I saw some symptoms of information asymmetry in the markets yesterday (Monday August 12, 2024) leading into CPI on Wednesday. Nasdaq had a hard buy wall, and bearish patterns and geo-political uncertainty wouldn’t bring the markets down, so I’m assuming funds are competing for liquidity based on either CPI or Unemployment data to be released later in the week.

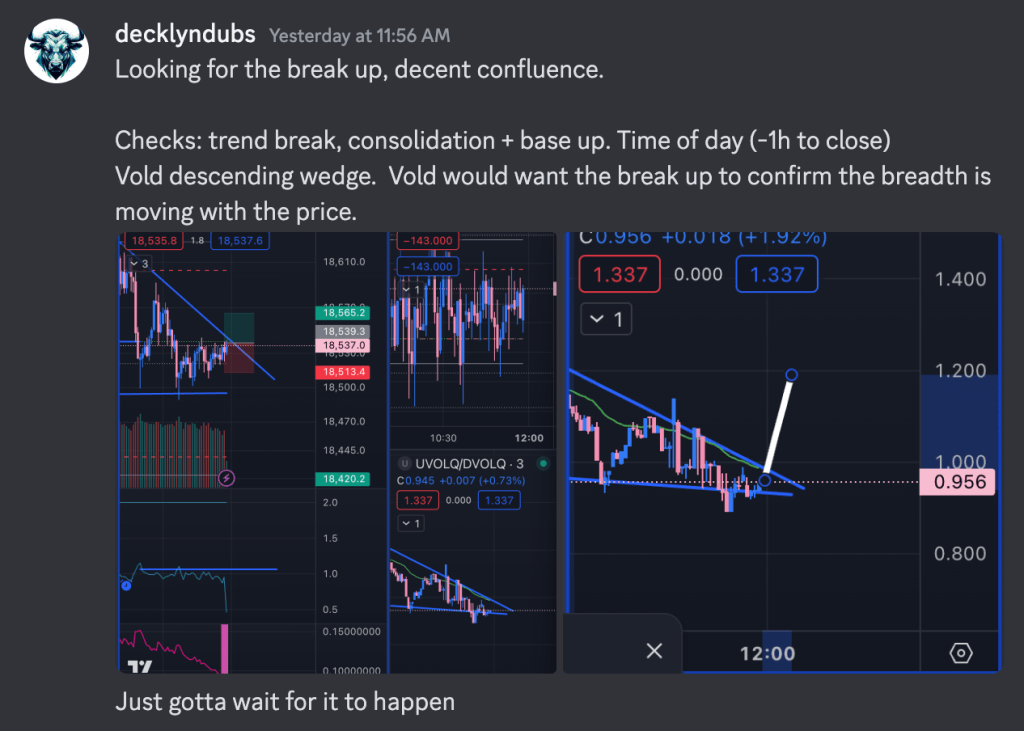

I found a long entry towards the NYSE session close and took it to hold. You can see some patterns: VOLDQ is in a descending wedge, and even though that data is very much derived, it still shows the same patterns and probabilities. I’m often looking at market breadth _before_ price to ensure the wind is at my back. When the price and breadth patterns break together, it makes for a confident entry. This trade was right into close, so you start to lose visibility to breadth. I was confident in my assessment: funds are using any liquidity that they can into CPI or Unemployment. I don’t know what the news is, but I can see that it’s coming.

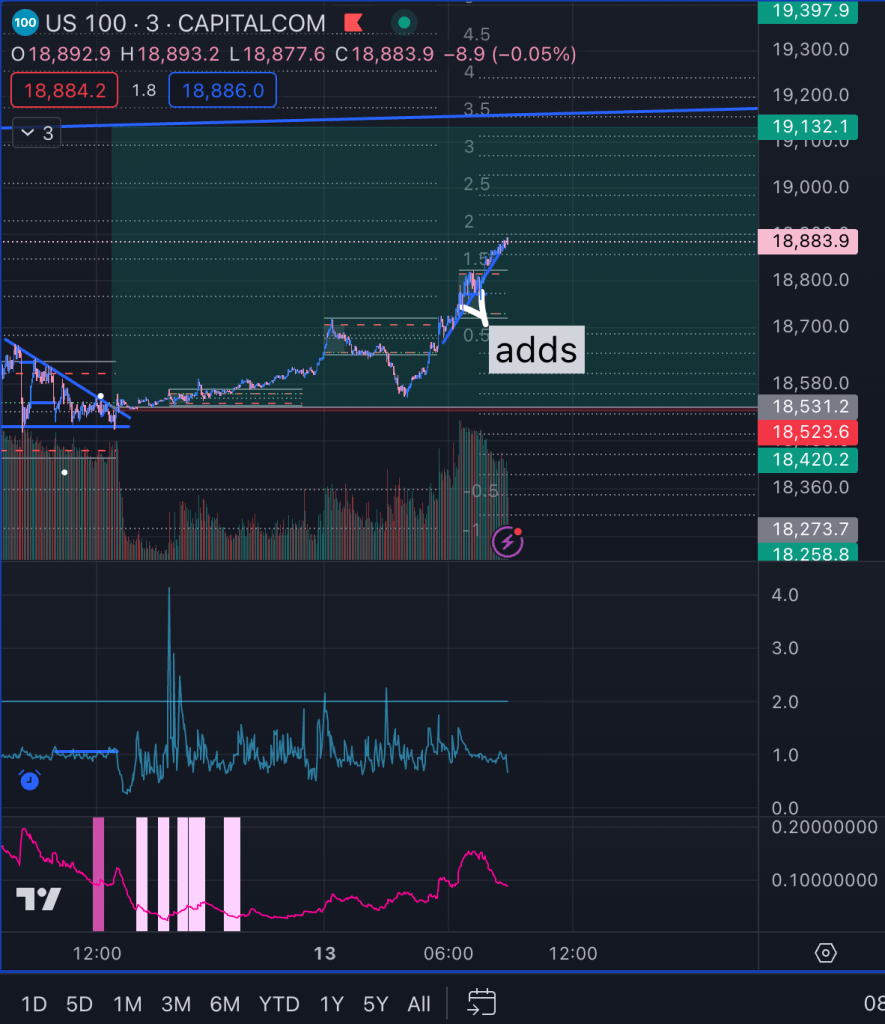

I put a couple more additions on in the session today. I’m using a different playbook today, primarily using this play: https://k-xs.com/2024/08/05/playbook-entry-safe-entries-for-putting-risk-on-trend-continuation/

I might have gotten a little tilted yesterday figuring out the market (breakin’ the rules) and ripped up a point, but I kept it under control. When there is some asymmetry in the market, I always get thrown off. It should be illegal but one of the economists at BLS leaks the data early, so you have to be careful trading before CPI. https://www.bloomberg.com/news/articles/2024-04-09/jpmorgan-blackrock-among-bls-economist-s-cpi-super-users

Once you know this, you can make sense of the market moves and capitalize with confidence by following what the market is telling you.

Leave a comment