I was a little startled this morning. I was ready to long into market open, I expected the PCE data to come in on expectation, and the headline number did. Here was my call from yesterday:

The headline figure was on expectation, with a little bit of a rise in personal income noted at the same time:

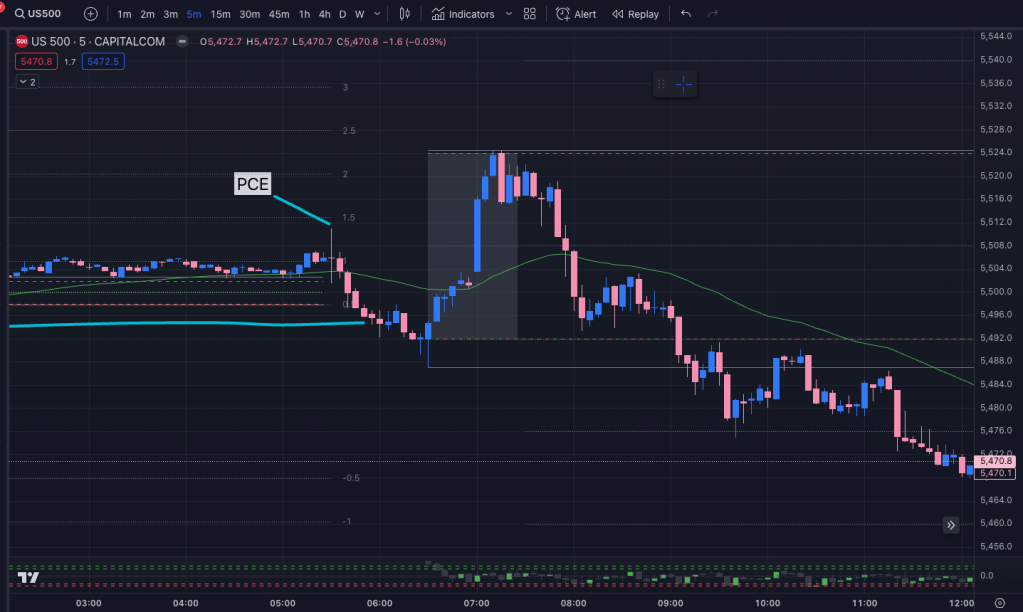

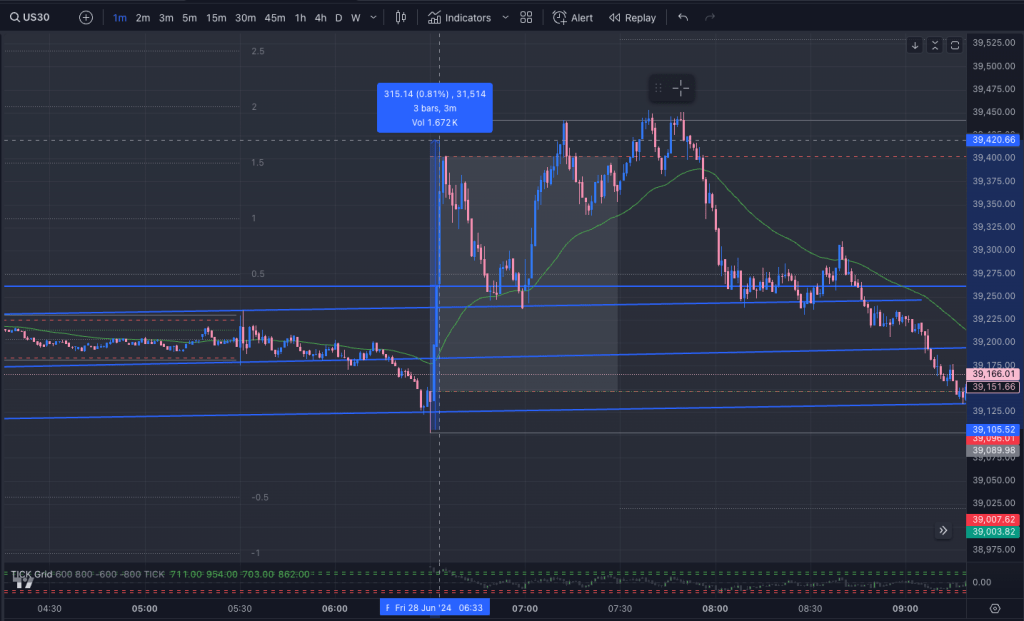

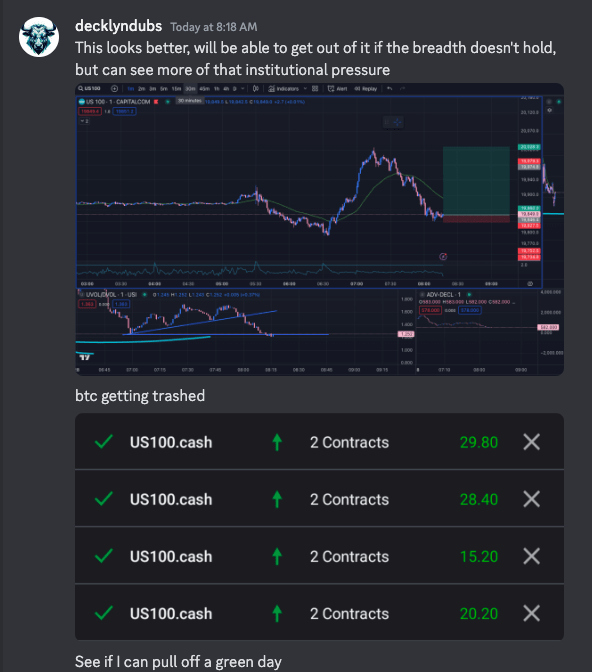

What happened next confused me quite a bit tho. I perused through the data and couldn’t find the narrative for sell pressure, but sell is what it did. This caused me to second-guess my plan, which was to check for buying pressure and long DJI, S&P or NASDAQ to capture risk on. This is on the heels of the presidential debate, where Biden had faltered a bit, forgot what he was saying. It looked like a win for Republicans, which drove up US markets and strengthened the USD (Thursday June 27th.) You’ll see the hour before NYSE open, where the market sank on the PCE data after bots entered long positions.

The sinking into open caused a glitch in my confidence on my read of the markets, and so I wasn’t ready for the market to move the way I expected anymore. I made some trades trying to read and chase the market, but my preparation was undone and I couldn’t figure things out until it was far too late.

Specifically the Dow I was monitoring to enter long, and within 3 minutes, it ran up almost 1%. I was ready to get it hard, and I got psyched out by what I’m guessing was just blatant manipulation to push the market down before buying it up, and then unloading for a profit.

I found myself tilted and frustrated, and by 8:30am my time (11:30am eastern) I followed my rules and cut the trading, but not before being twirled around and left confused. Even given that I missed the initial run up, the trade long was in play and 10am PT/7am ET provided the second buying opportunity at 39250 where support was tested. At around the +1h mark, the market had reached the peak.

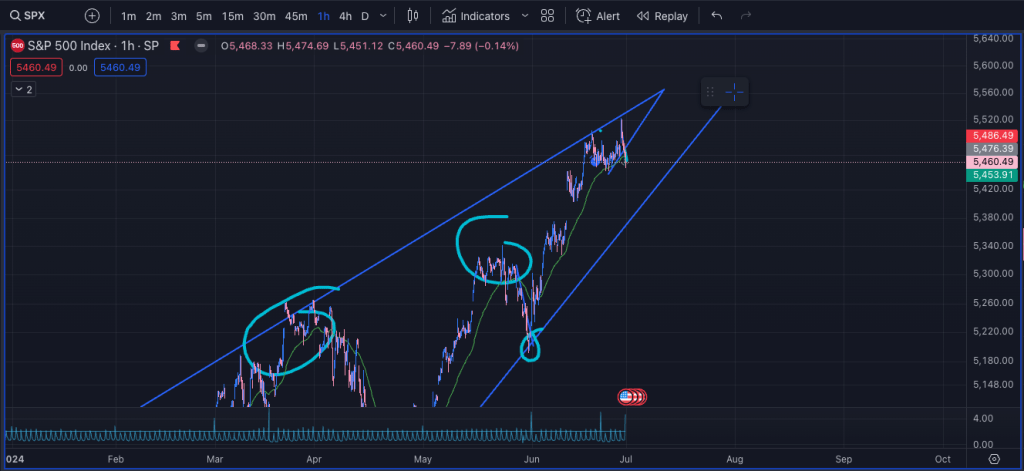

It’s interesting how prepared I had been before that pre-market move. I had been calling the top of the market since the 20th of June, and yesterday I said “I think I was wrong.”

Indeed, the S&P less than 24 hours later hit a new all time high. How could I miss this? It all boils down to fear and psychological preparation. I should have had this trade. You can see the S&P tapped a new all-time-high. If I was so right, how could I get the execution so wrong? These are the lessons that you have to digest and iterate on over and over and over until you trust yourself, and let your read keep you ready to catch the move. I’ve been in this spot so many times where I made calls that were accurate and I failed to capitalize on my own insights.

The high of the day would have been an excellent short to catch as well, hitting the top of the trend line in an ascending wedge. I’ve been monitoring this and checking my read plays out, and it’s just another trade that I was ready for mentally, but failed to execute on, this time especially because it isn’t a specific play in my playbook, so it’s not really “in scope” for me.

I did try a support play on NASDAQ where VOLD and PA found confluence support. This was a break-even trade, managed well. Didn’t get the momentum but it’s okay as it isn’t a loss. $140k notional position or so, ended up with no gains. I took a quarter off, set the stops at B/E. It was managed well even if not a winner.

Can see this one materialized, but it was only good for a scalp. The time of day was just on my cut-off time, so I’m not surprised I didn’t get anything out of it.

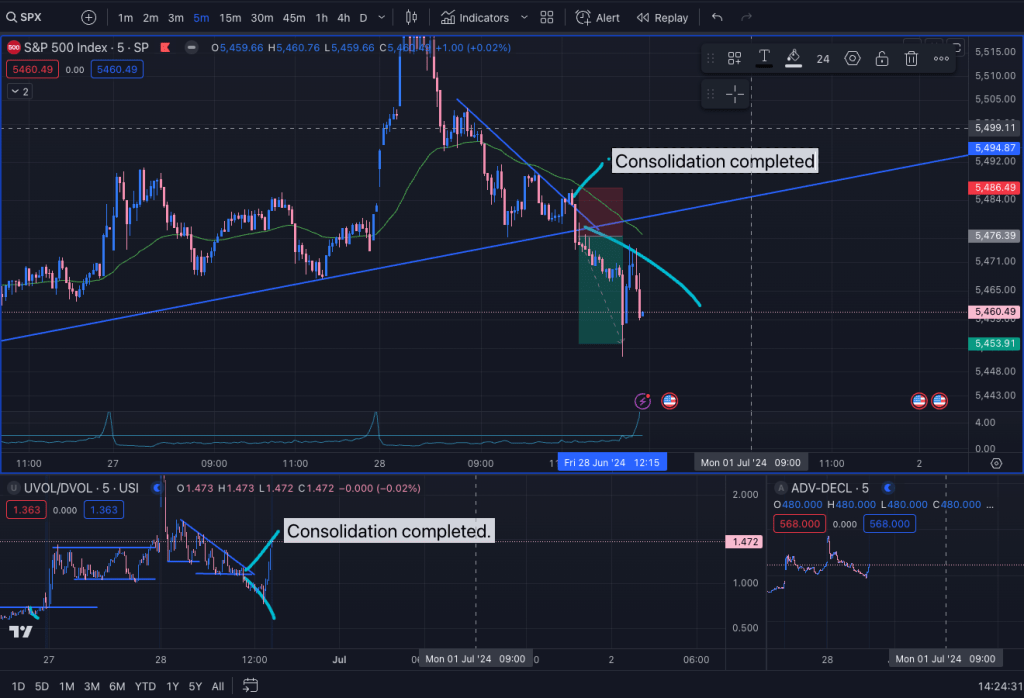

The market consolidated there so that turns into a no-trade zone in both structure and time. I got on calls, had a good work day, and just avoided until closer to that 2:30pm ET mark, which is where I have some of my best trades. If you take a look at how the market moved through mid day, there is a consolidation towards the trend line. Check VOLD in the bottom left, and you’ll see that it sets up a clear pattern, so this setup fits the bill for my beloved “Atomic Vold Scalp” – probably my most sophisticated and best-performing playbook entry (here: https://k-xs.com/2024/04/04/trading-journal-new-playbook-entry-on-vold-pattern-breaks/)

You’ll see that VOLD, on the bottom left, breaks the consolidation and support structure, and the price at the same time also broke to provide a confluence of trend breaking, and consolidation breakout. It’s a strong signal, and even though it was under the low of the day, I was confident in the position and took the entry. Given I hadn’t been trading well earlier, my confidence was rattled and I only put a 30k notional entry on it, this deserved 10x the size but I’m still re-collecting my confidence to be able to make the big trades.

The move was slow, but VOLD kept confirming the momentum was there for me, so I let it run. The price ended up collapsing very quickly about 30 minutes before the market close, and I took the trade off then, capturing the whole move, no draw down. It was a near-perfect read on the setup, and the execution (entry/exit) were nearly perfect on the trade. The only thing missing was the size that the trade deserved. The trade is a scalp, so once I saw the big move, I knew to take the profit, especially going into close. You can get serious movement in the last few minutes of the day, but it was quite extended to the downside and experience kicks in and I took it all. Pretty good move, capturing maybe 25% of the total daily range. I could also see the level had been tested a few time, it was time to get out! The price very quickly reversed.

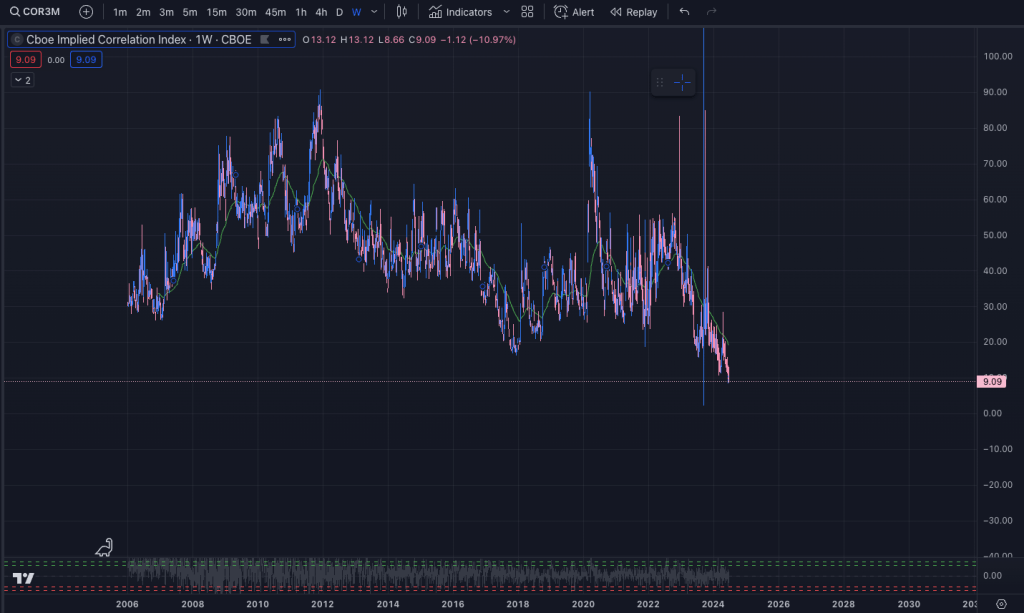

It was a red day for me, but I’m bolstered in knowing my read of the market was on the mark. Once I get some confidence back, we’ll be on track for some more big wins – you can see how brutal the price action has been lately, the conditions have not been good and I know that going through that, for me, can cause me to get a little rattled if I’m winding my win-rate low. I have plays for trend days, and inside days. What I lack is a plan for periods where the market is very unclear, or even how to identify those conditions. I did actually find some signal to help steer me through these conditions in the CBOE Implied Correlation Index which rates the correlation of the top 50 stock in the S&P.

The CBOE is at the lowest level it has ever been at in the data available (since 2006) and this lack of correlation between the big markets in the S&P would seem to be a good signal for when the index difficulty is up. When it’s low or trending lower, it’s likely a good time to switch markets and find a “market in play”. Trading indices when the constituents don’t have much correlation is likely to be a bad time. Moving to forex, commodities, crypto or single asset markets is likely to be more fruitful. It’s just a rule to put in the checklist: “is the market in play?” SMB are very clear about this: one of the top reasons that traders fail to make gains is because the markets that they are trading aren’t “in play.” Today we had a good catalyst (PCE) and that’s on the tail of the presidential debates yesterday, so there is enough action here to be able to find a move. For other markets, checking RVOL is always a good idea to find if a setup and play is valid – I use it as a filter in many plays in my playbook. I have to probably re-write my playbook and test the plays with some of these new ideas in the iterations. The discovery of the correlation index was great, and I’ll probably start to measure segments for constituent correlations, and roll them up for trading indices.

We’re getting there, one day at a time. Over all, I’m very proud of my progress, even if I don’t have stacks of cash to show for it yet. I’m at maybe 3.5 years of trading with thousands and thousands of trades under my belt. I can recognize tilt fast and am doing a lot better to know when I need to step away and calm down now. Keep at it, it takes a lot of work. If it was easy, nobody would be flippin’ burgers.

Leave a comment