The Efficient Market Hypothesis states that all known data is priced in immediately to an assets price and that no data can be exploited unless there is inefficiency in the markets due to asymmetry or inefficient markets- I’m going to show you that even competitive markets have inefficiency that can be exploited with speed.

Yesterday’s CPI data came in worse that expected, an inversely today PPI came in better than expected, and with a bot picking up that data, you can compete strictly on speed. If you can build a bot to read the PPI data as soon as it is released, you have exploitable inefficiency in the market, and even as a human trader, you can actually compete on this number as there is a slow and gradual repricing that occurs on higher timeframes. Even seconds is enough to watch, react, and respond.

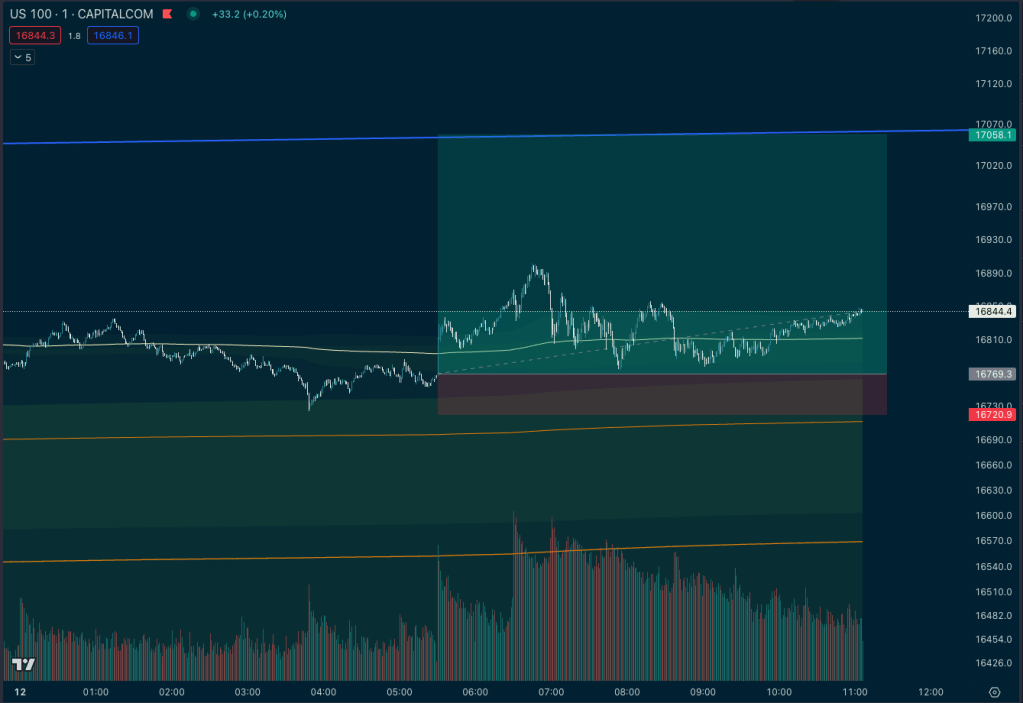

You’ll see that premarket – 5:30amPT or 8:30amET the PPI data is released and it causes an immediate repricing up. The first 1m candle captures most of the repricing, but even the subsequent candles are catching uptrend that is good for a few minutes of movement before retracement and subsequent continuation:

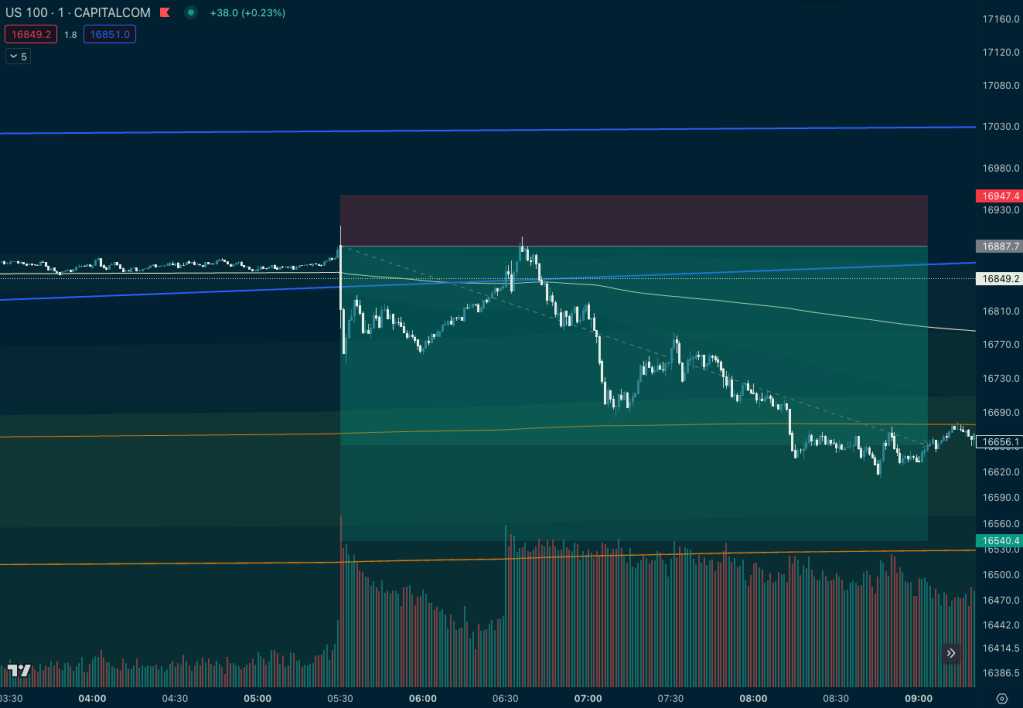

Yesterday we can prove the same movement is safely captured on the bad CPI print, even on human-timescales:

Both cases still show high-timeframe trends that can be competed for after full retracement.

The retracement on both shows that efficient markets will compete for the alpha by pushing into human-speed stop-limits but the second minute and subsequent high-timeframe trends are exploitable.

This requires further quantification, and also a study of high frequency competitors to understand how quickly the alpha is captured by high frequency traders, and what timeframes we’d need to be on to capture the alpha. You would have to pay for data or collect it to study the order book data, but higher-timeframe data can be studied to understand the second minute and high timeframes to find patterns in the repricing that are safely exploitable.

Leave a comment