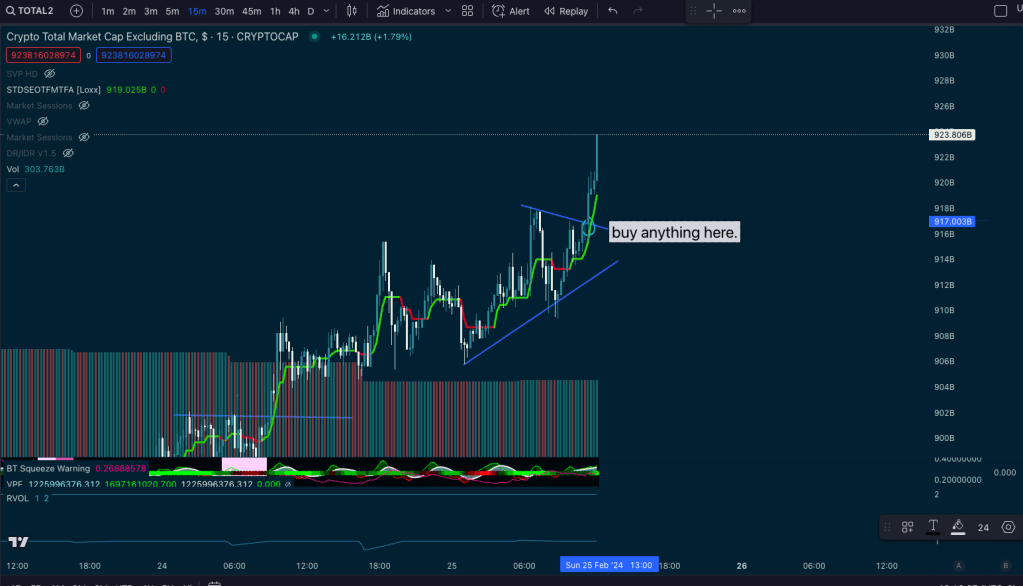

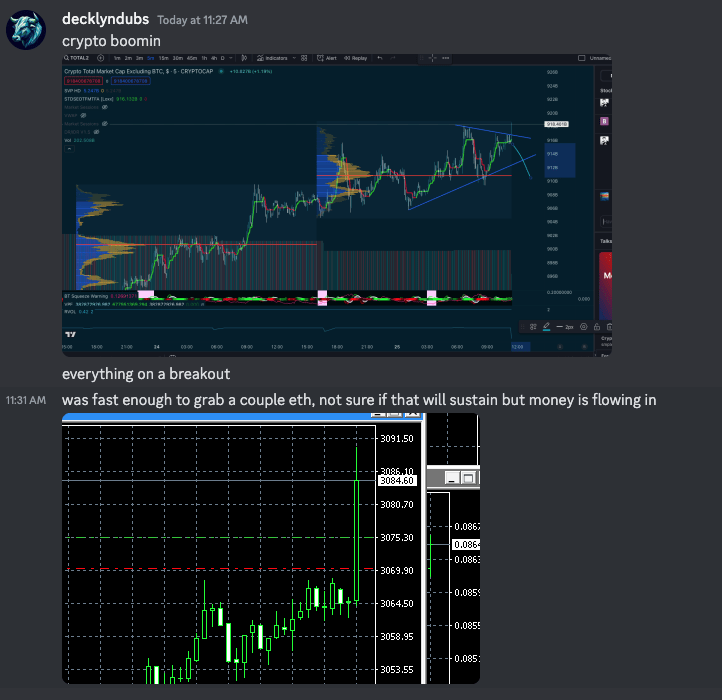

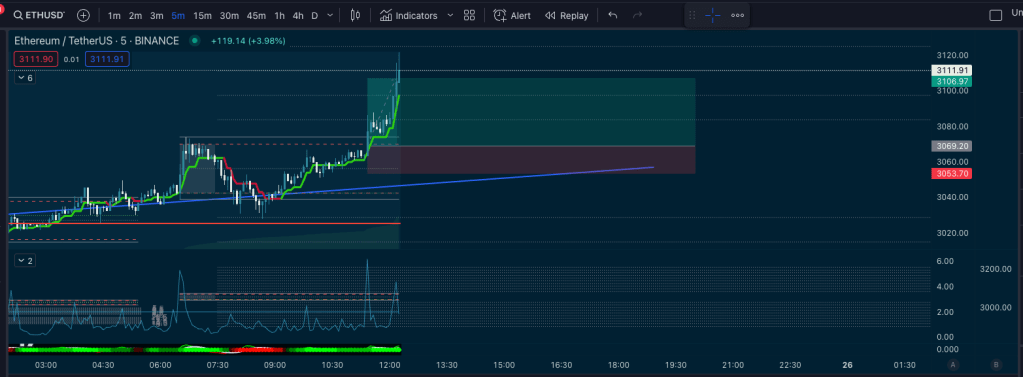

Took some losses over the past couple weekends trying to figure out how to read and trade crypto, and eventually caught the setup. Wasn’t prepared to enter so it was massively underweight but caught a clean big move that was very easy to catch. I’ve been trying to figure out how to “port” my index trading experience to Crypto. I’m looking for validation of analogs to signals I use in equity trading to figure out where money is going to improve probability in individual markets. Today I waited for TOTAL2 to give signal, either of reversal, or continuation, and entered ETH and BTC immediately on money flows into crypto. Everything is fairly correlated so you can treat TOTAL2 as an index, and trade individual assets like ETH on their correlation to the market cap.

I caught both BTC and ETH – I happened to have everything up and could click buy fast enough to get low risk entries.

It’s not easy to make decisions that fast – trading breakouts is not a good idea, but here we trading inflow to crypto so it worked out. I’ll note this as alpha and watch cap flows beside crypto. When you get really obvious breakout patterns on the inflows, it seems to be a good signal, so I’ll treat it similar to VOLD on equity indices.

Leave a comment