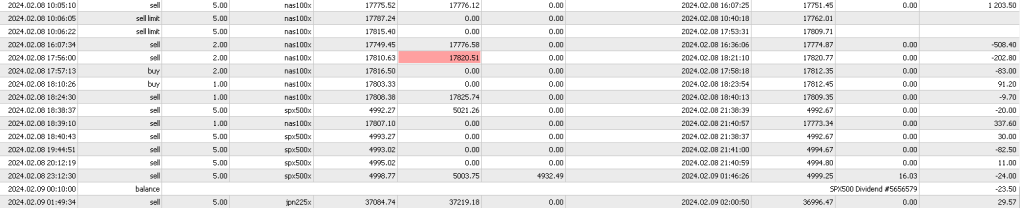

It was a “red folder” day today and I made some assumptions about how the market would respond and went short on Nasdaq into Europe market open with a big order, and later tried to short the bond auction. The market moved as expected into the data, but the data didn’t come in the way I thought it would. Still pulled a nice green day, PnL on the right for the trades today. Apx +$800USD on prop challenge.

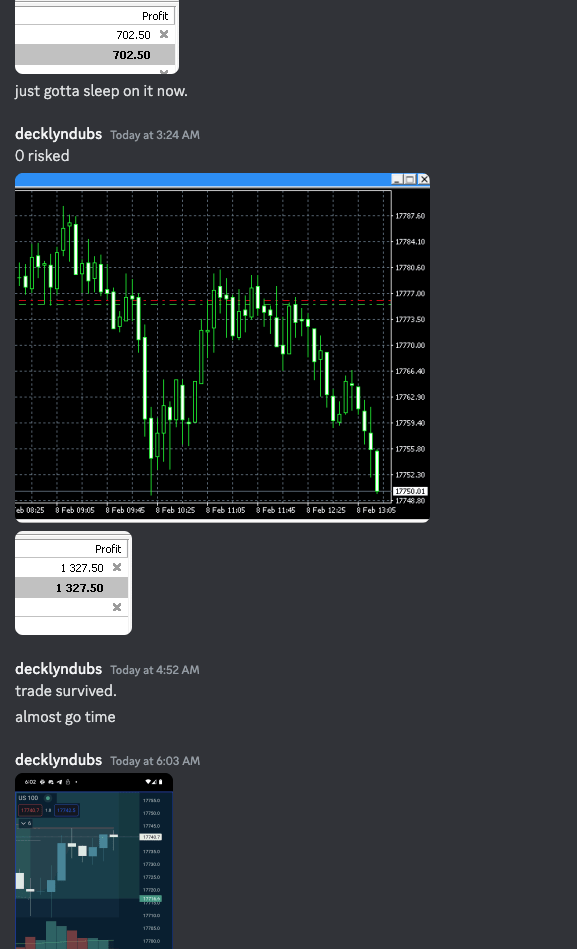

Was a little emotionally expensive to hold the position and try to sleep but the entry was super clean and I was able to 0-risk it before I went to bed.

I got up to look and find a really nice looking setup into the data release, which I assumed would be better than forecasted (eg bad for markets as it shows inflationary pressure), but it but I went back to bed just as the data dropped and it came in as expected. I reduced the position and held half incase the market dropped and it closed at entry. I was kind of irked that I missed so much of the PNL – it was a $3000 net position and I only scraped $500 out of it trying to reduce/hold onto the short. That gave me some ammo.

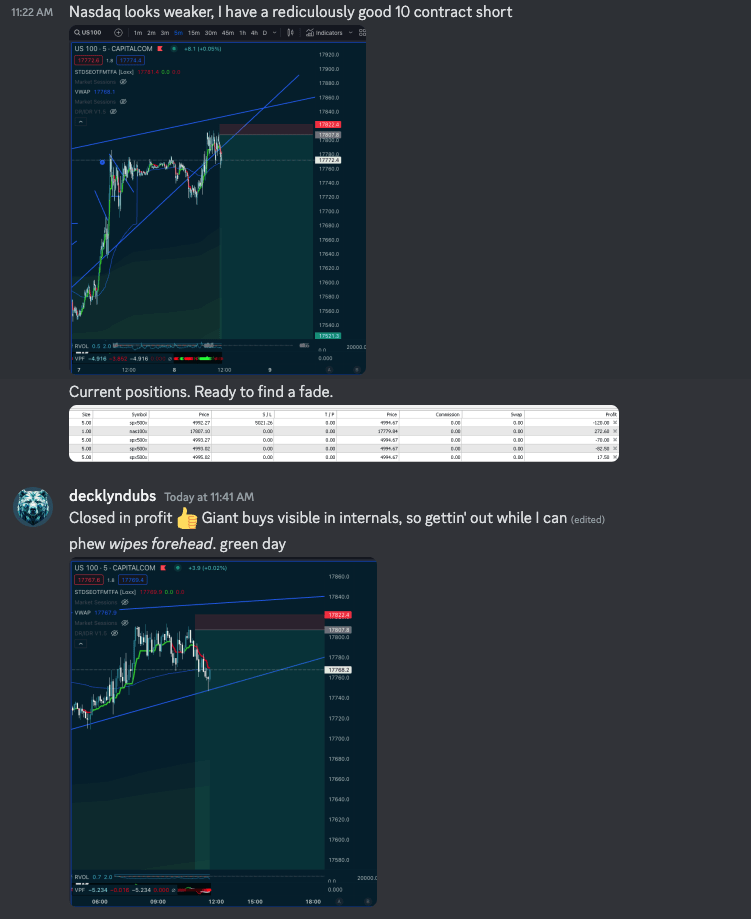

Sitting green, I took some risk on again shorting into the US30Y bond auction (25bn) which is a MASSIVE load of debt, and after the competitive portion closed, the 30Y yield dumped causing equity to reprice up against me. I had to be a bit patient holding Nasdaq and S&P shorts as the repricing knocked my position out of green. Once I found a profitable exit, I closed and didn’t look back.

As a final trade, I took a stab at Nikkei with a small play order into asia open and found a really clean short which I closed really quickly in profit. It was sized really small, but was a great fast trade on open.

Leave a comment