Invert your charts, the world changed overnight and nobody is used to trading it. How is it going for you so far? Have you been able to adapt quickly, or are you finding you’re trying your old strategies and they aren’t working?

No longer is the market excited when bad data comes in bad, euphorically anticipating, at one point this year, 6 rate cuts by year end. Now the market sees economic contraction, and know it’s too late for rate cuts to have any effect. Consumers may not know this, but the institutions understand I’m sure.

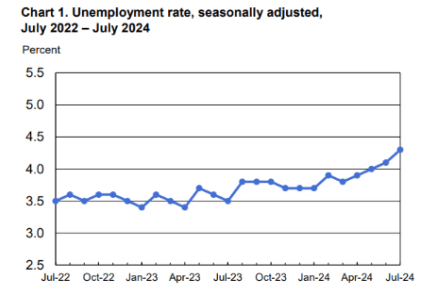

Unemployment is Rising

BLS has reliably revised unemployment numbers most every month for 18 months. Again, they reported the job additions were lower than first published in June. Here is the Unemployment rate published by the BLS in August for July:

You can see the trajectory on unemployment rate is up and accelerating in that move. This is not a good signal. That “strong economy” – it’s weakening. It takes time for rate hikes to work their way through the system. And if you think a rate cut here is magically going to save the economy from taking a nosedive, that’s mis-guided for the same reasons. These are cycles and patterns, and economists know this. They know this contraction is likely to happen, and they know it’s worse if people panic. They also know it’s much worse if they cut early and inflation rises while the economy is contracting.

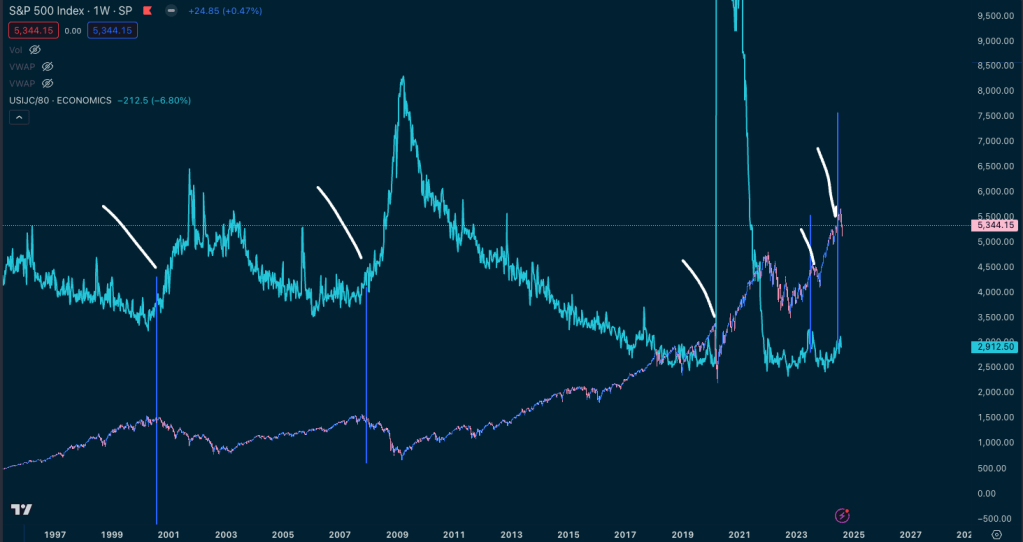

Unemployment and S&P Negative Correlation

It’s possible that this trend of rising unemployment stops, but the general correlation is negative. At the start of every major downturn in the S&P is a rise in initial jobless claims and unemployment. You’ll note that in 2021 the market contracted while unemployment did not rise – this was the start of the rate hike cycle, I think of that downturn as a “bracing for impact.” And you’ll notice actually that when initial job claims started to rise, that the market did too – the market started to price in many rate cuts in optimism of a “no landing” or “soft landing” – an anticipation that inflation was under control and that the economy didn’t contract dramatically. The hope was that the fed might be able to cut rates before unemployment started to rise. Demand in many sectors stayed high and the consumer acquired a lot of debt – many gave up on the idea of home ownership and just started to spend their money. The characteristics in this rate hike cycle were quite unique with some unanticipated consumer behaviours that may have helped contribute to a stickier inflation and unyielding economy. The fed wants demand to drop to halt inflation, and if people keep spending, it doesn’t happen as quickly or dramatically.

But if people start getting laid off, well that will get inflation under control. When people don’t have an income, it turns out that they stop spending then.

Given the recent strength of short-term debt markets, I suspect that this trend will continue, but not a linear way. The market is very much trained to greed after this recent run. People suddenly believe that the market can’t go down, and it won’t take much to calm fear and get a lot of heavy buying back in the market. I wouldn’t surprised if a cool unemployment print and an on expectation CPI print rally the markets right back to highs but let me be clear here: I wouldn’t be surprised to see a 10% movement on the S&P in either direction. I wouldn’t be surprised to see the S&P go sideways for 3 years. I wouldn’t be surprised to see the S&P drop 70%. I wouldn’t be surprised to see the S&P go up 10000000% in the next 5 years either (ie: USD collapse.)

I’m expecting maybe another run up if we get some optimistic data, I’m being cautious and open to trading either way. It’s worth remembering that if the USD becomes destabilized, people will be trying to “sell dollars” as fast as they can, so in my mind it’s not unlikely to see markets “crash up.”

The future is unknowable. All that we can do is to be prepared for opportunity. My focus is to continue building up funding as fast as I can stomach. My spot holdings (RRSP, etc) I’m moving out of exposure to TSX and into metals for probably 2 or 3 years, or until I see a significant event and an opportunity to enter into risk. Bitcoin is a wildcard long term but I expect it to shake out the non-believers before the equity markets really unwind, similar to 2021.

Check Your Consistency When The Market Shifts

I want to mention that this is a good time to size down if you haven’t been pulling gains on the moves. I took a couple weeks and traded at about 1/8th my usual position sizing, slowly scaling it up to 1/4, and then 1/2. I wanted to make sure I could win consistently in the new conditions. I remember other times that the market dynamics changed, and I took a real beating. Bellafiore talks about how all of the traders at SMB were in red when the rate hike cycle started. He says it was a mistake to not force everyone on the desk to size down immediately. When I see different behaviours, I take some time to ensure I can pull profit consistently before I start trying to build big positions.

Leave a comment