I was getting sucked into calls watching the breakouts on my phone and not entering in one of those perfect tests of patience! I expected a little heavier selling into NYSE open but you’ll see that the analysis over here is really on point: https://k-xs.com/2024/01/26/trading-journal-recent-vold-cycles-and-planning-for-next-week/. I should have just traded that but was in a btc trade.

Short recap: the VOLD cycles and time of day show europe and asia lifting, NYSE selling on open and buying on close, day after day. Let’s “forward test” the analysis I posted on the weekend:

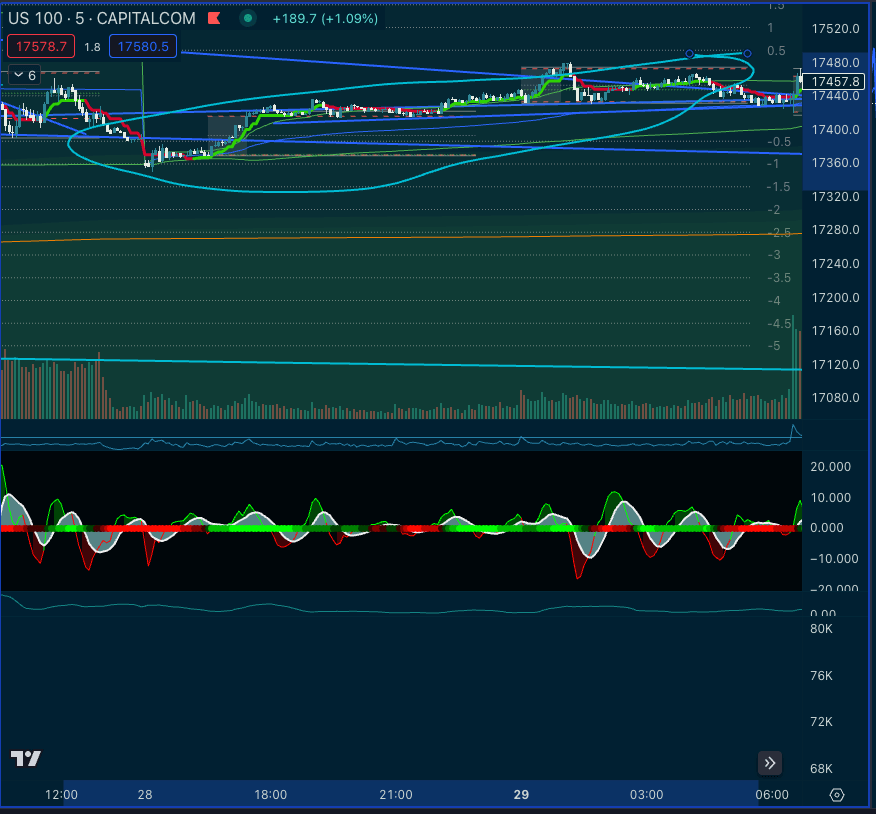

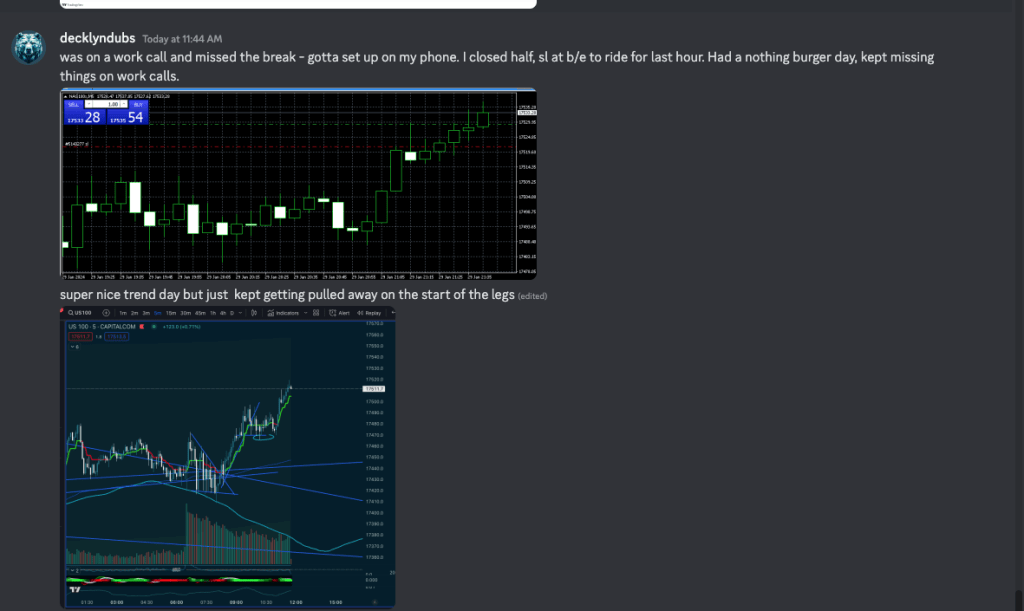

Asia and Europe cyclically lift American indices today – can see futures/CFD markets lift from Sunday open until Europe close (times in PT).

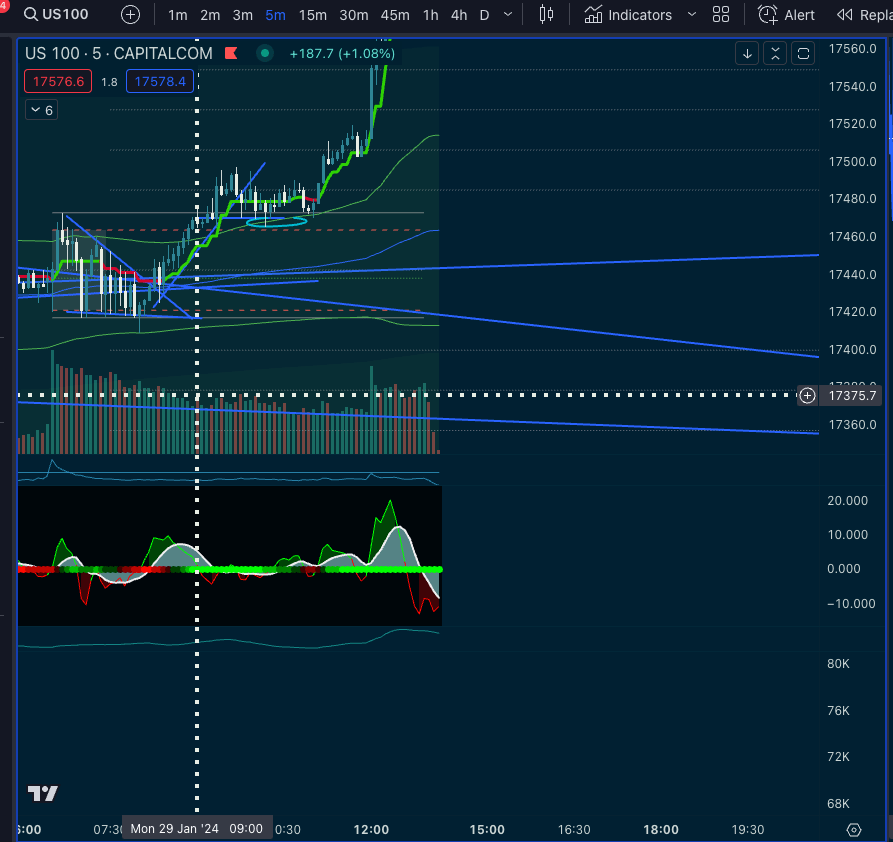

Then our prediction was selling in NYSE open and buying in the afternoon:

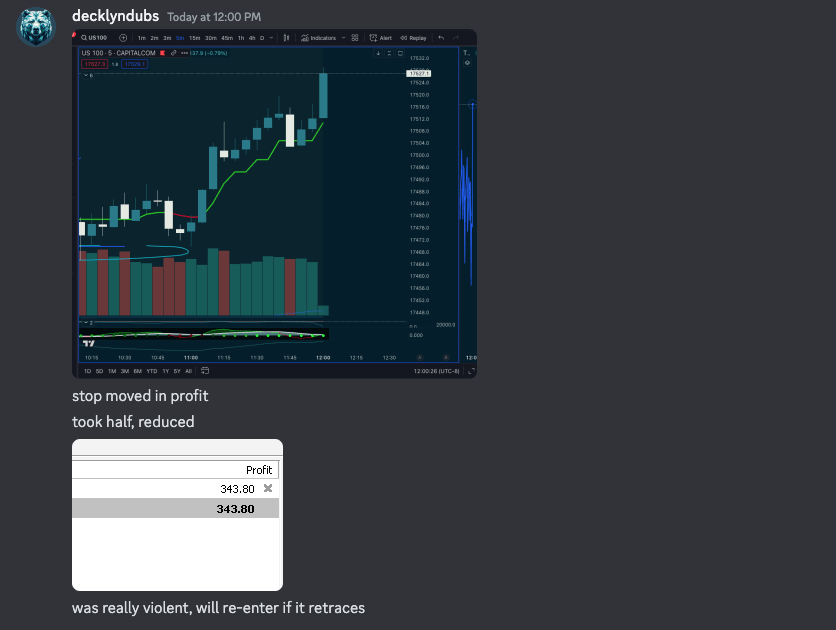

NYSE lunch shown, this has busted the trend already, we’re bullish today. All downside targets invalidated, we want a safe long with lots of risk on it. Entries shown are 10 contracts or ~165k notional

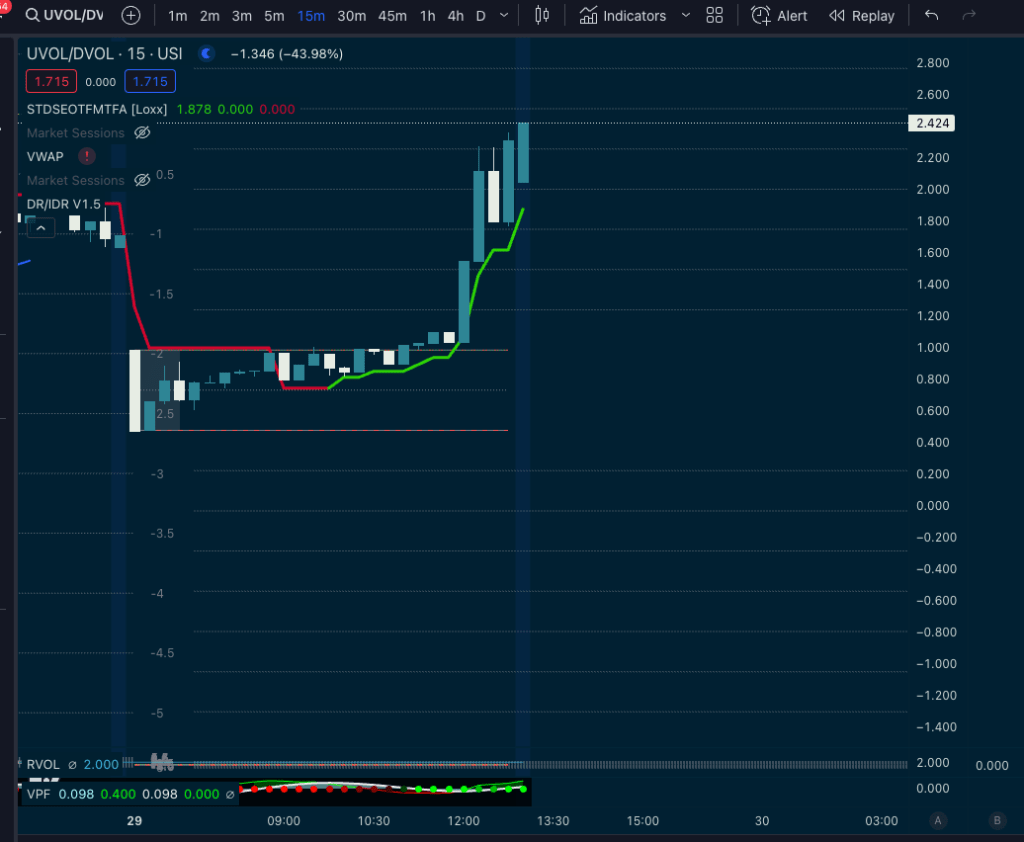

VOLD I called cycling short in the AM and long in the afternoon on multiple posts recently – let’s check:

Indeed VOLD opens low. I was actually shorting in the morning as I had a bias to invalidate the break over trend. Because of the complicated nature of this area, I closed half of every trade I made rapidly to do my best to ensure we close green on the day. I missed the break early on tho as I’m working full time and got pulled into calls. As a rule, I won’t shift my focus out of work to enter, even if I’m watching it on my phone…

Nasdaq broke trend early and I couldn’t find a safe entry, so I was trying to find a position to hold at safe levels.

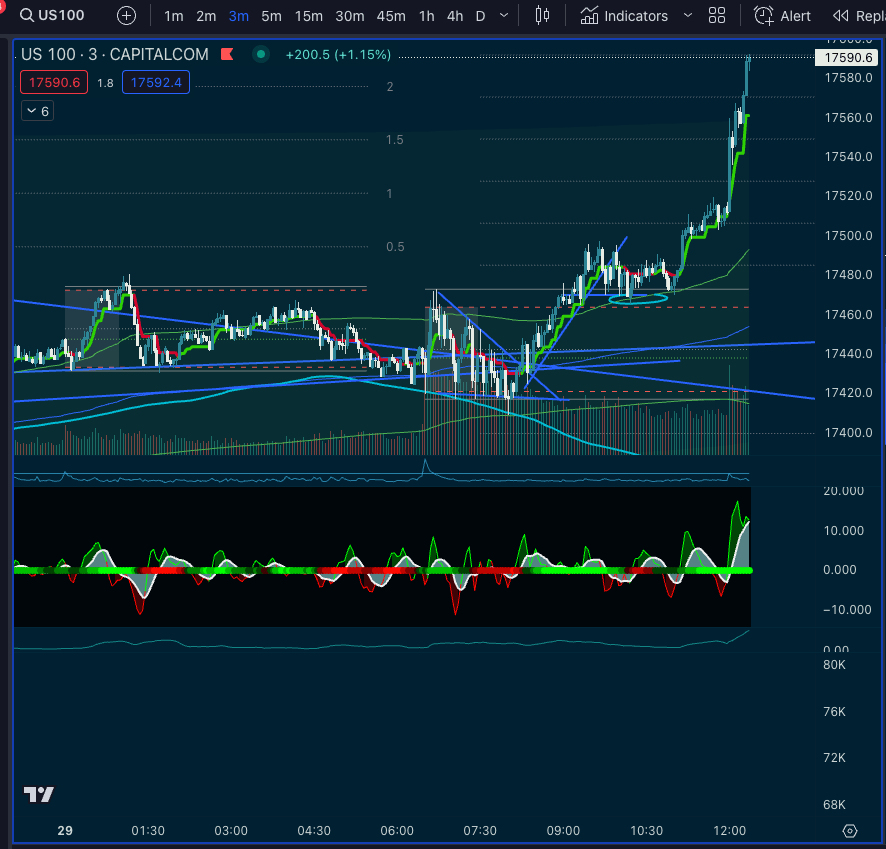

I had a fairly flat day covering risk, trying to find positions to hold without drawdown, but managed to catch the end of the day. I took profit pretty aggressively just to be safe as the move was violent. Why would I long at the end of a run? Surely that’s a fool’s errand! You just have to see the internals and know the type of day. VOLD shifting buy side is a signal to follow the trend! That’s institutional capital going long. 18k Nasdaq is likely.

I held that trade together and caught the move from there.

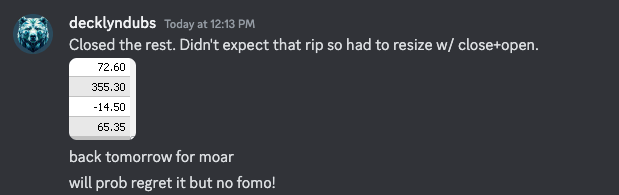

In total caught a little under $500 on challenge account. Could have been a huge day but I’m happy with this. I didn’t break my entry in pieces so was stuck closing/re-opening to reduce so you can see a pretty sketchy profit cut. Enter your trades in pieces if using MT4 one click!

I would have thought trying to long late on a huge run was crazy only months ago.

Leave a comment