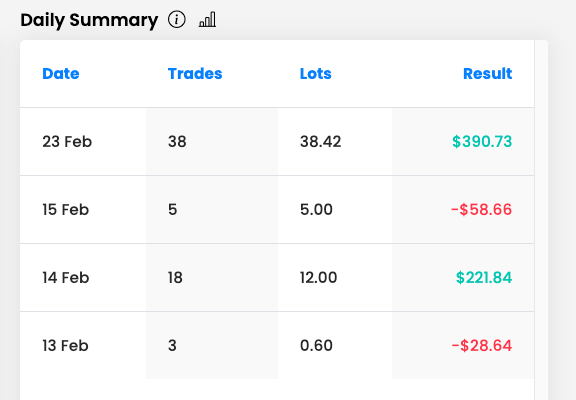

Net PnL: +390 on 25k (FTMO.)

Was a super nice trading day. Lots of volatility and clear trending. I mostly watched NVDA and traded US100 on the moves I saw as it’s such a big constituent, and seems to lead the markets like AAPL use to. The great thing about FTMO is that they have the individual assets as well, but I’m really used to trading indices, so stuck to US100 today. Long and short.

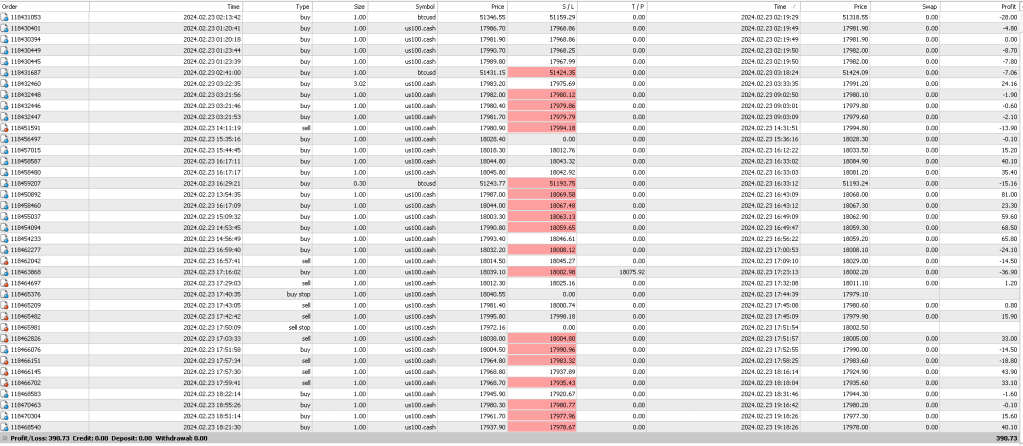

Account history for the day (looks like lots of positions – I was layering in and being pretty defensive):

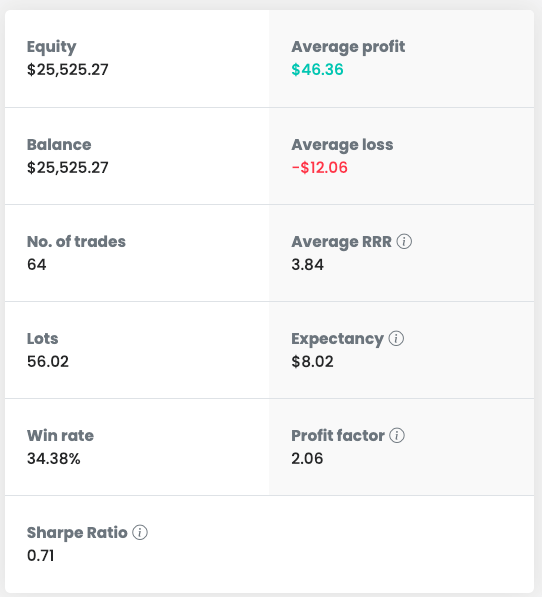

Netted nearly 2% on account (25k challenge.) I mostly just layered into trends as I watched NVDA break support and regain it. It’s mid day, so I’m stopping now. Could have done a bit better as I was shaken out of some good positions but I like keeping the RR mega tight.

Stats on account:

Daily history:

I can give some insights into the stats and how it relates to my trading style. You’ll note that my win rate is pretty low but my RR is high enough to offset it. A lot of that I could game – I split orders and it’s not unusual for me to be closing portions in loss around breakeven while the total position is in profit so it’s a little misleading. My position may be in profit but I’ll take all kinds of small hits around break-even on portions of the position trying to scale in and maximize gains while limiting my risk. You can see I have 4 orders layered in so only a contract or so is actually at risk at once. It’s easy to get out of without loss if it goes against you, but you can still try to maximize the gains on the position by layering in when you see the movement isn’t over.

I might put stop orders on breakout points, and a lot of times those adds can get kicked, but the position is actually really healthy and I’m just trying to add risk to be able to capitalize. Especially because this account is new, I don’t want to go in any drawdown here. It’s always hard to balance taking profit and letting winners run, and I could be a little cleaner and weightier. Now that I’ve got some head-room, I can make some bigger bets.

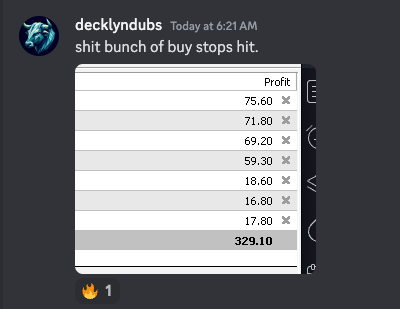

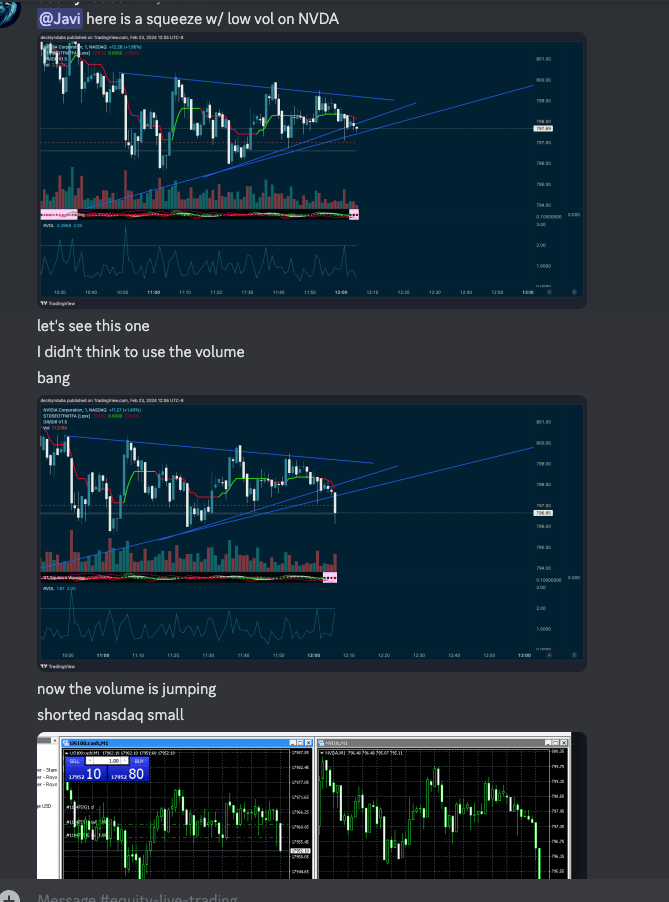

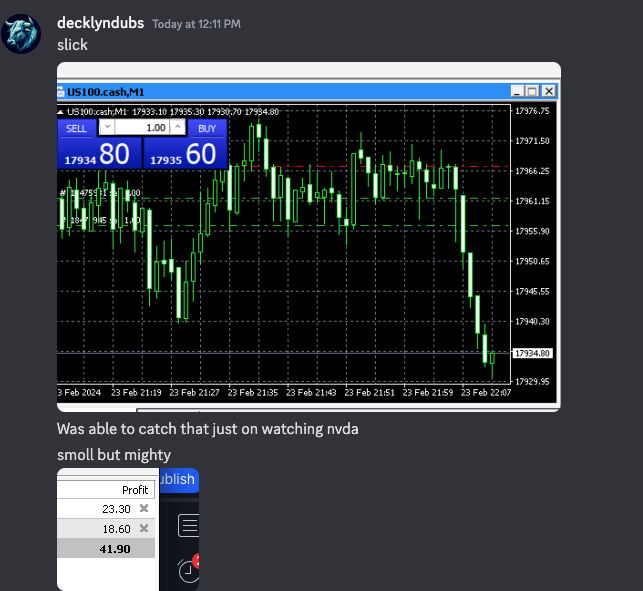

Here was another bangin’ trade from today using some quant I’ve been working on to identify moves. Once I saw it, I shorted Nasdaq as it hadn’t made any movement yet, so I got a really good entry.

Can see how good of an entry I grabbed! 17961. Thanks crystal ball!

As a prop trader, personally approach size as the total I can risk, not the total value. So I’m trading this like it’s a 2.5k account, not a 25k account. That’s probably different than what other traders do, but you want to pass the challenge, even if it takes a while!

Leave a comment