Bitcoin (BTC), the first and most successful cryptocurrency, is not only a highly profiting investible asset but also emerges powerfully as a sentiment indicator in the confounding world of the financial market. The price deviations of Bitcoin often elucidate traders’ sentiment, foretelling potential trends in the stock market, forex, and other digital currencies.

The primary reason why Bitcoin has become a critical sentiment indicator lies in its decentralized nature. It operates without a controlling authority like a central bank, which makes Bitcoin trading largely impervious to governmental economic policies and corporate fiscal updates. Therefore, Bitcoin serves as a crucial indicator of the mass sentiment of traders globally, reflecting their reaction to financial news, geopolitical shifts, and global economic events in its price movements.

Investor sentiment is essentially a psychological phenomenon that finds an expression in their trading actions. It is a gauge of traders’ collective feelings towards an asset, commodifying fear and greed, uncertainty and optimism. Therefore, often the unpredictable, volatile price movements of Bitcoin are not irrational, but highly informative of the undercurrents steering our financial markets.

Bitcoin’s price fluctuations are often caused by shifts in retail investors’ sentiment. When Bitcoin’s price goes up rapidly, attracting mainstream media attention, a fear of missing out (FOMO) triggers among investors causing them to enter the market. Conversely, if the price drops significantly, it fuels a panic sentiment, forcing investors to exit.

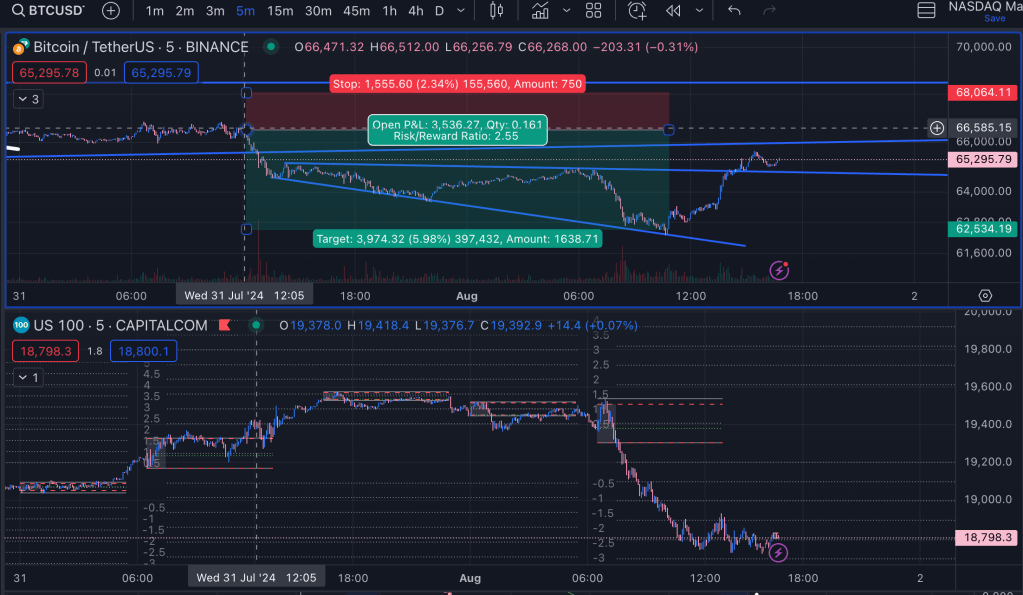

Moreover, Bitcoin is becoming increasingly correlated with the equities market. Many investors treat Bitcoin as a speculative asset. Therefore, when the equities markets are bullish, wary investors may divert their resources towards Bitcoin. However, in a bearish phase, they are likely to move away from Bitcoin, reflecting a risk-off sentiment. This correlation further substantiates Bitcoin’s role as a sentiment indicator. You can see how Bitcoin responded immediately to the FOMC decision from 12PT/2ET and the statement at 12:30PT/2:30ET July 31st compared to the Nasdaq. BTC clearly shows the risk sentiment in the market, even faster and more clearly than Nasdaq, which makes it an excellent market to trade macroeconomic news and data on.

Nasdaq actually rises at first – it’s not until the next NYSE session after PMI that the equity market starts to drop. This is very common, potentially because brokers actually create longs against the primary when traders on their platform short in order to hedge, or positive options gamma may cause market makers to buy as puts are written.

Several analytical tools like the Fear & Greed Index can be used to analyze Bitcoin’s sentiment but these tools don’t give much edge relative to understanding the macro sentiment by digesting the news. The Fear and Greed index deploys various metrics, including market volatility, market momentum, social media sentiment, and BTC dominance to provide a numerical representation of the prevailing sentiment in the Bitcoin market.

As you can see, parsing the news quickly can give you a competitive advantage! Keep an eye out for our MacroLens tool coming soon which will quickly push summary updates and sentiment from economic news as data, as well as find market reactions for you to trade.

To sum it up, Bitcoin’s price movements can serve as a metaphorical coal mine canary for traders, providing them insights into the overall mood of the market. Understanding these sentiment indicators can equip traders to make smarter, more informed investment decisions. This only reiterates the fact that in the capricious landscape of the financial market, human emotions of fear and greed have a critical role to play. Thus, Bitcoin’s role as a sentiment indicator will continue to be of high pertinence in the foreseeable future.

Leave a comment