Nothing more exciting to see than this:

Losing a prop firm’s dollars is much better than losing your own. This post is another review/analysis of my trading style and statistics.

Keep in mind through this post that my trading style is high speed with weight, so I use one-click trading with many small orders. A position might have 5 or 10 trades open so that I can manage the risk and never need to type a number on an active trade. I’ll usually trade without stop losses but actively manage them on entry before tightening the risk and walking away from them. I usually trade intraday, NYSE open especially. I looked at my stats and my best numbers are there and at close, and that’s usually all I tune in for. It lines up with “before work” and “lunch.”

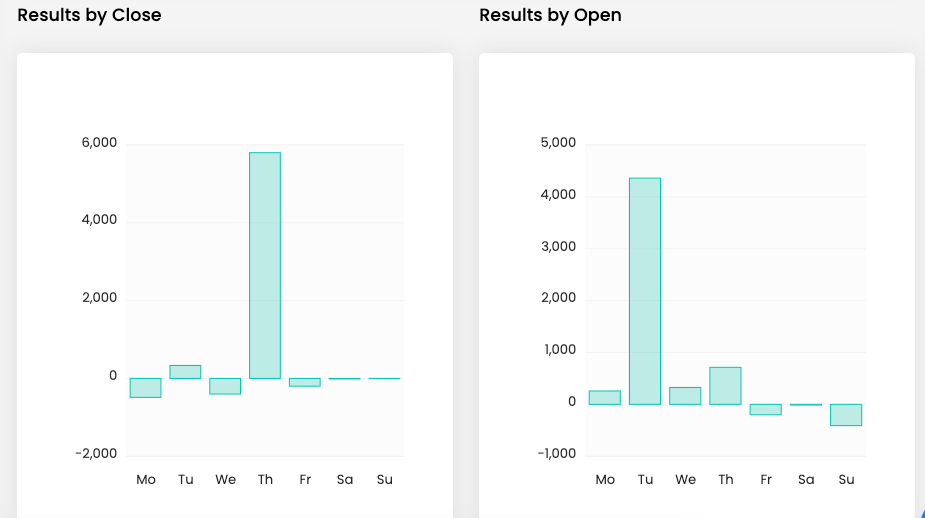

iSov on TV asked what days I do best in. It appears Tuesdays and Thursdays are my best days! I look at the clock, but not the calendar, when choosing a time to trade, but I’ll pay more attention now. Weekend bitcoin trading is _by far_ my worst period. I’ve stopped trading them. It’s only good for learning about yourself, not for making gains. Seems that Wednesdays aren’t good for me. But this is also GMT so it’s cutting the days different. I have to double check this.

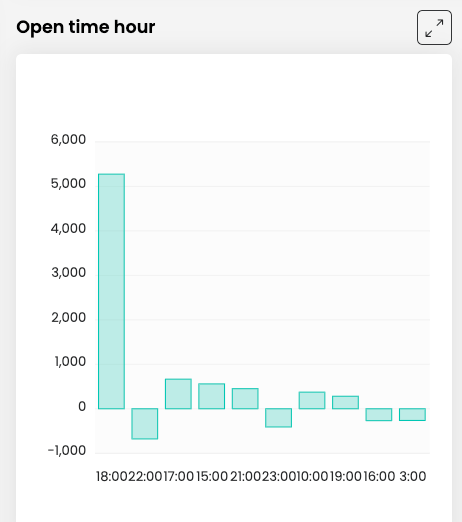

I hate waking up early and have been trying to sleep more and focus on work, so you can see all of the weight is at the end of the trading day, around my lunch. The window is 2pm ET-5pm ET because I’m often grabbing a snack and watching the market 11:30am-12:30pmPT. I would be WAY more profitable if I traded the mornings. 11:30am my time, or 3:30ET in NYSE hours is usually where I find setups on inside days. Trend days you have to get it early to really bring the bacon!

I thought I was here months ago, but I’m really seeing the consistency now. I can pass challenges without a sweat. 10% in a month is a cakewalk if there is a bit of volatility around and a good catalyst.

My first goal is to accumulate funding. More, more, more. When a good opportunity appears, I want to be ready for it. Might only be once a month that you find that perfect setup, but when it’s there, there is no reason you aren’t gaining 10 or 20% on it. If you have a 1mm account, that one trade is enough to live on. If you get two like that in a year, you’re making doctor money.

Don’t need the payouts, we need the weight when the opportunities arise. I’m starting to find I can pull 5 or 10% on trades when the conditions are right. Very little risked – maybe .5% – but with massive return of 10 or 20x the risk by layering in and getting the whole move. If I 10x’d my largest plays this quarter, I would have doubled an account in a day. It’s feasible and I’m trying to set a new size-record every “good trade”

The problem isn’t those trades, it’s all the stuff in between. I passed a 50k challenge phase a couple of days ago, and my win-rate was paltry 26.57%. it took only 11 days from start to finish. The feedback from FTMO is that the trading system demonstrates discipline. But I’m irked I don’t have pretty stats. My reward/risk ratio was very high – 5.68:1. But my winrate is also very low. I can game my stats and smooth my equity curve with a little discipline, but first let’s take a second to rejoice seeing the word “Passed” starting to appear on these. It was a long, hard journey to get here.

Of course I went crazy and blew a funded account up, but the rate of getting the funding now seems to be doable without burning lots of time. I have a good system and now improving self discipline.

I’m trying to get to 250k funding this quarter but it’s a serious stretch.

Next goal is to breach 1mm in funding (this year), so i have to figure out copy trading and just use payouts to buy 200k or 400k challenges until I get to the goal. That’s probably my next step is to link up a 50k to a 400k and 8x the position sizes automatically. Then I can earn while racing to get the next “block” of money to add to the pool. If I get a bunch of accounts and trade them all at ratios (some small, some large) I can avoid blowing every account all at once if my psychology falls apart one day.

Here are real stats from my trading. You’ll notice that in my trading style my win-rate is low and my RRR is high. I need a very rare win to float myself, so the steps to improve my profitability will be focusing on eliminating the losses, rather than finding the wins. I’ll go from newest to oldest so you see where I am, and where I came from earlier in the year.

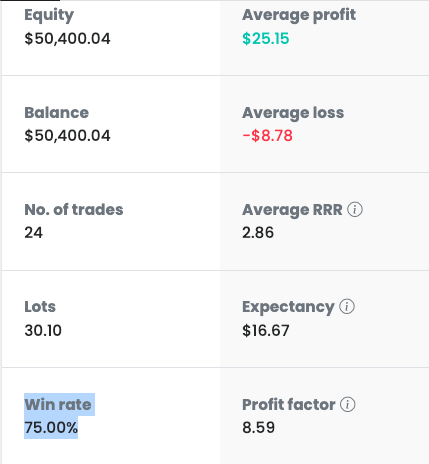

FTMO Challenge 50k – In Flight Validation Phase

This one I started recently so it doesn’t have much data. The stats look great tho!

Now i’m trying to game my win-rate, so the average profit will drop. I’ll take more trades in profit at the risk of missing some of the move. It’ll prevent drawdown if I cut the overtrading. And I can accept some losses so I don’t need to be too stingy with the stops – a little room can ensure you hold the trade in competitive markets.

The effect of this will be a reduction in RR, but a more stable equity curve. Historically my equity curve would chop a lot, I’d try to stay out of draw down, make big bets, recover, and then land the one trade. Now I’m trying to avoid the other stuff and just focus on trading the one good trade.

75% winrate, huge profit factor, and reasonable RRR. I would give my money to this guy for sure.

I don’t have any big wins in this one yet so I’m guessing that the RRR will end up being more like 5:1. This was just middling opportunities. I slept through my alarm and missed PCE. Brutal, best trading day of the year and I came out with like $80 shorting to the low of day. The stats are pleasing tho, and that profit factor is beautiful. If I can maintain the discipline, that profit factor should go up. 10+ would be amazing to see.

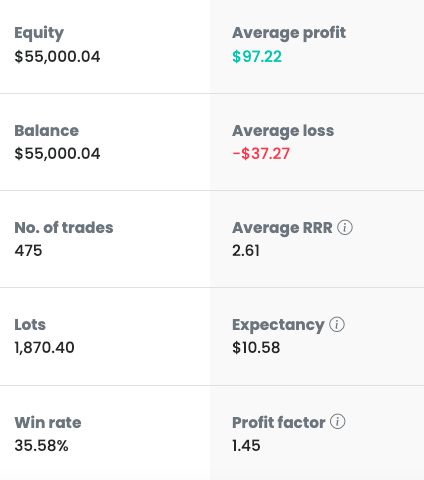

FTMO Challenge 50k – 11 Days to 10% profit target.

This is the last challenge I passed. This one I was making bets for huge RRR and it shows. My win-rate is a paltry 26.75% at the finish line with a massive RRR of 5.88. I was taking more aggressive bets and with less tolerance for drawdown. This increases the occurrence of losing trades as I have to close a position and re-enter it to avoid drastic losses. It’s common for me to have 1000% of my account size on a trade (eg 500k notional value.)

Mostly shorts. I am clearly a bear! 11 days from start to finish on that one.

Here is an older one.

FTMO Challenge 50k – 33 Days to 10% Profit Target.

This one took me longer. My winrate was better and my RRR is worse, so I was taking more middling positions with lower weight. That leaves to a slow bleed and big trades mis-sized. If you’re not over-trading, you’re likely to be psychologically prepared to enter massive positions. I had some drawdown in this one too IIRC. Apparently I let myself take some big hits on the way too. That’s a no no. I’ve improved since then.

Leave a comment