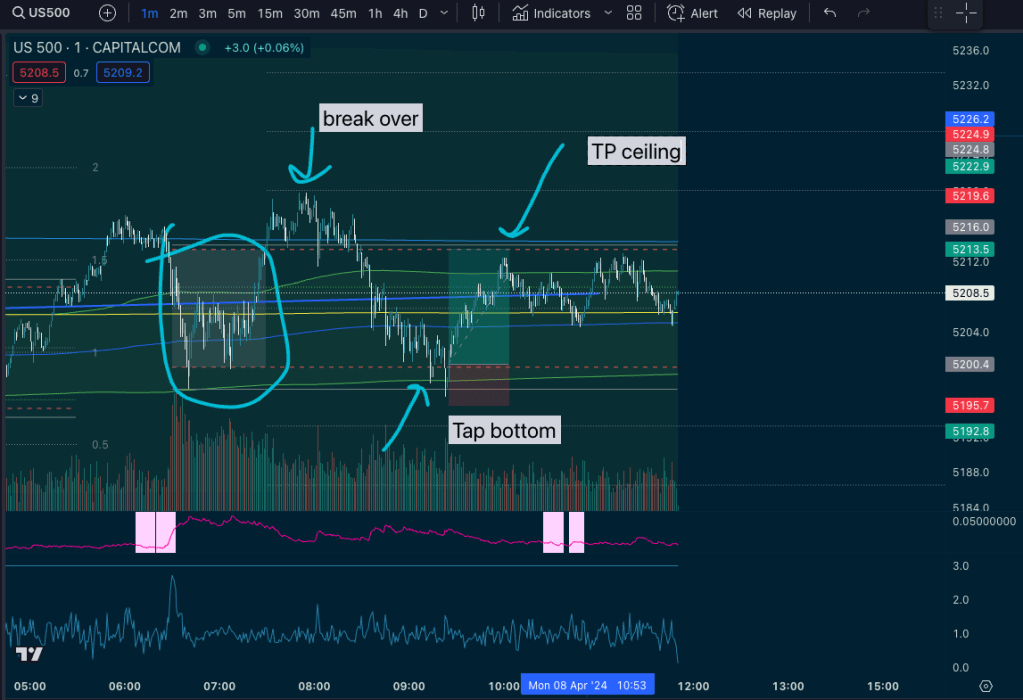

This is a good high probability setup in mixed moods. It’s not worth sizing super hard on unless you get a clear confluence, but it’s really high probability when things are sideways.

After getting the first hours of NYSE session high and low (DR), look for a break out of the range later. You’ll find a high probability of support or resistance on the other end of the first hour range now.

This setup works for big competitive markets including indices. Right at the tail end of the day especially I find this play works well. This was executed actually during NYSE lunch.

The closer you can get to the reversal off the area, the better the risk/reward for heavier entries. I’d estimate it plays out 70% of the time for decent levels of risk, especially if you catch a failed auction on the way back into the range. VOLD ratio was ~1 so there was a decent context to take some risk on this play as an inside day, and it worked out.

Leave a comment