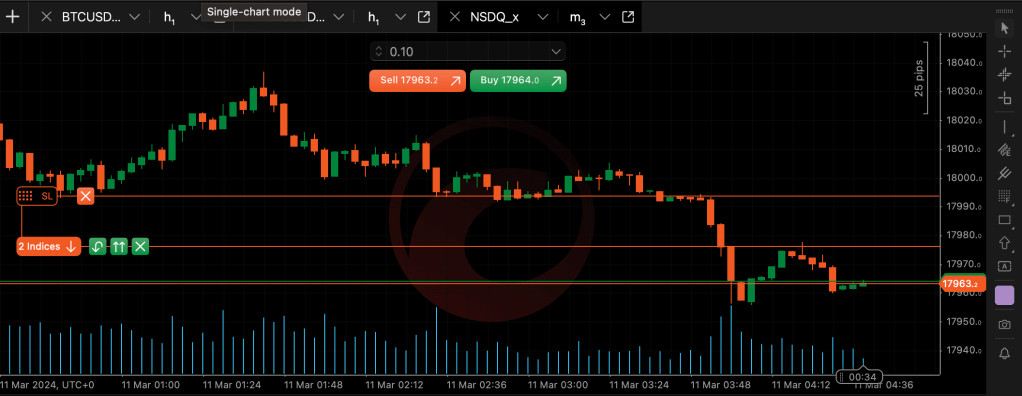

I switched to cTrader and made some little test trades on Asia open. cTrader is great! Way better than MT4 (IMO) and it doesn’t make those stupid sounds. It has ~one click trading like MT, drag and drop stops, and you can zoom and scale the charts easily. That’s probably as far as I’ll go with it, but it has a neat ecosystem too.

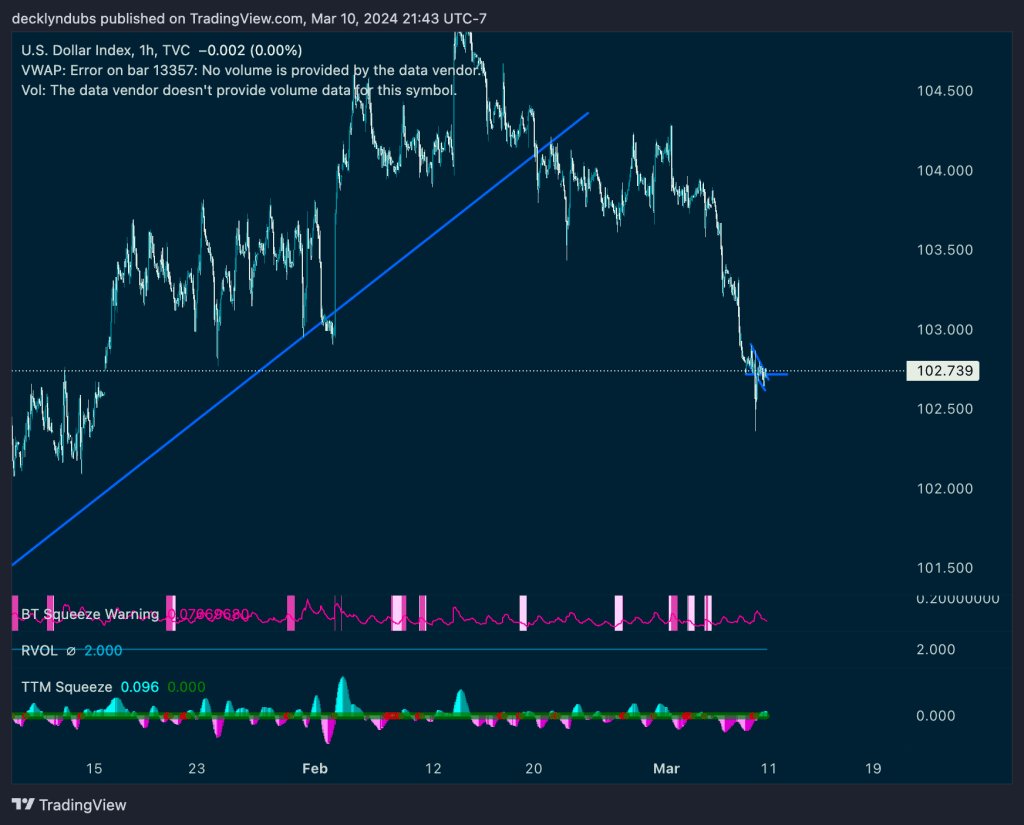

For market analysis for the week, I’m keeping an eye on the dollar. I was long biased into the week expecting the promises to change US banking restrictions in Basel III Endgame to have some hidden effects from smart money, but I’m not seeing it in the charts yet, and infact, markets seem to be continuing to risk off into asia, and the dollar is gaining some footing.

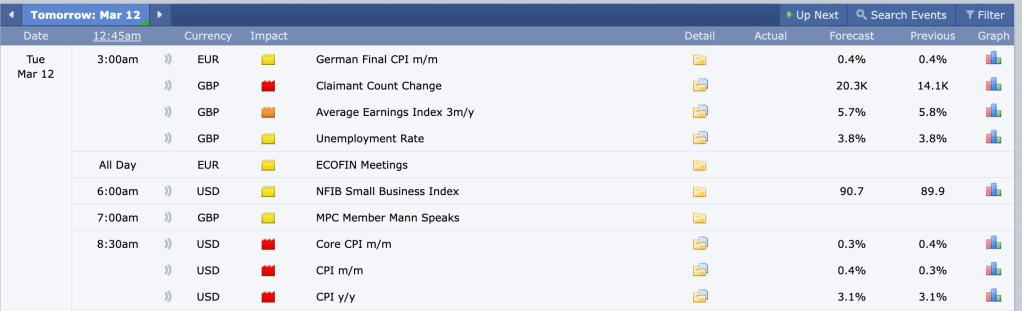

Assuming the dollar finds footing, we might see the uptrend in Nasdaq/S&P break. Tuesday CPI print lands, and core CPI is only expected to be +.3% month on month, which seems low to me. If that’s what’s actually priced into markets, I’d be willing to bet that is comes in hot and reprices the market down. This invalidates my hypothesis about Basel III Endgame, so we’ll have to wait and see. I’ll be ready for either direction this time. If the market has priced higher CPI and it comes in on expectation, it’s possible that the market rallies. Be prepared for both.

Those repricings usually happen twice – on the data print, then retraces ~100%, and then the move happens a second time. So I’ll try to hold a short into CPI to safely capture the reprice risk free, and then close and recapture it. Sometimes it’s taken a while to do the whole retrace, so if the market responds quite violently, it’s possible we don’t see the retrace on the glitch repricing. All of this is predicated by CPI being off expectations, and it may not be.

Leave a comment