I woke up really early feeling restless. I probably over-worked myself a bit with personal projects over the holidays. I got _A LOT_ done. That was after a long/late week doing a hackathon-type thing at work (we crushed it!)

I checked the indices in Europe time towards close and saw I missed a huge continuation of the Nasdaq’s downtrend. I entered a couple contracts, actually set the risk very high for the reward as I was willing to hold it back up to VWAP. Fortunately it went in my favour and I clocked a small gain on it when I woke up.

The setup just grabs the tail end, it’s a very risky but opportunistic position and was sized accordingly. I closed it at a bit higher than risked but if you size stuff right can you can take silly risks and it not touch your PNL too much as long as it’s not continuous overtrading/bleeding out.

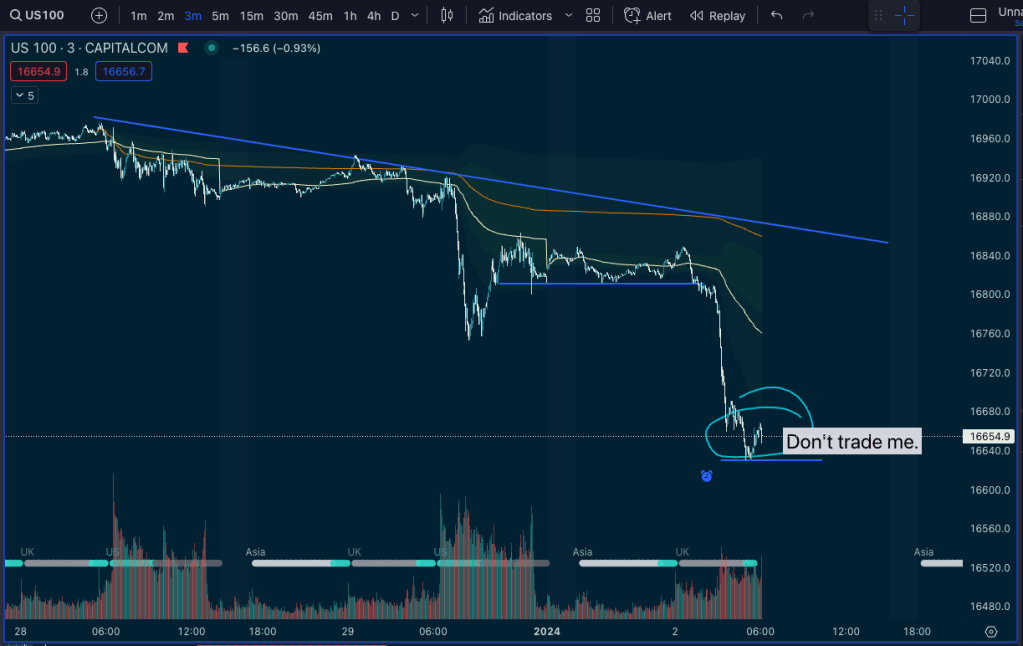

So one of the things I’ve been really trying to focus on is to be with the trend, and to not be fading it. We’re in a downtrend. I closed my position and set an alarm for a breakdown (risky/momentum play) and otherwise have two short-entry targets to look for higher up. There is VWAP anchored to the market top/pivot. All time high touched and then we’ve trended down since so I will keep riding that. There is also an upper trend line, and we’ve deviated from that. So the magnets of the vwap and upper trend line are going to tend to pull the price back up, but we’re heading into market open and I don’t want to take risk on. My conditions are either to bounce clean off of a VWAP for a short entry, or else to wait for the upper trend to bounce. We want to catch the V so we don’t want to hold/add to our position, but just find one banger short entry.

I’m also happy to ride it up, but there isn’t enough information yet – this area here is showing consolidation and these markets are realllly competitive so the price data is likely to be really random. Any alpha is mined out quickly and you’re left with absolutely no signal. Your opinions have no place here – this is a no trade zone.

We’ll see how this evolves through the day.

Update: deviated from the plan a bit, getting a bit burnt out. Over traded. Can relax for a bit ;). Ended green but it wasn’t anything big. I flipped to S&P and closed barely anything. Little break, lots of patience, and need to set the size wayyyyy up on my trades. Used to trading 10k accounts so I’m dialed in for those sizes.

Leave a comment