The recent discussions among traders highlighted the intense market reactions following the Federal Open Market Committee (FOMC) meeting. The FOMC’s decision to maintain interest rates, coupled with statements about future cuts being a possibility, has left traders in a frenzy trying to interpret the implications.

Market indicators have reflected a complex situation. As noted by several traders, the VIX (Volatility Index) spiked, indicating heightened uncertainty among investors. The fixed income markets are seeing bets against the Fed’s statements, with traders expressing confidence in potential rate cuts despite the central bank’s ambiguous signals. For instance, some traders are betting on employment risks rather than inflation risks, which seems to echo a broader market sentiment that contrasting economic indicators are leading to unpredictable outcomes.

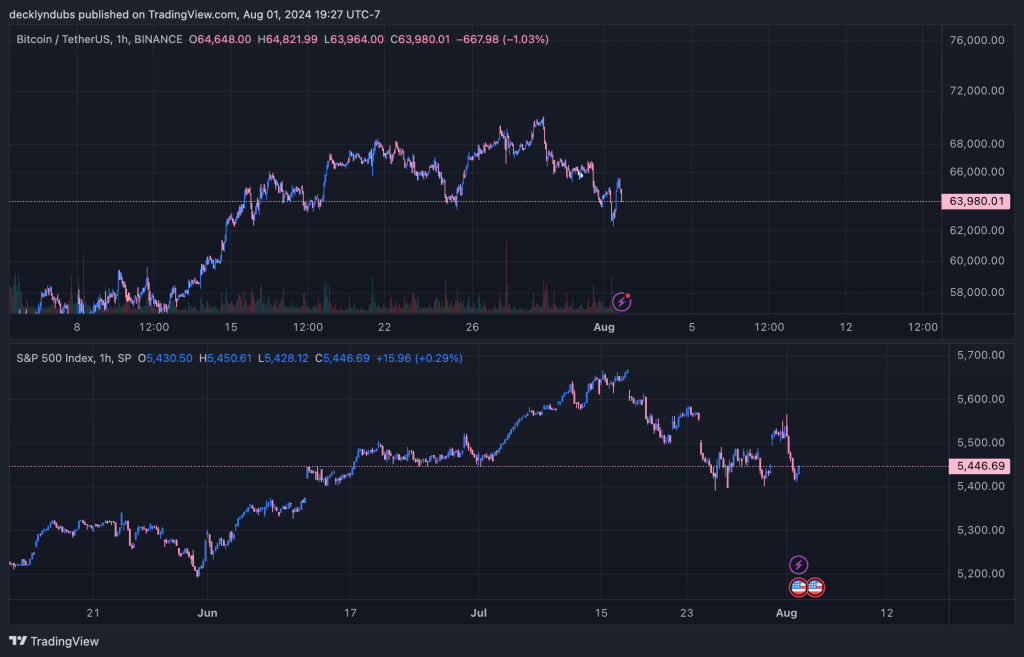

Moreover, as the discussions pointed out, the S&P 500 and other major indices, including Bitcoin, have faced significant downturns amidst this backdrop of uncertainty. The discussions spotlighted how traders are adjusting strategies, with some suggesting that “bad news is bad news” in this instance, further indicating a bearish outlook.

The combination of deteriorating economic signals, including contracting orders and backlogs, along with rising inflation pressures, suggests that traders must remain vigilant. This precarious balancing act between anticipating Fed moves and reacting to current economic indicators will be crucial for navigating the turbulent market landscape.

Leave a comment