price(!)

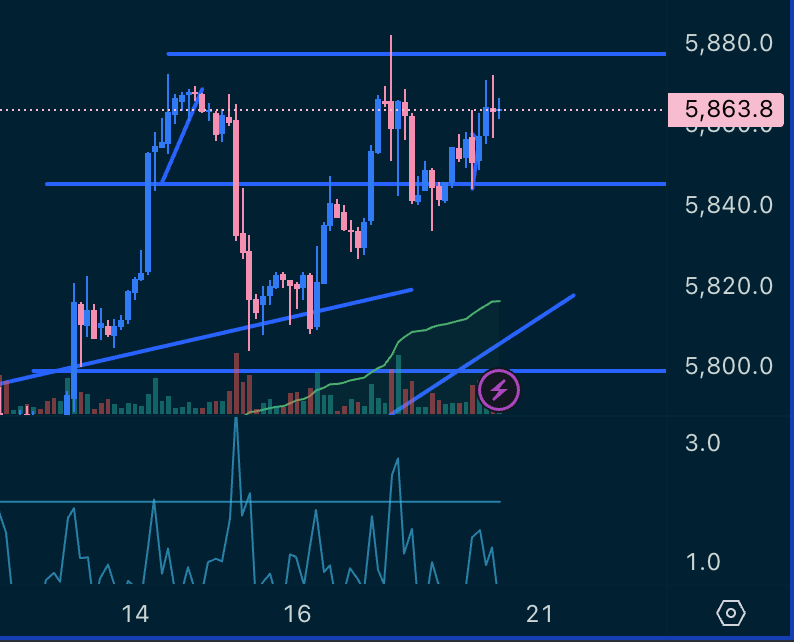

You can see this absolutely insane 1m move I caught with rediculous precision today at 2pm ET (friday Oct 18.)

I was able to spot this move early enough to catch it, and it was so aggressive I closed half the trade right away before letting the rest run into my entry.

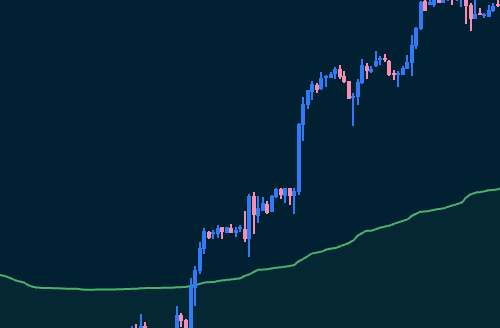

Metals have had really good momentum today, I was able to hop on this parabolic silver move, close it on consolidation, and then actually hop back on again for more of the move. I was late getting on it but it was such an easy move to catch still.

I was dialed in so the next move on silver was a much better quality entry, very easy to catch.

I was trying to catch an S&P move late day apart from that huge scalp I caught, and mostly it was jerking me around. I just kept the risk in check, reduced to cover the down-side, and get out if the trade wasn’t shaping up.

They’re quick plays for free trades, if you don’t catch a move you at least had the exposure if it happened. As long as you can get a clean entry and cover risk, it’s often worth taking the shot. It’s also just really good practice to be constantly conditioning your brain to make those split second decisions. If conditions get good or you find trades in easier (slower/less competitive) markets, then you can swing the back faster, take more mental cycles to make better decisions, and generally crush your opponents. The indices have extremely sophisticated opponents with about half of the NYSE volume moving around just in SPX derivatives/options. That means usually the price is actually shifting from market makers shifting their hedges for delta neutrality which makes the markets change behavious drastically hour to hour and day to day. 0dte have come to rule in the modern “theta gang” casino that is the options market, so I’m finding more and more that the end of day has almost no signal as market makers are just burning the theta on the bets they’re on the other side of.

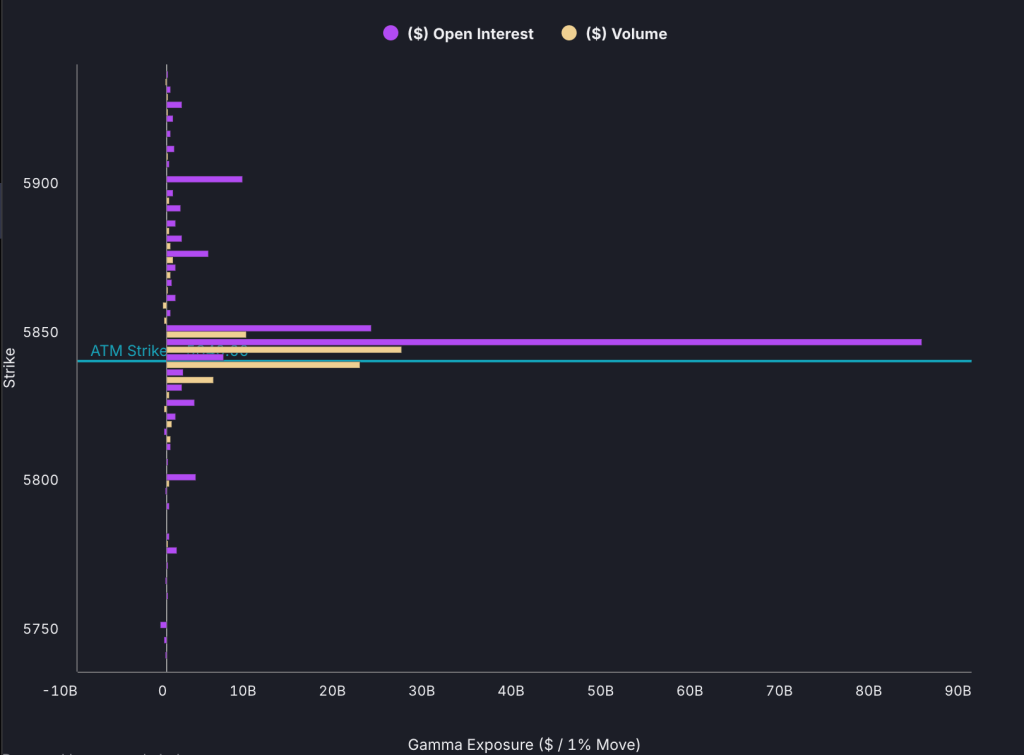

The other major factor in the market maker behaviours on the indices are gamma levels that determine how market makers are hedging for delta neutrality. Stated simply, whenever the price of the index moves, a market maker trying to mitigate their risk exposure have to hedge either against the move (sell every $1 increase in price for example) or hedge with the price movement in a negative gamma environment (buy every $1 increase in price.) This means that in the most common scenario of a positive gamma trading environment, that market makers have to push against the upward price movement to eliminate their risk exposure, which makes the markets move against the bets on the move in the markets. Consider the “stairs up” adage.

Inversely, in a negative gamma envionment, the market makers hedge _with_ the direction of the price movement, which exacerbates how fast the price moves with the bets opening against the market. “Elevator up.”

I’ve been spending a lot more time studying the options chain data and how the market responds to the bets in the options market. I’ll generally do my 5:30am pre-market prep for indices by marking levels that have OI+Volume on the options chain. I’ll check the gamma exposure on markets that have derivatives overtop of them (SPY, SPX etc) and just try to observe what the market does with the data.

You’ll see the levels of interest: 5800, 5845, and 5880 make up where the bids and asks are caught and it holds the price towards the major interest level.

This study of options hedging is still a work in progress, the SEC has said more or less that the public should NOT have this information so it’s generally not public knowledge and very hard to acquire and understand. I’m trying to avoid paying for subscriptions so I’m generally using 48hr delayed information in my analysis as well.

I’m considering MenthorQ and UnusualWhales for deeper options chain information, but I just want to make sure I can actually use it effectively before I start paying for anything.

Anyway, that’s a little recap. Just gotta stick to basics, continue to adapt to the changing market, test my plays are working, and adjust if I start to see my PnL waver. I’ve had a couple periods I wasn’t getting things to stick and it has been very fast to recover, so I’m very happy with how my risk management practices are working.

Leave a comment