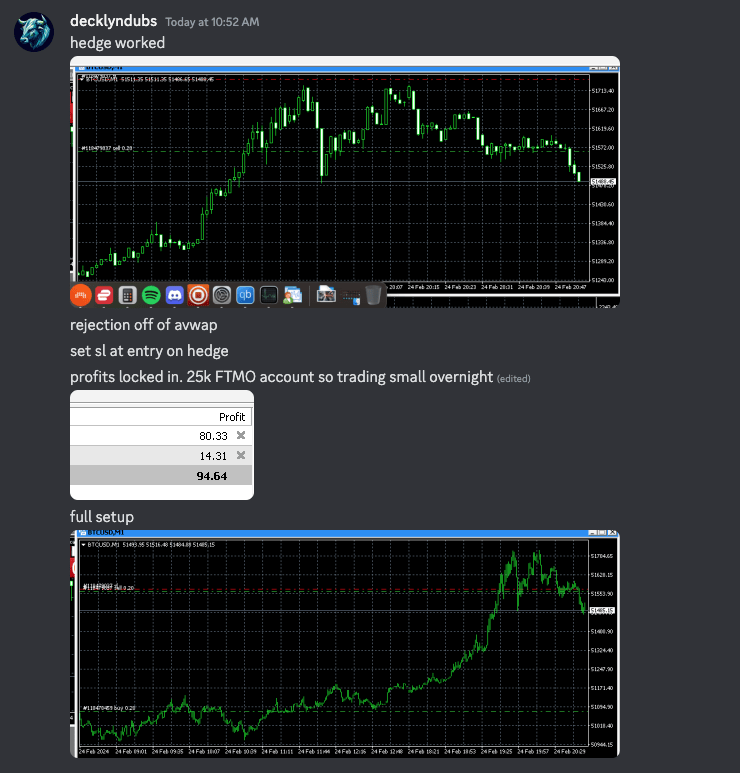

Woke up and wiped my eyes to find a small BTC trade overnight had survived. On a rejection off of AVWAP w/ low RVOL, I decided to hedge the position. Sometimes this approach can cause loss of the gains, but other times it’s a way to ensure you preserve the winnings you’ve captured on a move if the market turns against you. Here is the setup:

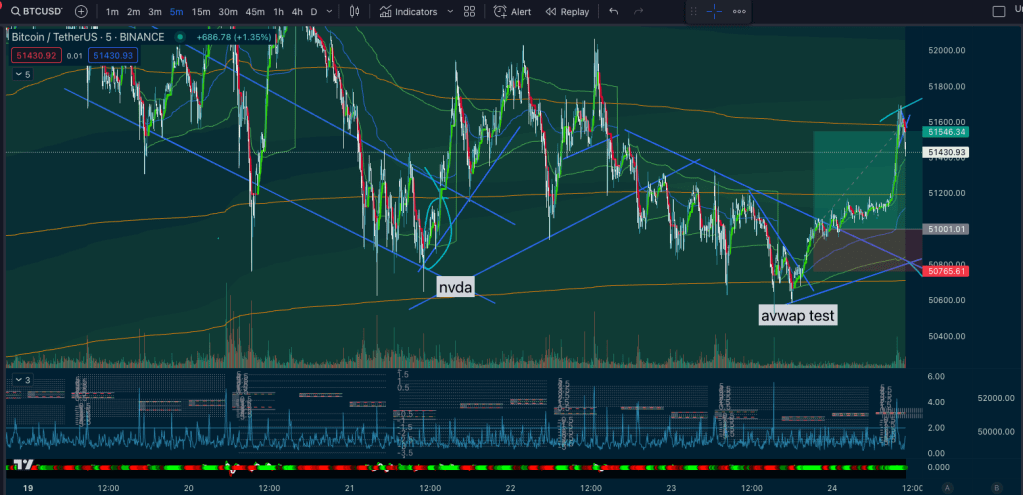

Overnight, I saw BTC basing on a test of an AVWAP I had charted. I opened a long suspecting a channel break, and at least a test of a higher AVWAP I had mapped/validated. This AM I woke up to find the trade at the AVWAP, and it failed.

I decided to hedge the position to ensure the profit was protected instead of risking it. Worst case, I was willing to give up 20% of the position – it’s better than letting it fall flat before your eyes. Similar to fully closing the position, and then re-opening, it basically moves your entry up capturing profit and skipping a portion of the move. If the hedge goes into money, and you close it in profit, it’s similar to catching your original entry artificially lower than you opened it so you can either keep more profit, or catch more movement.

The hedge continues to push into profit. It’s a useful risk management technique, but you’re likely to do more damage than good attempting this. Practice on paper and try to gauge how much damage you do versus how much capital you preserve using it. It’s easy to over-trade if you start engaging in hedging on a position. An easier and more consistent approach is to slice your positions and to take profit to cover risk, and let some run. I usually enter 3 or 4 smaller entries into a position and then aggressively cover risk to ensure I earn on a position, even if it fails.

Leave a comment