In the dynamic world of trading, capitalizing on trends can be highly rewarding, but entering safely and managing your position is crucial. This article outlines a strategy for entering trend continuations with controlled risk, focusing on entry tactics, stop placement, and knowing when to exit.

The Art of Entry

The foundation of this strategy lies in identifying consolidation patterns. These sideways price movements within a defined range often precede the next leg of a trend. The key is to wait for a breakout from this consolidation in the direction of the primary trend.

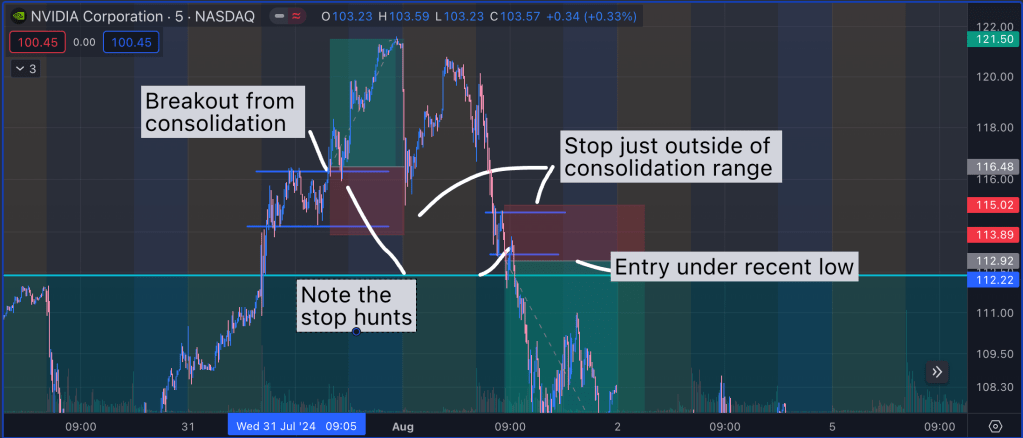

As shown in the image, a successful entry strategy involves waiting for a “breakout from consolidation.” However, immediately chasing a breakout can be risky. A more prudent approach, illustrated in the image, is to wait for a pullback and enter “under recent low.” This method often provides a better risk-to-reward ratio.

By entering after a pullback, you’re essentially waiting for the market to retest the broken support or resistance level. This retest serves two purposes:

- It confirms the strength of the breakout, as former resistance should now act as support (or vice versa in a downtrend).

- It allows for a more favorable entry price, improving your potential risk-to-reward ratio.

Intelligent Stop Placement

Once you’ve entered the trade, the next crucial step is placing your stop loss. As the image clearly shows, it’s advisable to set your stop “just outside of consolidation range.” This strategy is born from understanding market dynamics and the behavior of larger players. Please take this as a suggestion only: you may want to keep it much tighter or close the trade if you realize your entry idea is no longer valid as is the case in a failed breakout.

Markets are competitive, and large traders often engage in “stop hunting” – briefly pushing the price beyond obvious support or resistance levels to trigger the stop-losses of smaller traders before reversing course. By placing your stop beyond the consolidation range, you give your trade room to breathe, allowing for normal market volatility without prematurely exiting your position.

However, this wider stop placement may increase your per-trade risk. To manage this, you might need to adjust your position size to maintain your overall risk parameters.

Knowing When to Exit

While our entry and stop-loss strategies aim to capture the continuation of a trend, it’s equally important to recognize when the trend might be changing. The image doesn’t explicitly show exit points, but there are two key scenarios to watch for:

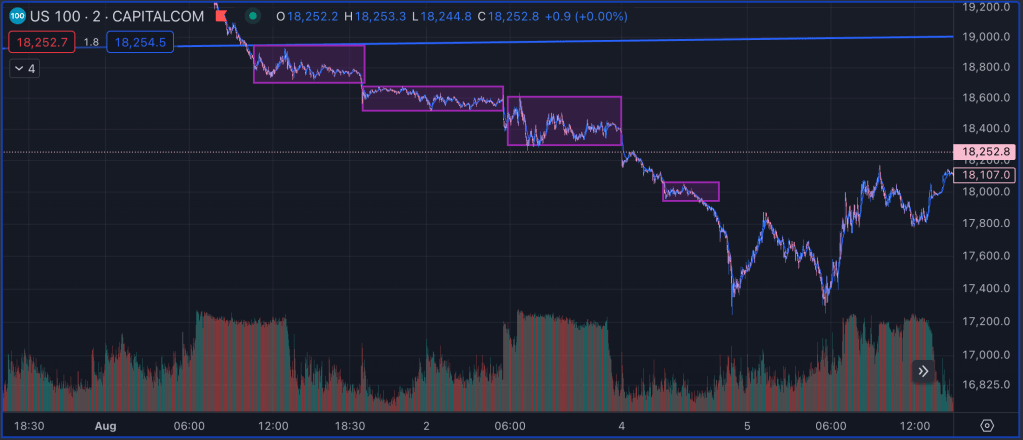

- Next Consolidation/Breakout in the Wrong Direction: If you observe a new consolidation pattern forming and then breaking out against your trade’s direction, it might signal that the trend is reversing. This could be a good time to exit or tighten your stop-loss.

- Reversal Patterns: A sharp move with a V-shaped reversal can trigger a shift in sentiment and rebound. Other patterns like horns (broadening) and wedges (tightening) can also signal shifts in sentiment and reversals with strong likelihood of the outcome (up to 80% likelihood of breaking out against the trend in the S&P historically.)

In either of these scenarios, it’s crucial to reassess your position. You might choose to exit entirely, partially close your position, or at the very least, move your stop-loss to protect more of your gains.

Remember, successful trading is not just about entering positions correctly, but also about managing them effectively and knowing when to exit. By carefully timing your entries, placing your stops intelligently, and staying alert to potential reversal signals, you can put yourself in a position to ride trends while managing your risk effectively. For your best shot at success, ensure you use multiple perspectives to find a confluence of signals for entry/exit.

Leave a comment