It took me a while to dig back over the testimony or Jpow and understand that the willingness to flex on the Basel III Endgame proposal, after receiving extreme opposition, is a signal for weaker banking restrictions and, I hypothesize, a rising M1 and near-term safety in the markets. I entered a long after digesting this a bit, as I was short biased.

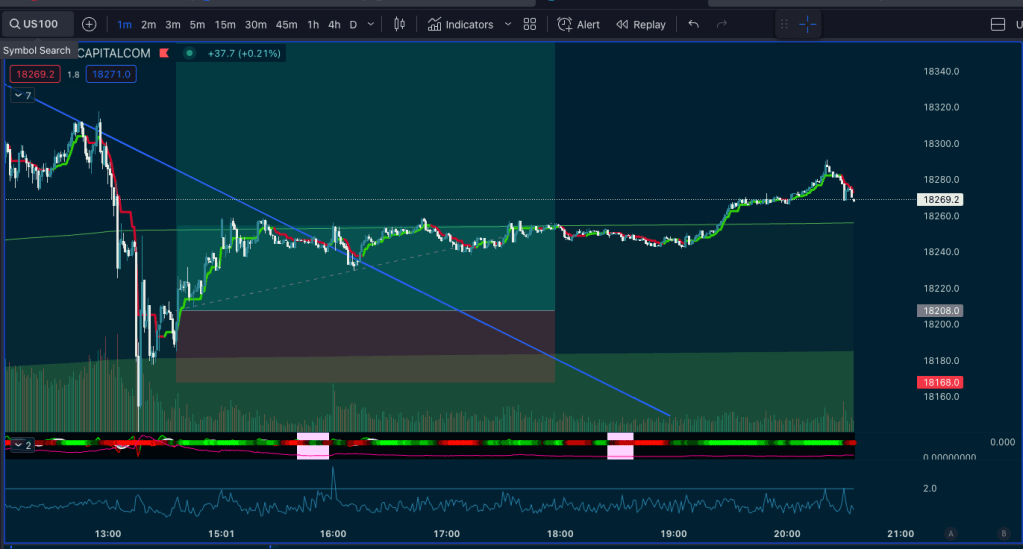

I slept soundly on this too. I closed around the high of the day, skipped the pullback into close, and re-opened long after changeover.

Here is some analysis I wrote on discord about Basel III:

I was digesting jpow testimonial a bit more and there was strong opposition to the Basel III proposal which aims to tighten capital requirements for large banks. They’re getting pressured to re-propose the bill, to loosen capital requirements. Although this will take a while, this is probably bullish for markets, bad for fed inflation mandate. Boost the markets, create inflation, deflate the debt. Even though the changes are far from coming into reality, I’m flipping my bias more bullish on this cautiously as it looks like the government may have figured out a way to create inflation without the fed being involved. I don’t want to be too conspiracy theorist but the us really needs to deflate the deficit at this point. This isn’t sustainable.

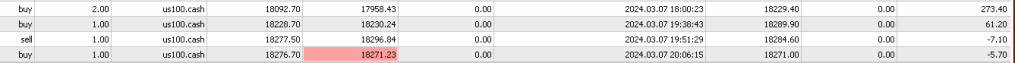

Account history from last night into the bell ring. The position is small as I had to sleep on it but still better than half a point on the account.

I opened a long after the changeover into Asia. Biden’s state of the Union came on, didn’t seem to do much but I pulled some risk off in the talk after he started talking about the Ukraine-proxy war, and put the risk back on a little later.

My expectation is that institutions will take advantage of insights into the Basel III Endgame news more than anything in the week and this will be the new “rate cut narrative.” The markets would be pricing in restricted capital requirements on banks, which would slow money supply growth. If that’s being reversed, then that’s what I want to be following. That’s my hypothesis at least, and now we just need to watch and see if the data lines up.

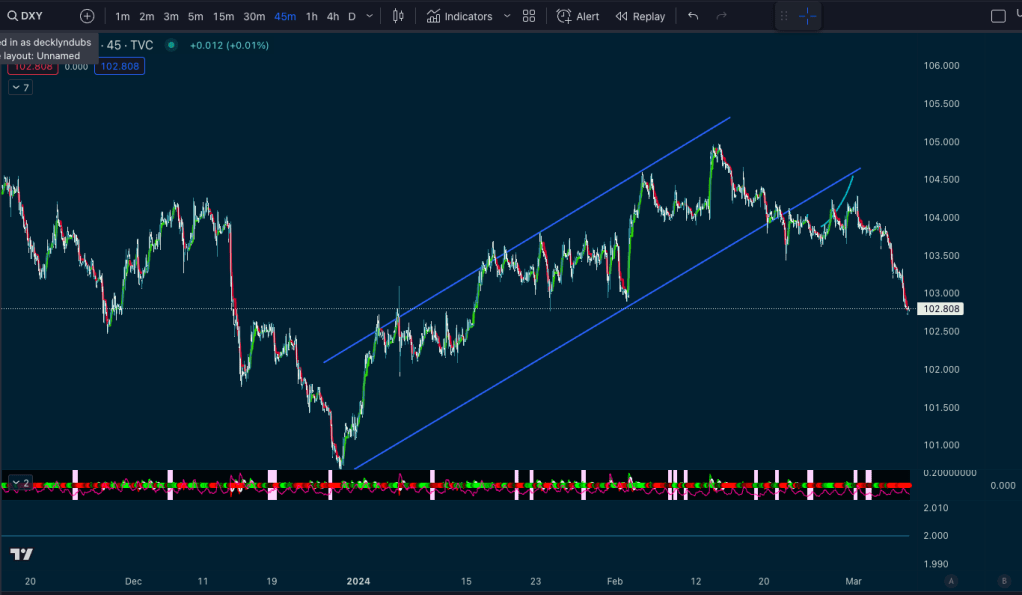

The dollar is dropping, and I think that this is really the evidence. Whatever narratives that might be causing this, the US Dollar is what to watch. As long as the dollar continues its descent, the markets will rise. Whether it’s rate cuts or eased capital requirements for banks, the markets are rallying. Unfortunately many retail traders seem to be obsessed with shorting the markets. “Don’t fight the Fed,” as they say. If the government and fed let inflation go hot, however they might frame it to the public, that will boost markets. If the dollar doesn’t stabilize, people will get out of it, and that selling of the dollar will deflate it and increase demand for other assets such as Gold, Crypto and Equity.

Leave a comment