Today is the second day forward testing the utilization of a seasonality model for trading the S&P.

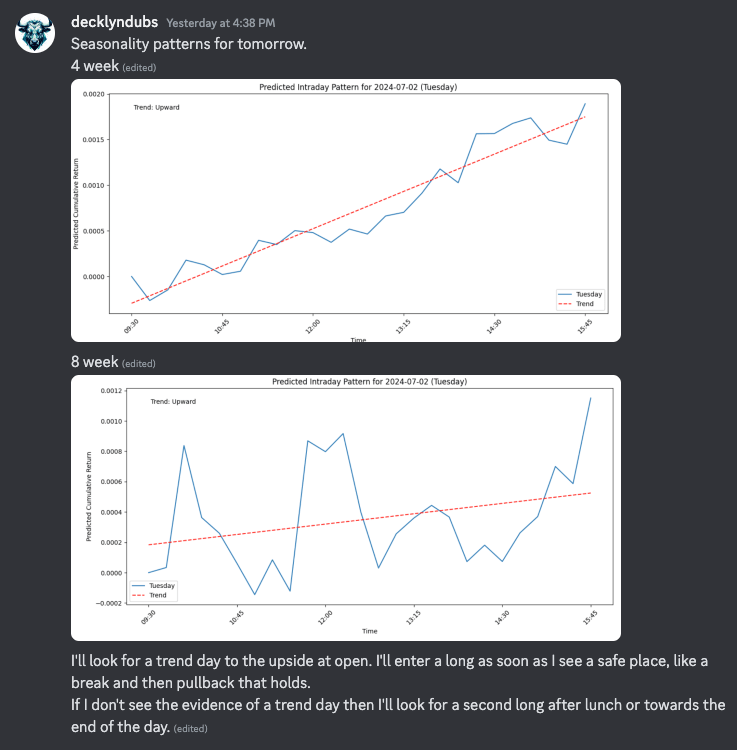

I generated the models for different look-backs and came up with these two models to use to anticipate entries. You’ll see I jotted down a trading plan in the discord.

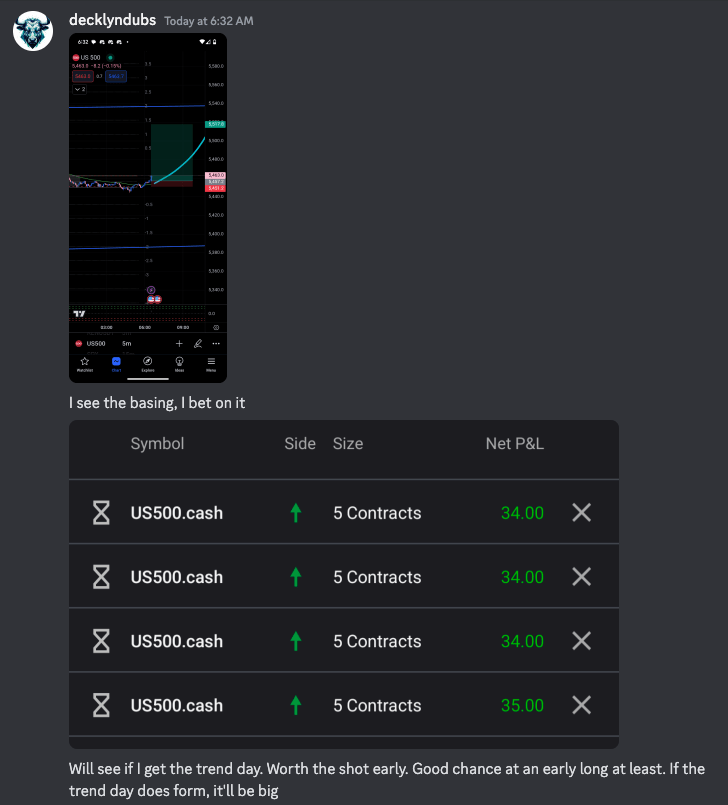

I woke up, and just started hitting the buy button into the open bell, getting 20 contracts long on S&P and planning to close the trade immediately if it went against me.

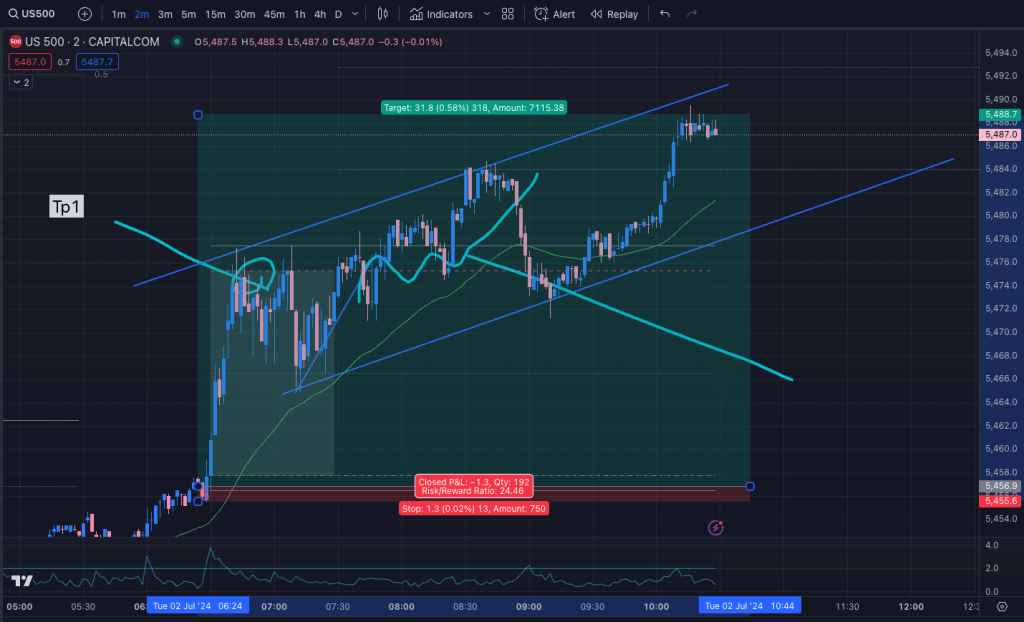

I took 25% in profit at the first sign on consolidation. The remainder I closed at approximately 25:1RR. This looks like alpha to me.

Wow.

Leave a comment