I nailed a perfect Bitcoin trade today. You’ll notice that I’ve been discussing checklists and trying to use them. I have 3 right now:

- Daily checklist (3 things, habit tracking)

- Market Analysis/Planning and Preparation. Before trading, conduct a high level review and document ideas/plans.

- Execution. Check position quality and sizing are appropriate. Attempt to reduce over trading and size big(!) on high quality positions.

This trade was overnight so it wasn’t sized huge. My self confidence is also a little shaken so I’m careful about entering large size. That’ll come. BTC is a difficult market as well. To recap, I first had done analysis on BTC which you can find over here:

https://www.tradingview.com/chart/BTCUSDT/feEmMpPo-BTC-major-resistance-in-symmetric-consolidation/

You’ll notice that I had a plan for either up or down from there, and assumed it would sell off of the fib 66k, so I started to watch for an entry after drawing this up.

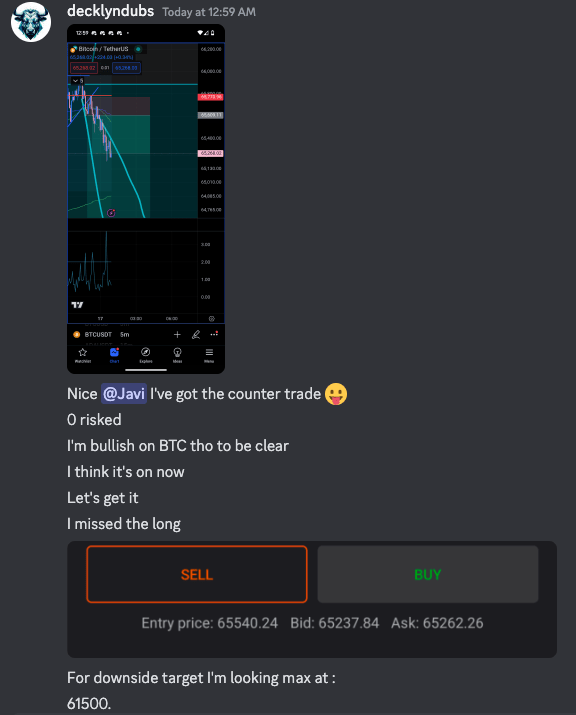

Out of Asia hours, I saw consolidation and an opportunity to potentially trade into low liquidity out of market sessions. Here was my checks/analysis from discord. I evaluated the trade as an A+ setup, not an A++ setup, so I entered modestly, especially considering it was very late.

I wasn’t planning on trading it at first, but I did end up entering here on the short side. I had a tiny loss ($7) trying to figure out the direction but when I saw the signal, it was quite clear.

The trade went into green immediately. I 0 risk’d it and went to bed.

In the morning I woke up, and found it in green (I was surprised, BTC is so difficult!)

I found an extremely high quality exit signal end of lunch hour NYSE session. Can see the checks in the discord chat. I hedged the trade to cover it, and ended up closing the trade completely.

Excellent trade, front to back. Well managed. The checks considerably improve my decision making, and I will continue to re-enforce the habit.

Leave a comment