This week, I’m taking a step back to reassess and refine my trading strategy. After analyzing my recent performance trading major US indices (S&P, Nasdaq, DJI), I’ve uncovered some interesting patterns and insights that I’ll be incorporating into my approach moving forward.

Key Observations:

- Day-specific Performance: My most significant gains have consistently occurred on Tuesdays and Thursdays.

- Late-day Success: I’ve noticed reliable, albeit smaller, movements during late trading hours.

- Macro Analysis Limitations: My previous reliance on macro analysis for directional bias has shown limitations, particularly when market sentiment shifted regarding expected rate cuts.

Lessons Learned:

The psychological aspect of adapting to changing market conditions is crucial. My previous macro-focused approach led to a bias that worked against me when the market began repricing rate cut expectations. This experience has highlighted the need for a more data-centric approach.

New Focus: Intraday Seasonality

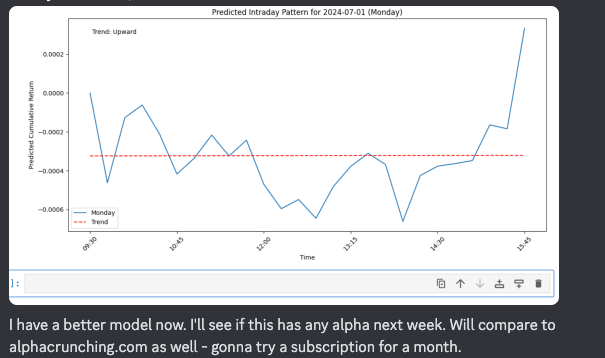

To address these insights, I’m shifting my focus to intraday seasonality. I’ve developed a model to predict intraday patterns for each day of the week, analyzing various time windows to understand how seasonality predictions change with different data sets.

Key Components of My Refined Strategy:

- Intraday Seasonality Model: Utilizing this to predict potential movement times and directions.

- CME FedWatch Tool: Monitoring the rate of change in rate cut expectations for a quantifiable measure of market sentiment.

- Targeted Trading Windows: Focusing on specific time slots (9:30 AM – 11:30 AM ET and 2:30 PM – 4:00 PM ET).

- “Atomic Vold Scalp” Play: Continuing to employ this technique for intraday scalping.

While I’ll still consider macro factors as a general guide, my primary focus will be on quantifiable data rather than subjective interpretations of news or macroeconomic indicators.

Example: Monday’s Trading Plan

Based on the intraday seasonality chart for Monday, I’ll be looking for potential long positions late in the day. I’ll use my established chart setup patterns to identify specific entry points.

Next Steps:

Throughout this week, I’ll be closely monitoring the performance of this refined strategy. I’m particularly interested in seeing how the intraday seasonality predictions align with actual market movements and how this data-driven approach impacts my overall trading performance.

By reducing reliance on subjective macro analysis and focusing on quantifiable data and patterns, I aim to improve the consistency and reliability of my trading decisions. I’m excited to see how this new approach unfolds and look forward to sharing updates on its effectiveness in future posts.

Remember, this strategy refinement is part of an ongoing process of learning and adaptation. As always, it’s crucial to manage risk carefully and be prepared to further adjust the strategy based on real-world results.

Stay tuned for more updates as I implement and evaluate this new approach!

Leave a comment