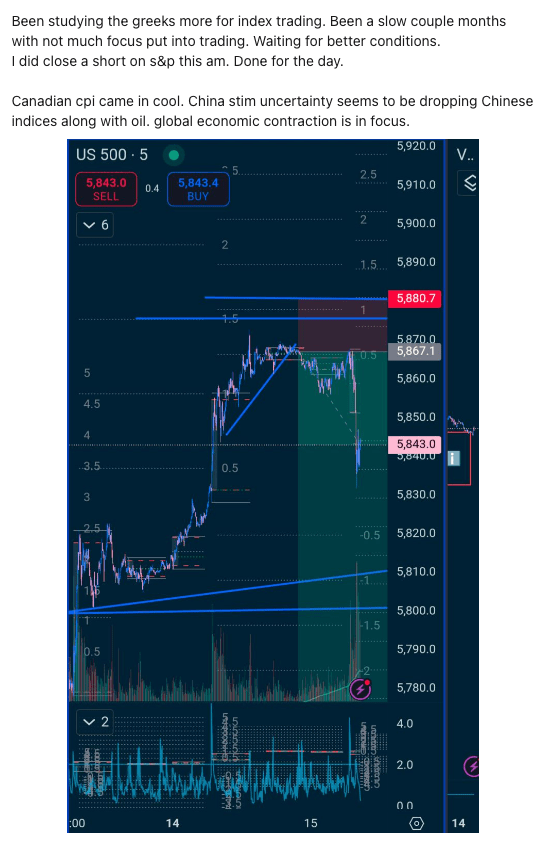

Checked the greeks last night and opened a short on S&P overnight.

Today gave what appears to be rotation out of megacaps so this played out. RTY shot up, as the major indices dropped, mega-caps like NVDA took a nose-dive, with NVDA hitting the quarter-anchored VWAP within a dollar.

Today there wasn’t sell-heavy breadth, so I’m reading this as deflationary rotation, with stronger bets on more rate cutting.

Regret closing it as S&P broke trend.

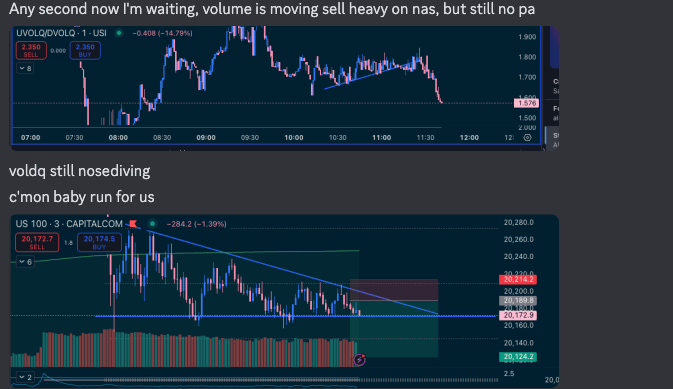

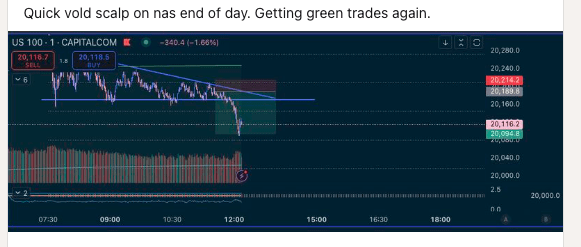

Second trade was a VOLD scalp on descending wedge for NAS/US100.

First, I saw VOLD move. This is my entry signal:

This actually took a lot of patience for the PA to show up.

This ended up evolving into a nice trade. All in, that’s +20% on what I have to risk, good day and a multiple on original investment banked.

Leave a comment