I had a nice trade on futures open, I was in the passenger seat in dodgy wifi 15 hours away from home, and jumped on this trade within a few seconds of broker’s market open.

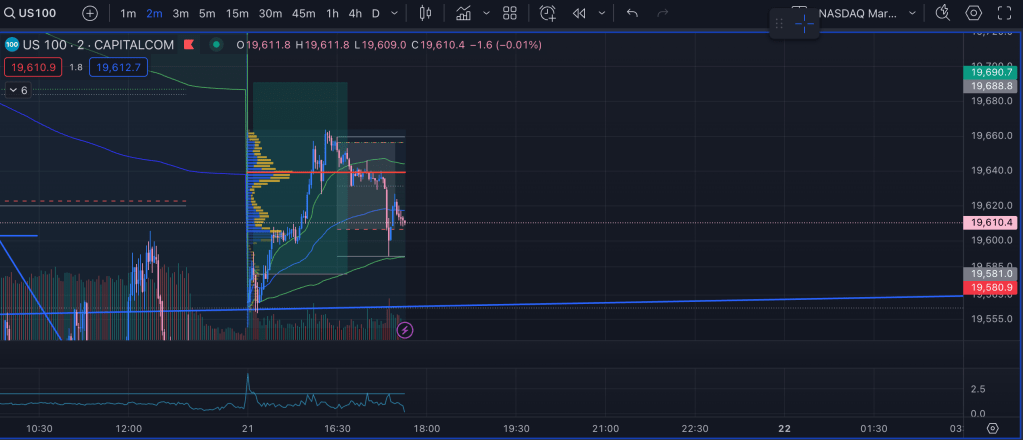

Can see the Nasdaq entry/exit point:

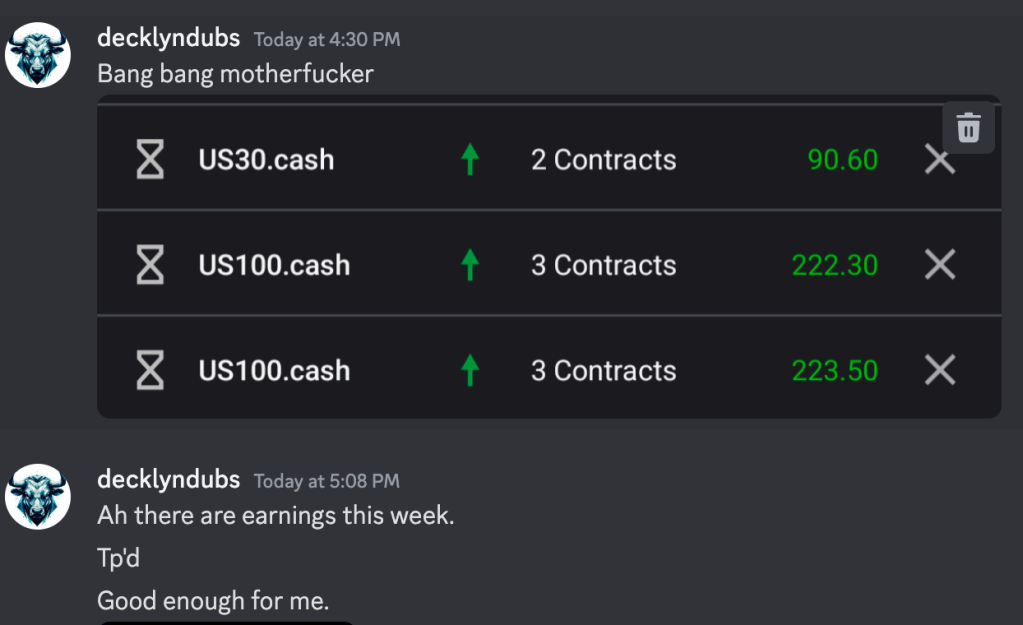

The trade was outside of market session, before Asia open on a Sunday night. This was 100% a macro trade, I didn’t check the chart at all apart from watching that the market gapped up significantly on futures open. I jotted down an explaination in Discord for the reasoning behind the entry, and the exit.

“Markets don’t like uncertainty, and with rumours of Biden dropping out or generally not doing well, it creates a value gap as the market is unsure what will happen. Once there is certainty in the market, you can expect that value gap to get taken. My economics prof used to say “sell on the sabre rattling and buy on the bullets.” meaning uncertainty is where you sell, and certainty is where you buy. The adage relates to the threat of war, but it is a general statement. With er and more uncertainty next week, alpha decays again, so I decided to exit as I can’t see any probability from here into Asia and Europe session. Could keep a piece running, would rather just sleep and trade the sessions from here.”

Leave a comment