I had a less-than-stellar couple days around the FOMC giving a bunch back from the BTC trade over the weekend. I have to remember to just avoid it – I say to myself “I’m not gonna trade today” and then I trade and lose. But that’s just the slow, iterative process of making errors and learning from them. Ready to take a checklist now and journal every trade, not just in chats but full on write it all down, setup quality, etc.

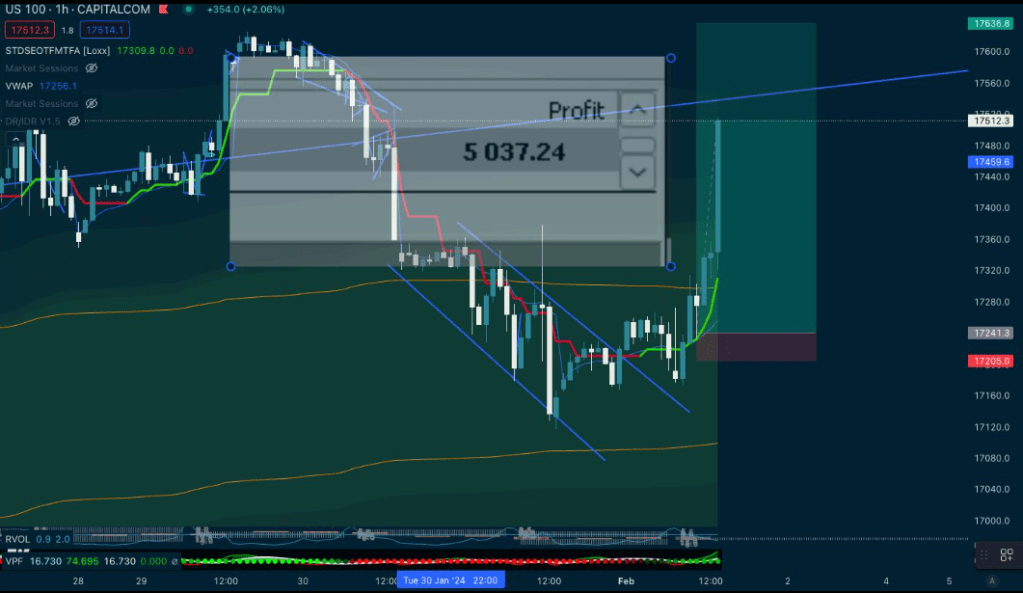

Today was an A++ setup. I was a little late, but got entry on pullback and it looked mega bullish. I’m long on BTC as well but it hasn’t moved yet (~42500 and I added more on a pullback from 43000, again a little late but it’s holding AVWAP.) Maybe I was lucky, I was just reading the data, but big tech earnings after hours caused an EXPLOSION with Nasdaq closing apx +2.2% on the day.

From the Discord:

A little later:

Holding for now. BTC I’m still watching test 43k.

Regional Bank Crisis is appearing in the media again, which I read as full-on bullish as that means the rate hikes are breaking things – and it isn’t the US economy! The Fed will force loans to cover liquidity, but I’m betting that the market will bet against the Fed. Today the Fedwatch tool showed the debt markets pricing towards a higher chance of a March rate-cut than they did overnight. I’m guessing that the correlate there is yet-another-regional bank crisis.

New York Community Bancorp (NYCB) played the role of rescuer during a 2023 regional banking crisis by purchasing some assets of the failed Signature Bank. Now it is experiencing some trouble of its own.

The stock of the Hicksville, N.Y.-based lender initially fell 46% Wednesday after it reported a surprise net loss of $252 million for the fourth quarter and announced it slashed its dividend. Its 37% decline for the day was the largest one-day percentage drop in the stock’s history.

The news sent new shockwaves through the regional banking world as stocks of other mid-sized lenders such as Valley National Bancorp (VLY), BankUnited (BKU), and Western Alliance (WAL) fell. An index that tracks those banks ended the day down roughly 6%.

Yahoo Finance https://finance.yahoo.com/news/regional-bank-that-played-rescuer-in-2023-now-in-turmoil-163932844.html

I could be wrong, but to me this is really bullish news for risk assets as the markets will price towards 100% chance of a rate cut in March. The _only_ thing the markets seem to care about is the rate cut probability. Even if it’s over-estimated at a 50% chance of 150bps cut this year (as of today, Feb1 2024,) it doesn’t matter – markets are not rational.

Leave a comment