The release of the FOMC Meeting Minutes are classified as a “Red Folder” events. These events have trading restrictions for proprietary traders from firms like FTMO because of the risk involved. Proprietary Traders with high leverage accounts are not allowed to execute traders aoud these events because of the risk.

Most of the events are a countdown – watch the countdown and get the data. I have a swing account that has more restricted leverage but it lets you trade these times. (That’s why I have two accounts for the 1000x challenge.)

There data points are quantitative events, where a number is released and the market responds, the meeting minutes from the FOMC are qualitative. Processing the information quickly is difficult. We can use GPT4 to help increase the speed of our processing by taking the minutes and asking GPT for analysis to gain an edge relative to simply reading the report.

Asking GPT to interpret the sentiment and S&P response, it gives the following back:

The sentiment of the FOMC meeting minutes is cautiously optimistic and reflects a measured response to the current economic conditions. Key sentiments and themes include:

- Positive Developments: The easing of financial conditions, with a decline in interest rates, an increase in equity prices, and a depreciation of the dollar, is viewed positively. The rise in equity prices, supported by lower Treasury yields and strong earnings growth, indicates a positive market sentiment.

- Reduced Inflation Risks: There’s a noticeable decline in yields on nominal Treasury securities, suggesting reduced risks of prolonged inflation. The market also perceives the Committee’s policy rate to be at its peak, reflecting a belief in the stabilization or reduction of inflationary pressures.

- Monetary Policy Expectations: Expectations that the peak level of the federal funds rate has been reached indicate a perception of easing monetary policy ahead. This is further evidenced by the anticipation of a reduction in the policy rate by mid-year.

- Market and Money Market Developments: Continued decline in the use of the overnight reverse repurchase agreement facility and modest upward pressure on overnight repo rates indicate some tightening in repo markets but overall stability in money markets.

- Economic Slowdown with Resilience: The data suggests a slowdown in GDP growth and continued tight labor market conditions, with high but easing consumer price inflation. This points to an economy that is cooling but still resilient.

- Caution in Economic Outlook: There’s a cautious tone regarding future economic prospects, with acknowledgment of uncertainties and risks. The staff revises down their inflation forecast, expecting a gradual alignment of demand and supply in product and labor markets.

- Balanced Approach to Monetary Policy: The Committee’s decision to maintain the current federal funds rate indicates a balanced approach, recognizing the need to be responsive to new data while staying committed to inflation targets.

- Acknowledgment of Risks and Uncertainties: There’s an ongoing acknowledgment of risks, including the potential for stronger economic momentum, easing financial conditions, geopolitical developments, and the impact of past policy tightening.

- Commitment to Price Stability: The unanimous vote to maintain the current policy stance underlines a strong commitment to returning inflation to the 2 percent objective, balancing this goal with the need to support economic growth.

Overall, the sentiment is one of cautious optimism, acknowledging positive developments and reduced inflation risks while remaining vigilant about economic uncertainties and committed to price stability.

– GPT4

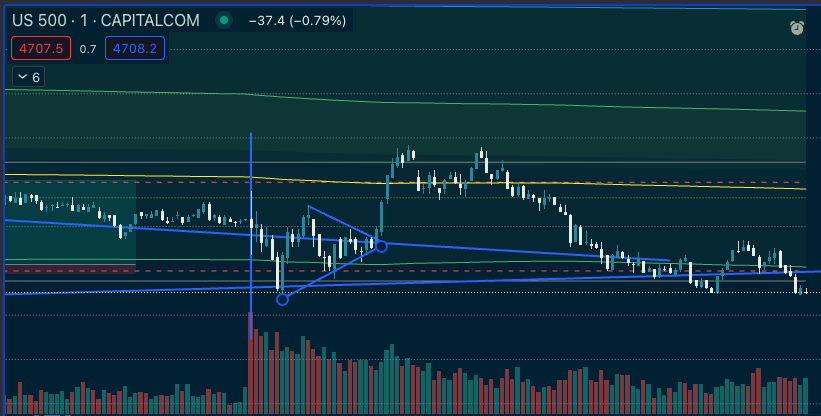

The market will do whatever it wants, and a lot of this is going to be expected/priced in, but we can process the information quickly with the help of GPT and then listen to the market data to see what happens after the data is posted. You can see 30 minutes of consolidation and then a bullish impulse into session anchored VWAP. The vertical blue line highlights the moment the minutes are released.

Leave a comment