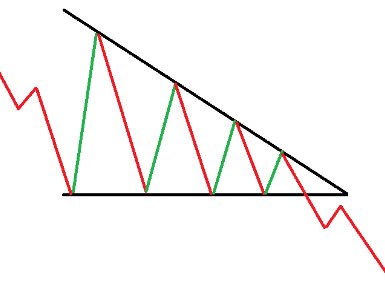

Given a name mostly making fun of Lance Brietstein calling a similar setup the “Bouncing Ball” – descending triangle breakdown. This setup is strengthened by the floor being the hour 1 floor.

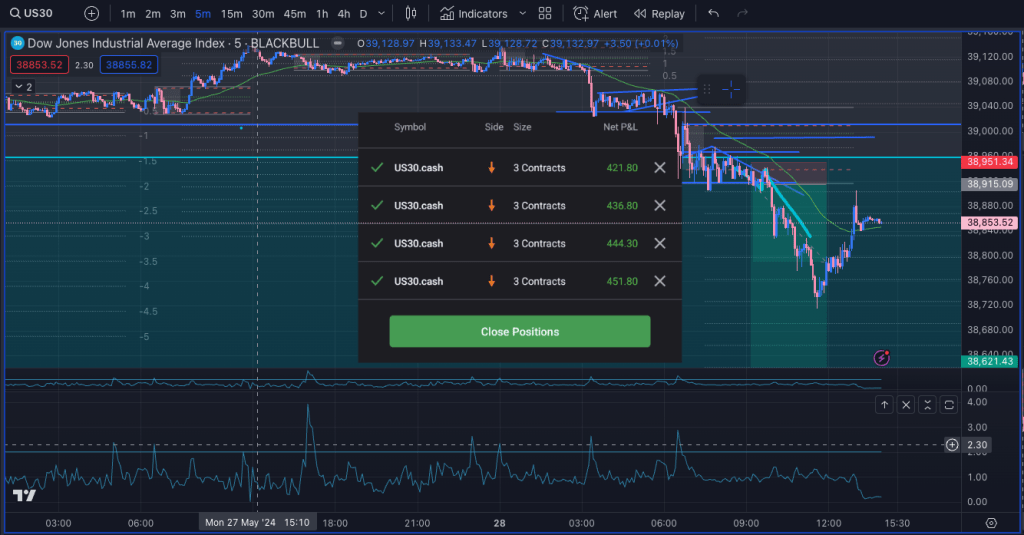

To look at an example setup, and to describe the quantitative setup: DJI had extremely low RVOL and massive drop in volatility (eg NATR, BB Width.) This one should be easy to quantify and alert on:

- proximity to 1h box high or low (aka DR Ceiling/DR Floor.)

- low volatility as measured in Bollinger Band width. It should be at 20 or 40 period low.

- low Relative Volume – not much trading.

Set a sell stop if it’s a short, and just let the order fire. The stop loss can be tight, the order can be big. I saw multiple of these on my chart looking around different markets today in the last couple days. I see the fundamentals lining up so am looking for safe low risk entries to find some short interest to hold for a breakdown under major areas.

Below, that might be the whole move (scalp) or use it to find an entry to try for the breakout (39k dow.)

Update: SPEAKING OF WHICH… I had another nice example of this today. I traded 39k breakout pre-market/bell ring. And then I got the later/larger move. I bet hard. Note the “turtle soup” before the move. That was my signal, and I entered a HUGE position (500k notional.) Right at the finish line for this funded account.

Leave a comment