One of the things that I noticed in the July market sell-off was that the VIX seems to show where the volatility will come in. The VIX crept along at a yearly low in a consolidation pattern (descending wedge) and broke out from a multi-month consolidation pattern:

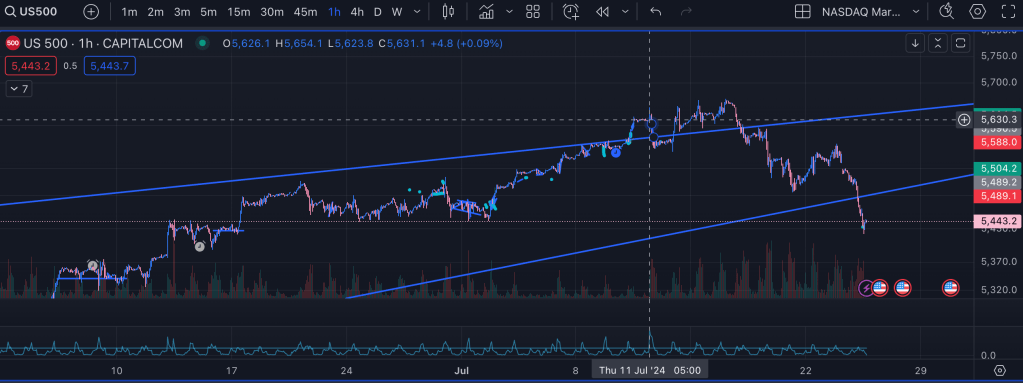

The contraction in the S&P/Nasdaq is precipitated when the VIX cleanly starts the breakout. July 11th the VIX starts to waver, and within a few days a trend shift starts to appear in the markets.

I missed a couple nice swing short entry points as I’ve been focused on some other projects and a little too zoomed in. This observation is interesting, and worth some further study around historic trend pivots.

Remember that when the markets rise without a pull-back, the VIX will drop. When markets start to drop, the VIX will go up.

Leave a comment