Continuing to focus on low attention, high impact trading, I’ll re-iterate my rough rules and framework going into today:

- Work is priority, trading should require almost no focus now for me to make massive gains.

- Limit trading: chose only one high quality setup.

There are two new additions/areas of focus after taking a hit yesterday:

- Don’t hold drawdown. There is no need to risk more than .1% or $50 on $50k capital to make 1 or 10% gains. Layer in, take profit, hit trades that go against you immediately. I held risk needlessly yesterday.

- Fast trading. Trading on phone is insufficient – get in, take the profit, be able to click a button to close on any drawdown.

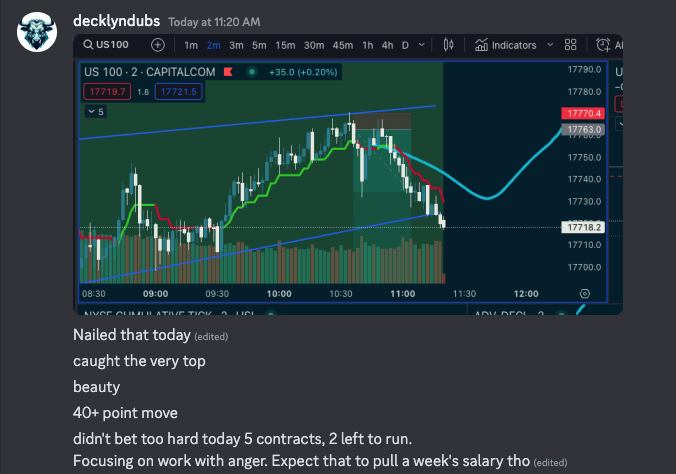

Today’s setup wasn’t super strong so I was very gentle on the risk, putting 5 contracts short into nas, managing the trade for about 10 minutes, taking profit off, and setting the risk green. I left the trade to run and the remainder went to entry, so it was a green trade but I could have either set the risk at breakeven to hold the trade, or else I could have take the profit off at resistance. The trade was small so I attempted to hold the remainder after closing 60%.

Setup:

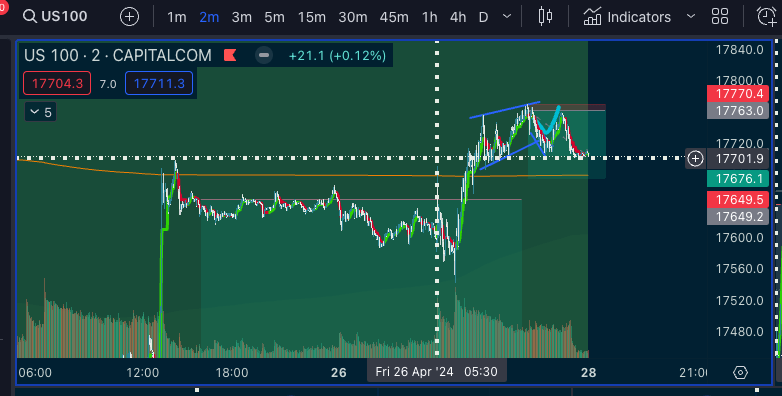

The day rallied with on-expectation PCE, meaning that the market was pricing hot inflation already. I held a couple contracts overnight to see if I could get a good short on hot inflation data, but when I woke up you can see the 5:30am print kicked me out at breakeven. I put the risk at $0 only holding a few bucks of drawdown on the position. I managed it very carefully, just didn’t work in my favour.

You’ll see the run up after PCE, which I slept through. As mentioned, I’m trying to keep my focus _off_ of trading and on work, that means sleeping through news, generally sleeping through morning kill zone as well. My best trades are when there is data so I’m aiming usually after lunch now, which is 12pm-4pmET, or about 9am-1pm PT where I am. So it’s after standup, and usually right around lunch that are the best areas. I need basically only check the internals, figure out where the vold scalp is probable, and then set an alarm on tick, listen for the beep, click the button. Watch for a few, get the risk off, and that’s it!

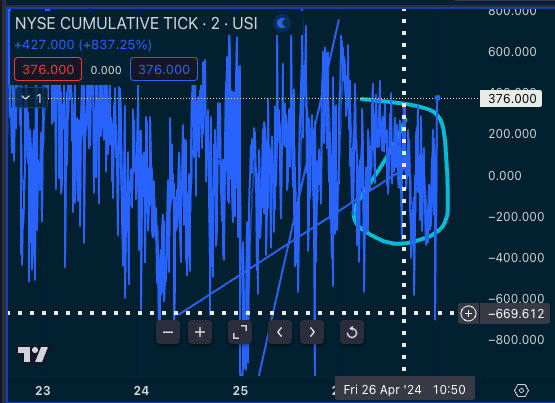

This trade formed up pretty clean, what I did was look at tick and set an alarm on it, and check for a clean trend shift.

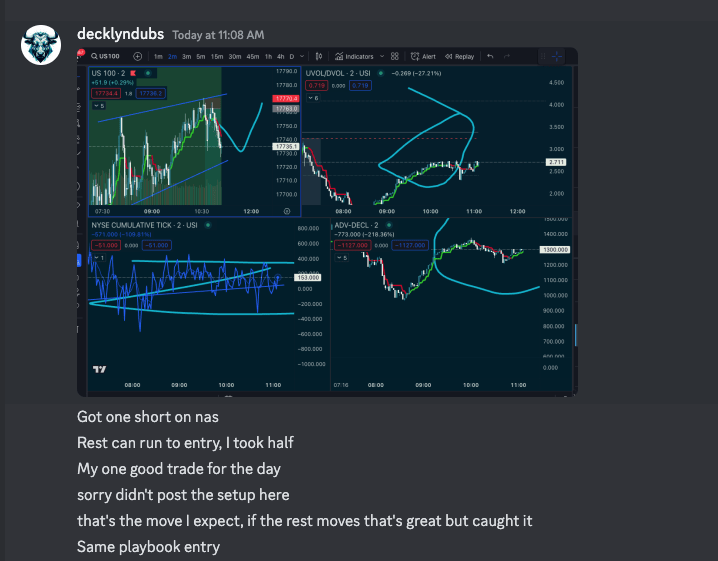

I saw people on TV were trying to short it a little early, and I said to a bunch of people “almost, not yet.”

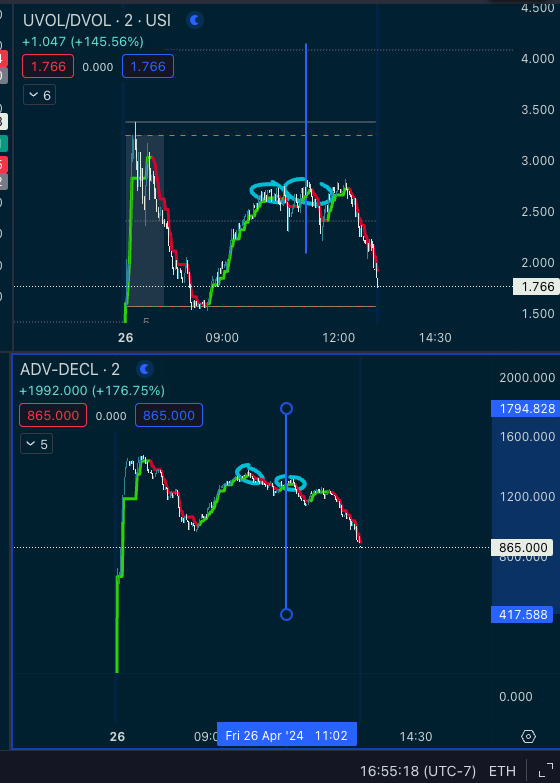

I took a $10 loss on the first shift in internals where I tried to hold a contract short at about 10am PT but it was too early. The second bump on VOLD and ADV-DECL was the entry that I went hard on, you can see above on TICK that’s really where the trend shift starts.

You can see on the price here that this trade forms, I caught the peak of the day perfectly.

I entered hard. I held $15 in drawdown at max drawdown and the unrealized PNL was about $150 so 10:1 RR. Excellent scalp. It wasn’t worth the weight, the internals were against the fade so I didn’t play it too hard.

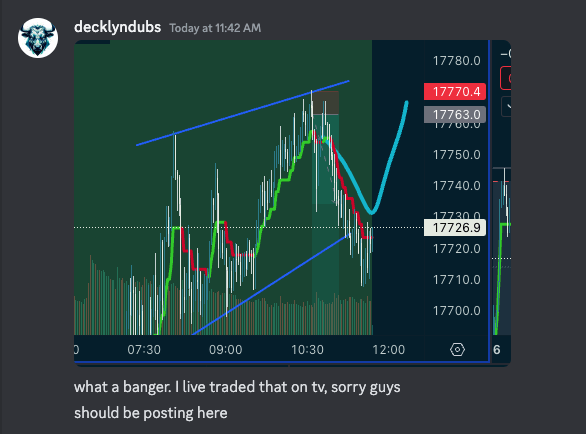

Here was some of the journalling:

Excellent play.

I clocked profit, it ended up hitting my stop unfortunately. I wanted to hold the entry but it just clipped me out as I went to do laundry.

The prediction on the PA was very accurate, you can see my check mark in green which was my prediction of the PA.

Woulda been great to hold that over the weekend. That’s okay. One good trade! That’s all it takes.

One of the traders on TradingView I’ve been talking to watched me trade it and gave me feedback:

The fan club increases as people watch my decision making. I’ve had excellent feedback from a lot of good traders this year. Thanks for the encouragement guys. Thanks xeno! Thanks epoch! I love you guys!

Feedback on the post:

Thank you Joe!

A Quick Tribute

I wanted to take a moment to thank my Economics teacher in college. The one like Russel Turner.

Leave a comment