This article meanders a bit. It took me some sifting around to figure out that this is me being really bad at swing trading, and using the wrong entry tactics for the play. I get there eventually, but I have to chew on it to figure it out.

I have a setup I’m trying with BTC a bit on the weekends or news catalysts, and it’s by using TOTAL3 – market cap less big L1s – as a breadth indicator similar to VOLD. If I find a confluence pattern and signal, I know that trade is 80% probable to work, but I’m having more problems with the speed. And part of it is the level of competition in this market. BTC is _very_ mined out of alpha. There are so many other bots and people out there trying to catch the same inefficiency that the signal is mined out too fast to compete with my fingers.

Order book expansions are auto-correlates and you have a metric-load of probably-illegal bots positioned and messing with the order-book data, competing against each other. These models are built using state of the art Machine Learning approaches, many now use generative AI to process, as an example, the micro-expressions on Jerome Powell’s face as he steps up to the stage. That’s a real example!

I’ve been working on Deep Reinforcement Learning models that use attention, like GPT. You or I can do it without too much work. I’ve seen datascientists report profitability within a few months who study the markets very deeply. It has been harder than I anticipated by orders of magnitude, tho.

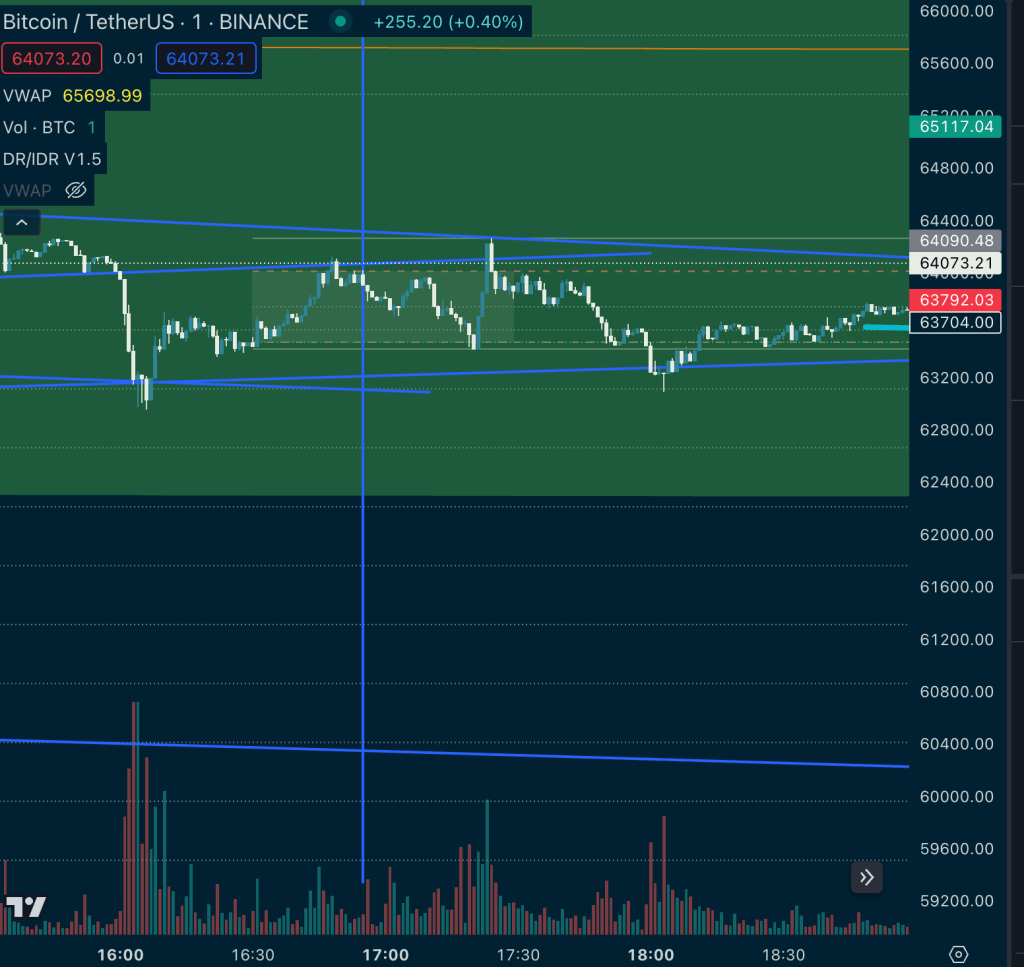

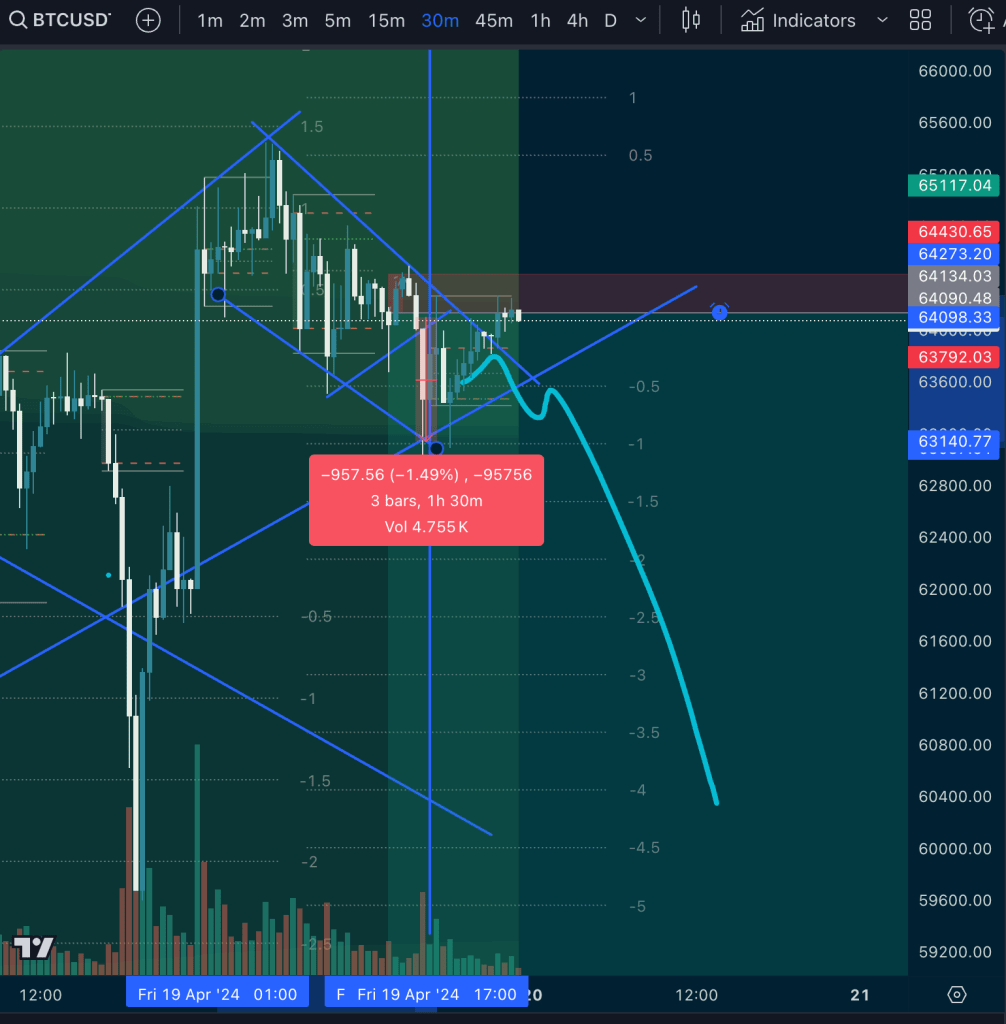

Back to the topic – there is a way to get around the need to have a bot watching for orderbook expansion auto-correlation and this is the main play I’m looking at is massive scalps on potentially minutes . But unless I get lucky and catch a huge one, I need to be ready to trade to find a big move by catching the breaks I can find. Sell orders would make sense but you don’t have enough time to see the signal and enter. There are seconds to enter and get the alpha. The BTC expansion earlier lasted 4 minutes going into halving. That’s “sell the news” bets like mine piling on. I know some portion of the population is thinking that, so that’s the expansion/inefficiency I’m trying to catch. To what degree broader selling will occur is the $100MM question, but I was hoping to catch a heavy entry to hold into the days ahead to have an easy trade.

I was sick, I went to get soup and I missed the second bounce later too. After processing this a bunch, I realize that I’m trying to apply scalp tactics to swing plays. My swing trading is terrible because I’m never playing them like swings. I read the market well (for now) and I can’t execute and hold a trade. I just use it for the overlay on analyzing which plays to take. I know that’s common, the guys at SMB say they pretty seldom take swing plays. I can see it too – the just don’t have the same potential because you have almost no edge trying to read the future. Who knows what BTC will do? What news event might appear? Swing trading can be a coinflip, especially if you have weight on. My buddy Epoch did manage to hold shorts on NAS tho, huge respect to him. You’re an inspiration to me brother. Heavy-weight.

If I really want to trade a swing, I think there are a few things I’m doing brutally wrong.

- Don’t add on the break if you’re trying to hold it. You don’t need scalp-weight on a slow burn.

- You need a good clean entry only on the swing. Accept the risk of entering early. Probably the setup gives you low risk entry areas.

- If you’re patient, you can find far better entries.

- Never, ever forget the context of the trade. Hey, what day/time is it! Almost time for Saturday morning cartoons in japan on this trade. Go learn about the world or do something useful. Don’t trade here.

According to GPT:

Saturday morning cartoons have been a cherished part of childhood in many countries, including Japan. In Japan, the tradition of watching animated shows on Saturday mornings is somewhat similar to that in the United States, but with its own unique characteristics and offerings. Who is trading with you? The bots. The bots will win, every time. AI is better, smarter, faster than you. Don’t bet against the AI. Bet against you.

It’s very difficult to trade these hyper-competitive markets, there is very little signal and you’re competing for alpha when it appears, on raw speed, both ways, in and out of the trade.

Today I was sick and I wrecked a good position by adding too late on the break. If I had just used some cascading limit orders, even if the fills weren’t great I could still catch the move early enough. Because the cap winds slowly, and the price moves so fast, I think I’d need another faster signal like a crypto TICK to be able to catch the alpha in BTC reliably. A lot of good traders I know won’t touch BTC or if they do they give cash back trying intraday. It’s a beast, one of the harders markets I can think of. That’s also why I _really_ love trading BTC tho. If I’m trading before work, I want it to be simple. Get the win before the coffee cup is empty. Then lunch + trade close at Noon PT. Shut it down at close. Back to work.

But on the weekends, I have time to parse the news, research AI, build models, take courses, and skill up with tech. I’ll journal and process experiences, look at losses, and identify behaviours to tweak. Because BTC is such a difficult market, it comes a puzzle or game that ominously bleak in your odds of beating it consistently. But it’s something with such disparate market participants, from AI and illegal spoofing, to unskilled retail traders, to professionals watching history unfold.

I’ll keep watching. If I were on it today I’d have pulled the profit. Making decisions whilst sick is needlessly wreckless behaviour. That’s a major theme for me this year is really dialing into my emotional states and checking I’m not decimating myself. I can’t hold it together as a software engineer either but the fallout of pushing a few lines of code for someone else to review is a lot more manageable than the utter destruction a few bad decisions can bring.

I caught a 1.5% move today on BTC with good weight and I let the trade go against me. It’s just pure speed and focus. It’s really hard to stay focused on finding and reacting to the catalyst when sick, there is a notable delay in my responses. I can see it playing the tape back in my head. And if I’m clear I just go “no fomo, it’ll wreck the setup” and excercise restraint, but today I put weight on after looking away for a few and for this atomic scalps I have to be there to add, and be there to check the first stop. If I’m sick, all over the place.

I really want to get my physical and cardio health back in check, that’s gonna be a major one for me this quarter. Get to the gym, go for more walks with Ash. Get back into kick-boxing. Take more breaks from trading. Every day has a good opportunity. Especially in the high-volatility market conditions – if the trading is really good, keep yourself in shape and rested to be able to capitalize on those rare opportunities when the stars align. Basically, for a lot of us anyway, you only need one trade. One trade a month that’s just perfect. It’s got everything. That’s the only trade you even need to think about. When everything is pointed in the same direction, you’ve gotta be ready to hear it. Work, make art, go for walks, eat good food. Just take care of yourself or you’ll risk death before you get a chance to enjoy some of the life you’re working so hard at. This takes years. Years of consistent dedication, self reflection, adaptation, and learning about all of the systems that underly these systems. You have to be curious to go explore the world and find all of its little secrets and mysteries. If you’re not in peak form, you’re not going to be able to do it as fully as you could.

Leave a comment