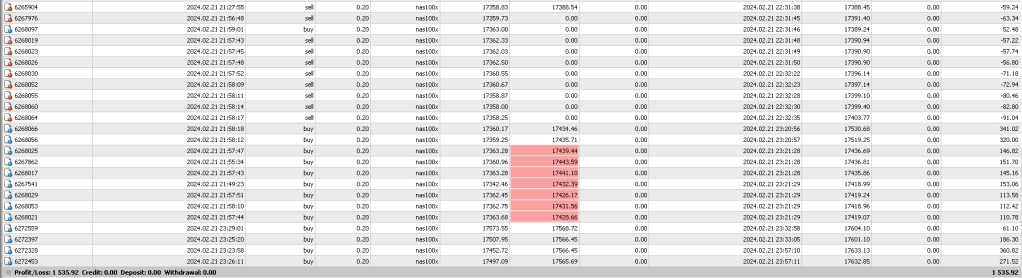

Net PnL for the day: +1535.92

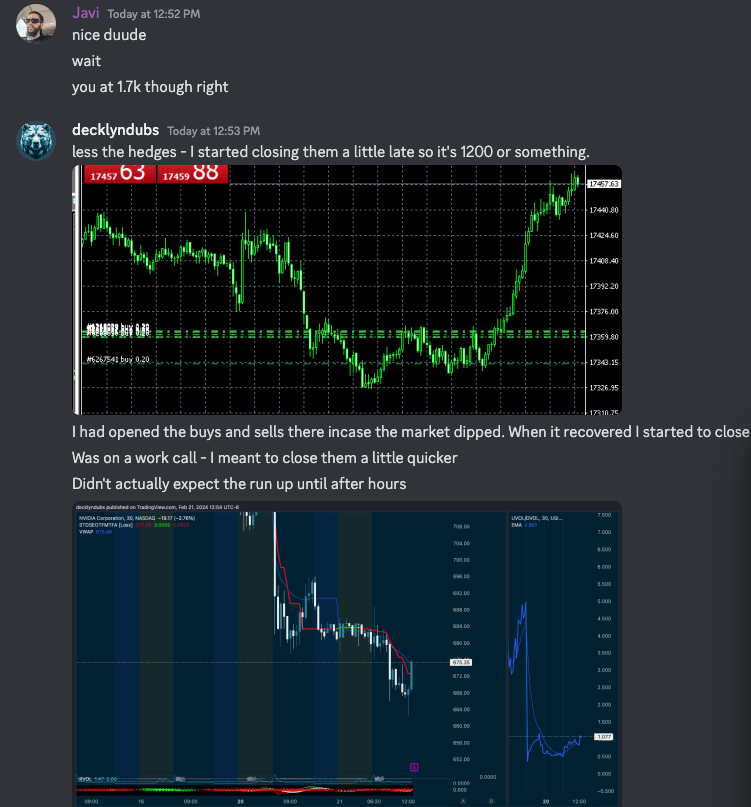

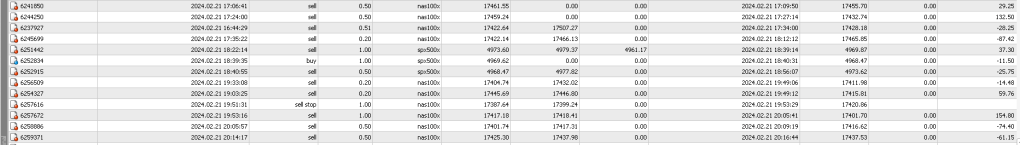

Up early to trade open. I had kind of a sloppy start to the morning, I pulled some profit and then gave it back jerked around on the FOMC minutes release. I kept it together and opened 16 contracts hedged close to the end of the day to have some opportunities to respond to the market moving in different ways, and to be sure I had a position for NVDA. I traded NAS/US100 as it’s less likely to experience the wicks around the earnings news.

When NVDA earnings were released a little after 4:20ET, I had made sure I set the stops in money. NVDA immediately popped up on the news of an earnings beat, and I closed a hunk of the position on Nasdaq. Immediately, intense sell pressure swooped in and cascaded through the stops I had set forcing me to take profit on the position.

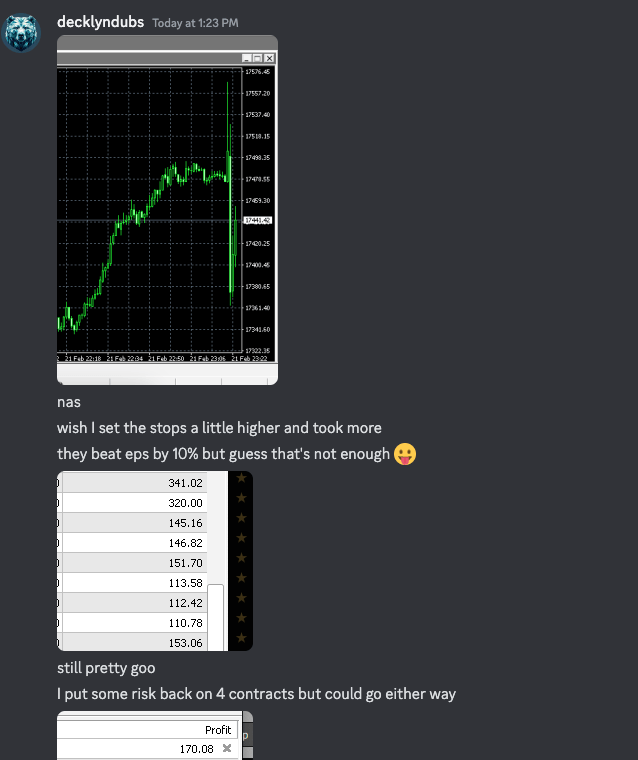

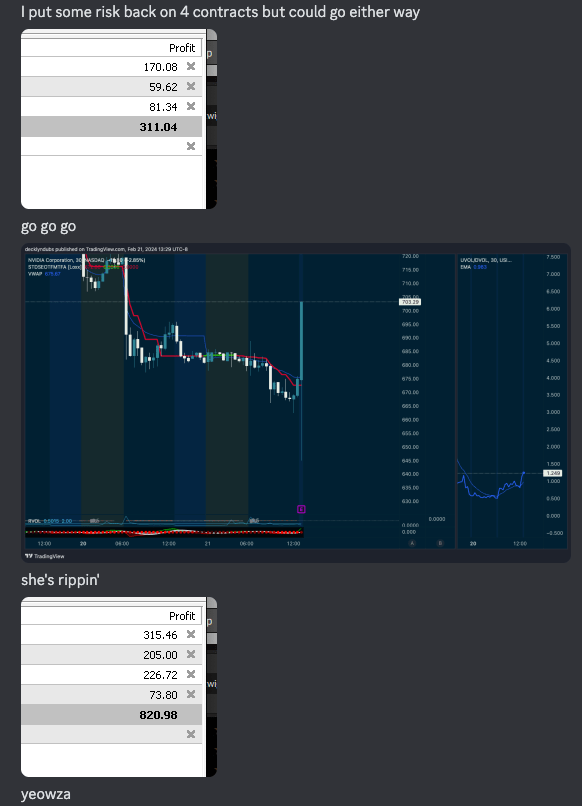

Once I got my head together, I started to put risk back on the setup seeing how the market was responding. What happened was amazing – everything in the indices all started to rally.

I slowly layered in checking everything was holding up. I took some profit back off to cover risk as the market continued to move, trailed the other stops, and then fully closed the position at the bell ring.

To be transparent, the morning trading session was ugly for me but I was tiered down. I need to stop over-trading and just wait for the really good setups to come to me. This is the reality of the craft – most of it is understanding your psychology and behaviour, and figuring out how to fix bad habits and be aggressively patient.

Here are the hedges and the trades at the end of the day. I was down a little into this trade IIRC but all it really takes is one good setup/catalyst to make up for days or even weeks of middling trading.

Leave a comment