I had a 200k TFT challenge I had been running with decent progress (6.5 of 8% target, that’s pulling 13k USD in a month. Livable!) But then TFT collapsed, so I’m back running a high leverage 50k challenge w/ FTMO. My expectation was for this year to be mostly a wash any way but I only go up now baby. The slow iterative process of refinement of skills and split-second decision making is now bearing clear visible fruit in my PnL, performance, decision making. I’m capitalizing on trades better, making really great decisions utilizing catalysts, and doing a much better job of waiting for the signal. I can show a couple recent trades.

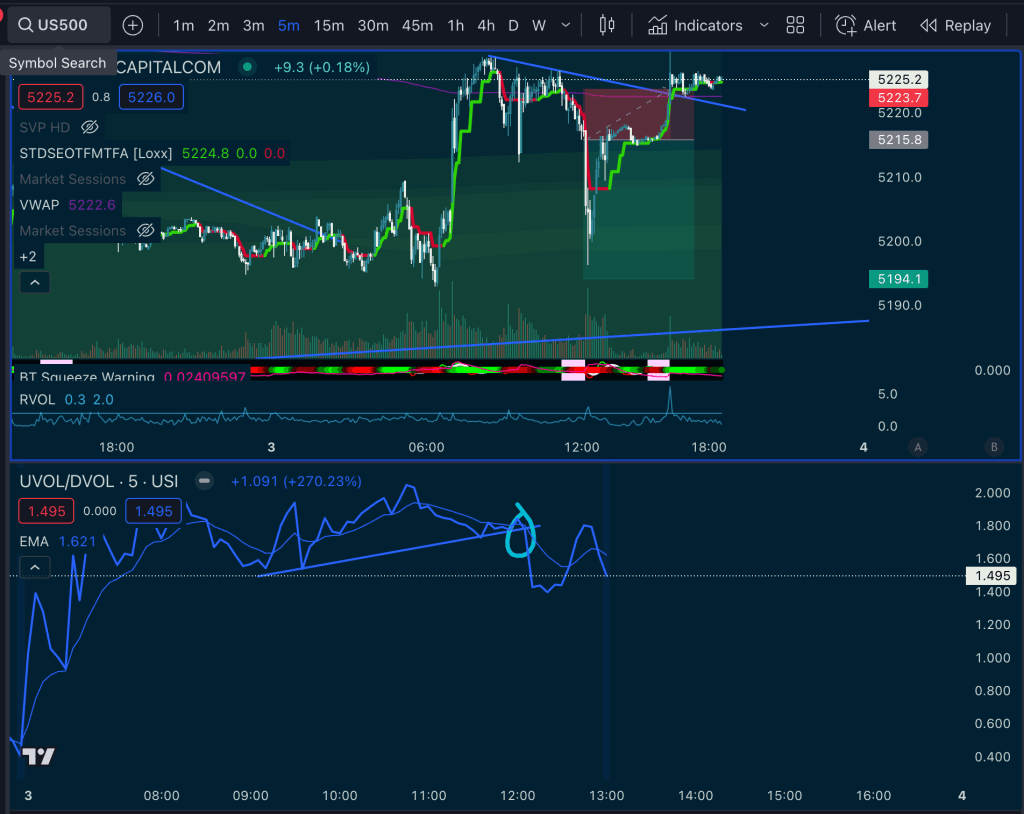

On the split second decision making, this trade was from today. Market really mixed today after way hot ADP but then slightly cool PMI. I got blown out of a heavy short from pre-market when PMI landed. Lessons learned is just to take the profit, think of open as a random void of nothingness, no alpha, no nothing. I don’t mind holding trades into open because the rewards can be stellar, but if it doesn’t just got into green, better to take it off. Anyway, this trade was late in the day (last hour) which I find is the easiest stretch of the day to make a good decision in, as you have the whole story from the day by that point, especially lots of breadth information. You’ll see below the VOLD ratio I’m calculating has a few taps on a trend, and because the day was very mixed, I decided to not enter any position until very very very strong confluence to ensure a high probably, heavy weight trade. I saw VOLD break, and within a couple seconds I had multiples of my account in the position (33 contracts US500 short, something like 171k notional on a 50k challenge account.) Fast fast fast. It’s amazing seeing the decision making of the human brain, the pattern recognition, to know “okay this is it” and to put weight on it! It was $500 trade in only a few minutes, and I really should have went wayyyyyyyy stronger on it, but I was entering on my phone (MetaTrader is pretty sketchy on the phone too. I’m transitioning to CTrader but I’ve had this FTMO account since last year.)

Despite catching a pretty poster, I round tripped that trade entirely. Lots of greed left in the market. But I’ve been processing this and looking at SMB traders as an example here. If you see a 99% probability setup that you can get it hard hard hard for very little account risk (if I lost that trade it would have been only about .1% risked for 1% gain, 1:10 Risk/Reward) so a position that’s so high probability you can enter immensely huge trades on. Next time I see a setup like that I’ll just continue to hit the buy button until my margin is fully allocated, and I’ll take the risk off the second that I see the pressure the other way. This is where the tape reading comes in, and for indices, really I look at the breadth data instead of order book data (Tick, and VOLD mostly).

So to really have pulled a salary on this move, which is what it could be worth, you’ve gotta go just super hard, split second. My lot sizes were at 11 (60k notional a click basically) and that’s a pretty good size on 50k to risk .1% or so on the first order. Because I saw it a little bit early, but waited, I could have dialed up the lot size 5x or 10x to put about 1% of risk on the first click, and then it’s free after that, so on 50k that could have been 10%+ with only 1% risked.

This is where it all comes together, because this isn’t a catalyst trade, but it’s super clear structure, I had seconds to respond and I did it, I added all the weight at the front, wasn’t trying to chase it, I just didn’t watch the breadth and it went to entry. Because the risk is so small, you get greedy wanting to hold it, catch it all. But let’s say 10m candles you’ve sized it really really big because you know you’re only going to put 1% of risk on it on that first set of contracts, then your eyes will lead you to take the profit when you see how huge it was. I have a rule to split orders into 3: one part to cover the risk (can’t lose!) one part to secure profit (winning!) and one part to let run (let it runnnnn!). So if the first portion closes $500, you’ve got bullets. If the second portion closes $2000, you have a week’s wage to eat. And if it happens to run, you might get a magnificent and huge return. It only takes one of these trades, but you have to be ready to put the weight on.

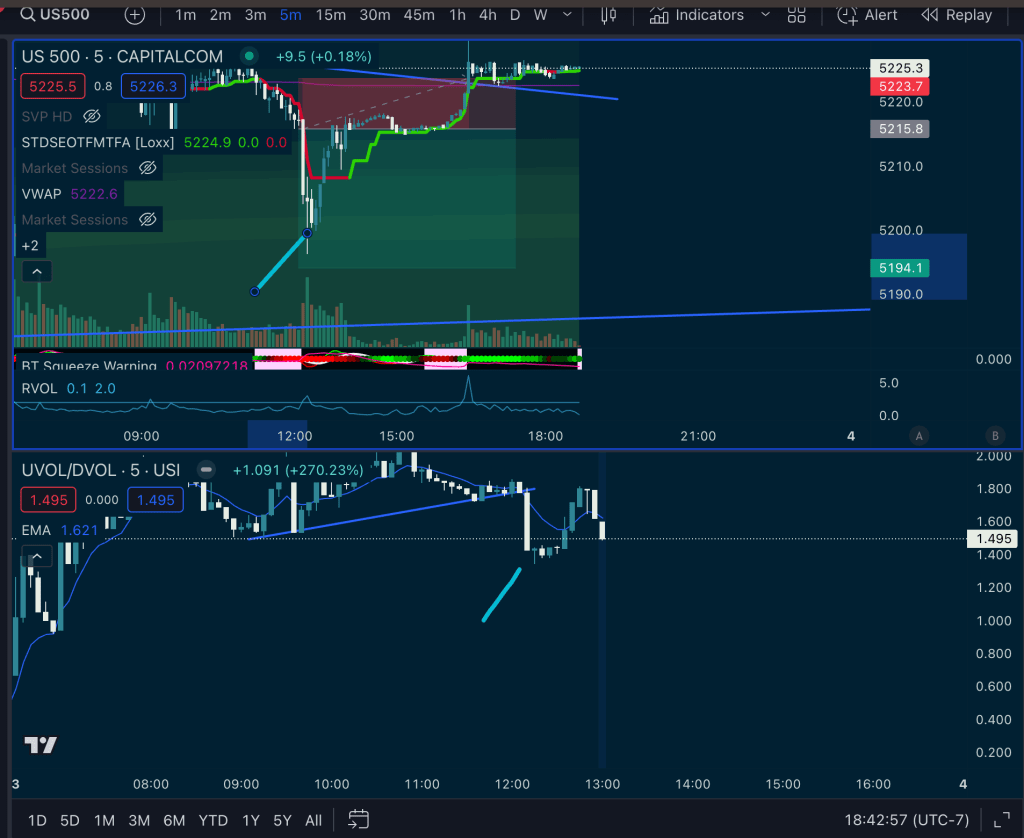

I usually don’t swing trade, but I had a really good multi-day catalyst trade on economic data this week. I broke my rules a little bit and let the whole thing run. I slept really soundly, woke up, saw a couple taps and closed it.

Absolute banger of a trade.

So, no sweat really on TFT collapsing, but that puts me out $700 if I don’t get a refund on the challenge. No biggie. The plan was really to take $500 and show we can grow it, but I’m expanding that budget a bit given this especially. I’ll just pull this FTMO challenge over the line, and then basically take payouts and copy trade to scale up. I saw a trader explaining how he scaled to 6.7MM in funded capital – you just have to put it to work. Invest it all back, copy trade on challenges, and let that account explode. Let’s say casually and carefully, you can pass a test a quarter (+15%), 50k turns into 250k in quarter two with the first payout, and that can scale to 1mm in the next quarter. We’ve got the skills, we’ve got the plan, one life to live, a plan to break free, a lovely supportive little human on the adventure with me, up and down and sideways and backwards. What a ride!!

Leave a comment