I had a pretty good quarter finally crossing that consistency line. This is a bit of a second round of reviewing my trading behaviour as I had a good chance to sit on my last comb through the quarter.

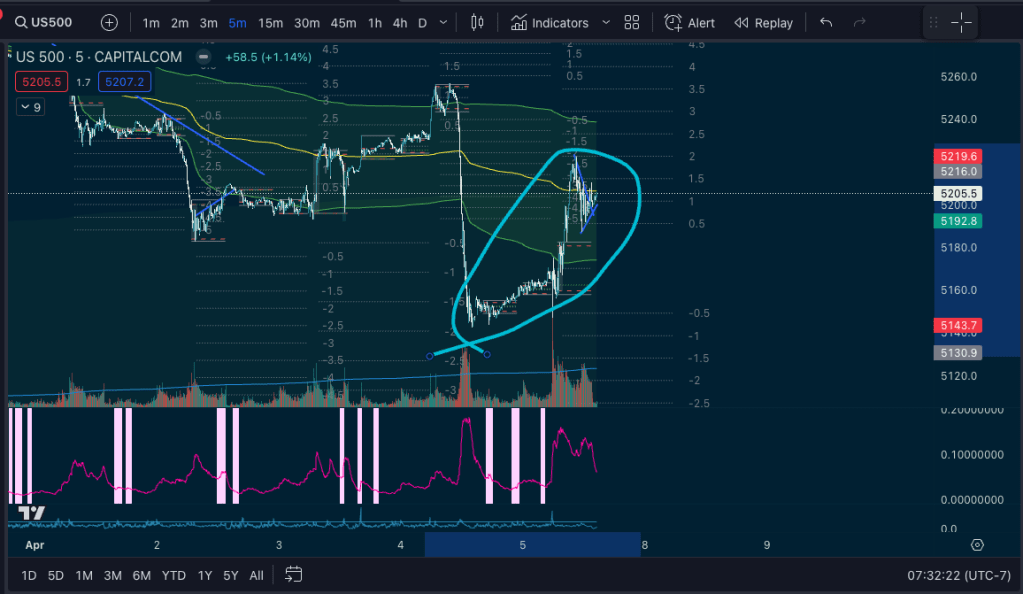

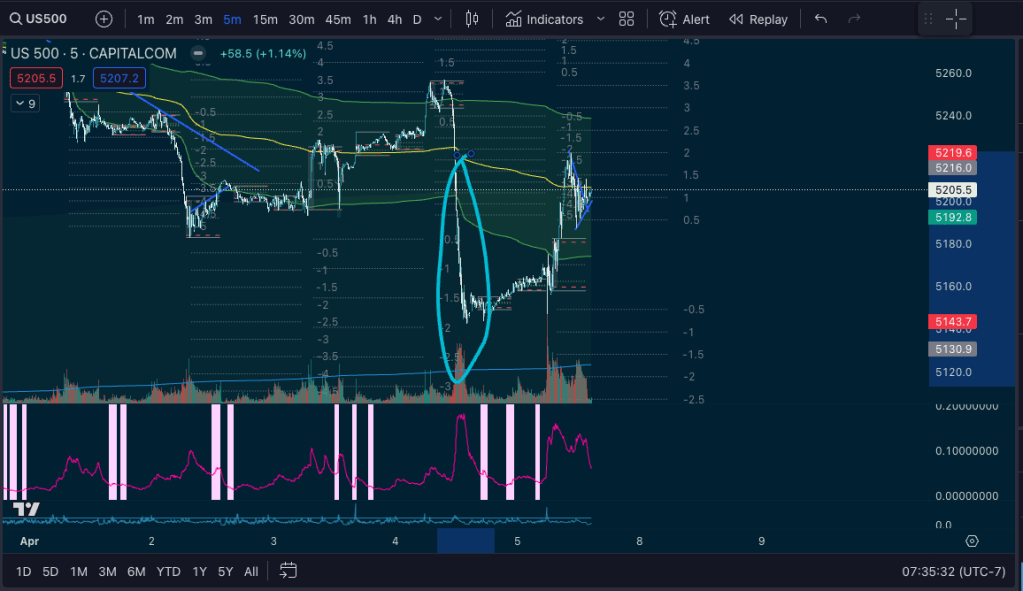

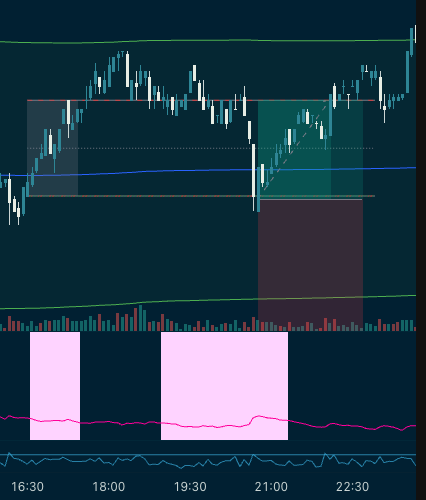

In 2023, I was very focused on using quantitative methods to catch retracement. The theory is that after a big expansion, you’ll often get some degree of pullback/correction. It happens on all timeframes, but I’m specifically talking about intraday. Here is an example of a sharp selloff into NYSE close, and the retracement the following NYSE session:

You’ll see the circled section – that’s the area that I was targeting in 2023. This setup is sometimes referred to as an FVG Fill (Fair Value Gap) where there wasn’t any scrubbing in a zone, so the price will tend to fill and scrub out values. Theoretically, this is a nice trade as you can screen for the expansions fairly easily and then play the mean reversion.

In practice, this is a very hard trade, because the retracement is not reliable, and the price can continue. This year, I’ve shifted my focus to the other market phase that precedes retracement: the expansion (circled):

And I actually did capture exactly that movement. I actually set a sell stop order the previous evening and didn’t trade the market that day, but the order executed and I got the move. I wasn’t actively trading this move as I was just late enough to see it to skip it, but I did journal it live as a setup and trade in my playbook over here: https://k-xs.com/2024/04/04/trading-journal-new-playbook-entry-on-vold-pattern-breaks/

I discovered after posting that that I had actually entered on it and caught it all 15 contracts short about 1:10rr, $50 risk’d. I’ve had a great streak of capturing expansions with sell stops this quarter, especially the crypto bull run is an excellent space to use buy stops to get on expansions when you’re asleep.

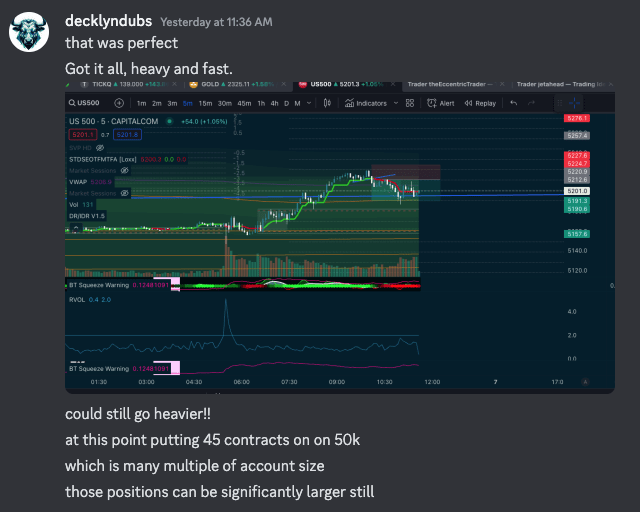

So, these expansions have different qualities than the retracement/mean-reversion trades, and one of them is that the price moves in a straight line usually quite quickly. Generally a good news catalyst will turn that trade into near-zero risk trade. That quality is important because the stops can become very thin. If the stops can be in the 1:10 or 1:20 range, you can enter and layer in to _immensely_ large trades that can basically replace your salary in minutes. These setups are observable in patterns and data, but there is often a good catalyst to go with them, whether you’re aware of it or not. There were streams from the central bankers that were talking hawkish about the rate cut possibility and the media has pinned the market movement as a correlate to that, but I wasn’t on the stream so can’t corroborate the market moves. What I saw in this trade was strictly in the market breadth and price action.

So, that’s a really significant shift for me that I noticed at the turn of the year. That move we just looked at, I skipped trading the retracement entirely – I certainly considered an entry – but I wanted to play the short the other way, and I did. Wasn’t a huge move, but was high probability so got 45 contracts ES short, 0 drawdown for apx +1% in a few minutes.

It was a good trade, managed well. I entered in 3 pieces to keep risk around the .2% range, I took one portion to cover risk. The PA went against me and hovered around break even – I was ready to close it if it went against me for a couple bucks of loss. It continued down to the avwap, I spotted the buy pressure, and I exited the other hunks into the wick and on the reversal as soon as I could see it was time to go! I could have traded it 5 or 10x larger, and have been trying to figure out where to add the extra weight now, as one or two trades a week, even if they aren’t big moves, they can be really big positions.

Although the retracement was a much larger move in the day, the short side was easier, faster, and clearer setup with no guessing. I have literally started to skip the sections I used to trade, and trade the sections I used to skip.

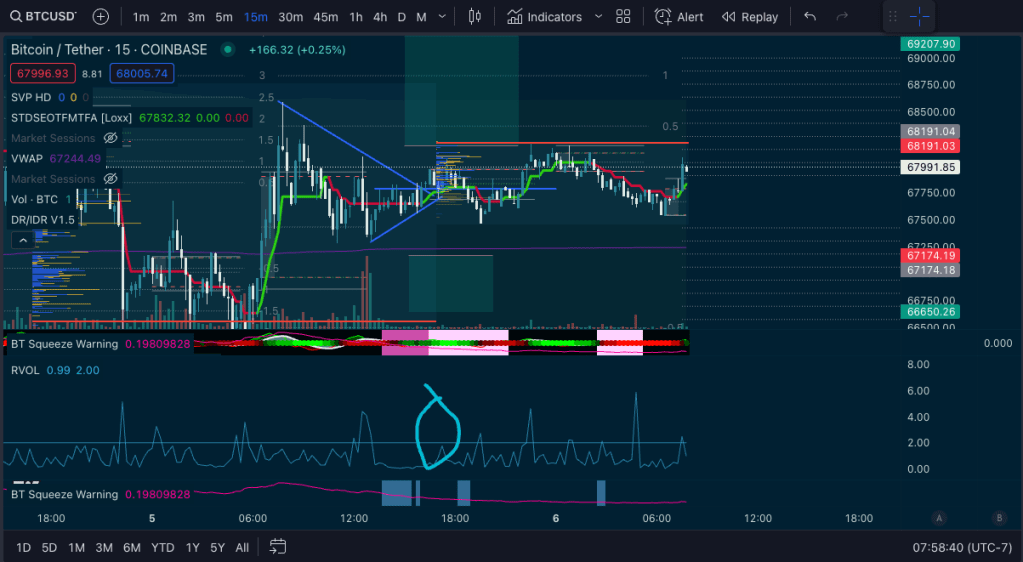

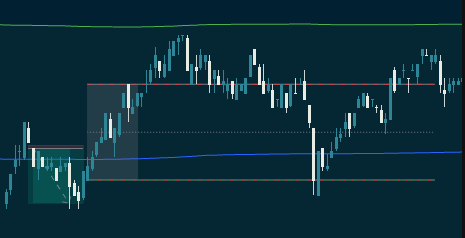

Finding expansions is interesting because there are generally a few things that happen before they occur. Because my strategy has changed to focus on expansions with massive entries, these are almost exclusively the trades I’m focusing on. A catalyst can simply cause a fast move, whether it’s just massive greed in the market igniting momentum, or else a news event that causes panic selling. If you have the broad context of the market and the psychology of its participants, you have some edge in playing those cascading movements. A lot of times you can anticipate something will break up or down, and you can set sell stop or buy stop orders to mark enter on a big move, even if you’re asleep at the wheel. I usually risk these at about .1% but I will often set sell or buy stop orders safely in an area that only an expansion would hit. I don’t need to be sitting at the computer but I have a really strong probability of getting a winning trade if it’s hit. Here is an example of BTC looking ready to break into a bad time (friday post NYSE, it’s the weekend for everyone.)

While the trade never forms, the rvol just never shows up, you can see a sell and buy stop would catch the move safely if it did form. Active trading we can watch and respond to the signals, if you’re setting automatic orders, the entry has to be on a significant move that will sustain, so the entries and going to be later, lower quality, and so they will be smaller. Traded active, you’d long on the rvol hit (circled) and you could enter super, super hard, it never gets to a good level to get on the trade tho.

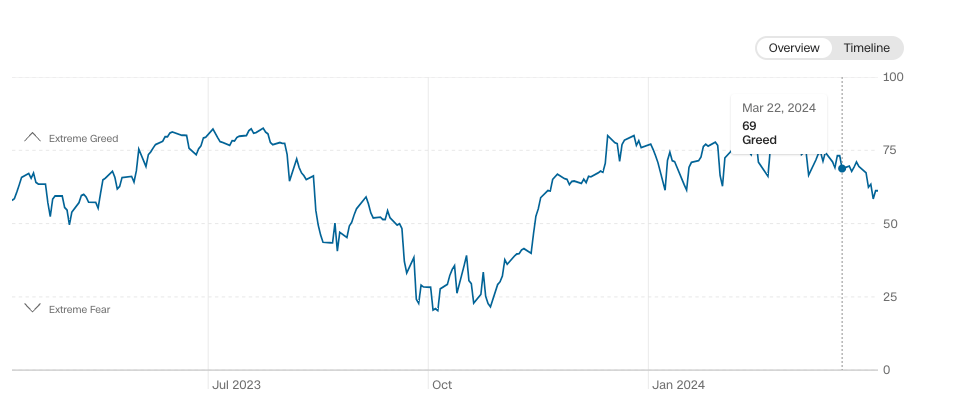

So, these are a few of the observations in my behaviour and the way that my style has changed over time. It’s probably been most of a year that I’ve focused on equity indices, and I believe I have a pretty good tool set now to trade those markets. There is another shift under way which is to play currency markets on macro catalysts instead of equity markets as those moves are often simpler to capture. Especially if the market is indecisive. I’ve been trying to find shorts since around March 22nd. I have this date circled as I posted a signal to friends and family that it’s a good time to take some profit. A couple buddies did take gains off of BTC around 69k. We all know it might go up, but it might be 1 year, or 5 years or 10 years, so people that were not willing to wait did take some profit.

So, markets are forward looking, but it’s competitive. I knew the markets would turn to fear, but I was anticipating it before fear and greed index made a 5 month low. Market participants slower than I am are looking at “only up.” I was even ostracized for entering short positions. I was even today, even in a perfect, straight winning trade.

Another observation this quarter is that I’m incredibly on point processing macro data and interpreting it ahead of the market, but that can change as the market will react differently to off-expectation data over time. Still, today this gives me edge. It’s one of the best tools I have at my disposal – interpreting the market pivots, and trading in the right direction so that the wind of the market is behind me.

So, inside that context, I find all of the prevailing trends across timelines, and understanding their confluence, which directions are safer to trade, and test the hypothesis with incoming data. I’m trading less because I can see in the context of time what the mood of the market is, and if it is indecision, I will often sit out. You have a hypothesis, you test it, you confirm it, and then you ultimately will capitalize on it. I start to adjust my exit criteria too, to take profit faster and fully as we move into indecision.

I’m still over trading a touch, the recency bias can screw me up on the tail of a win. I’ll get excited and want to test more plays and theories, and start to put risk on substandard setups fuelled by dopamine. Still, after a win I’m doing a much better job of letting things reset, not trading at the end in the garbage. I’ve got a rule to not trade consolidation after expansion. Just, get on to the next one.

I’ve had a couple rules evolve out of my trading practice which are pretty helpful. I won’t go over every stipulation I put on myself but these are the two most interesting ones I’ve found:

For me, there is enough market breadth data by late day, that I have enough information on my head to take high probability positions. I used to say “don’t fade the end of the day” but it’s become more “find a trade to move into the end of day.” I have a couple setups: the Atomic Vold Trade, and also DR “retirement.” I have to write the latter up, but basically towards the end of session, you can find these high probability moves off of the DR or “box” if it was broken earlier in the session.

The other observation in the same thread is if I’m trading pre-market, I should just close the position on the first dollar of opposition on open. I round tripped a trade the other day into market open. Pre-market and London sessions are great for US equity indices, but market open is a nebulous grey zone.

Let’s say you took this short, you’d just want to shut it down into open. I had a trade like this the other day, and am processing the experience. Open is a nebulous mystery, and I prefer to wait for breadth data to start making decisions in the market session.

As a final piece to this, fading late in the day is often not good. The last hour, whatever prevails, I won’t try to trade a fade/opposed.

Good quarter, happy with my progress. It’s not about the money yet, but about the consistency. I’m starting to see bigger returns on the trades now. I suspect the next quarter I can get a bunch of funding accumulated.

Leave a comment