Trading Prop Account Challenge (50k)

Opening Balance: $50002

Closing Balance: $49795

I cannot believe how badly everything lined up at the end of the day. This is probably one of the more interesting losses I’ve logged in a while and there is a good lesson in this.

I’ll start by laying a little background on the lesson and theme in this: I remember reading Mike Bellafiore talk about one of his traders at SMB being on the phone with a trade open, and Mike flipping on him for diverting his attention. It reminds me processing losses when I went back to work from trying to trade full time as an absolute beginner (this was a terrible idea!). I’m on the west coast – 3 hours behind NYC – so I often get up 5:30am and trade pre-market. I was confident in my trading, was finding consistency, and started trying to manage trades while splitting my focus between work and the trades. My profitability dumped and I blew things up. Lesson: you require absolute focus.

Today was just a mishap caused by perfect co-incidences. I traded the beginning of the day, absolutely crushed a bunch of work. I did watch and take a couple small scalps but they don’t require focus as you just kind of set them up and let them go, and I was tiered way down anyway scraping like $40 on a couple tiny positions.

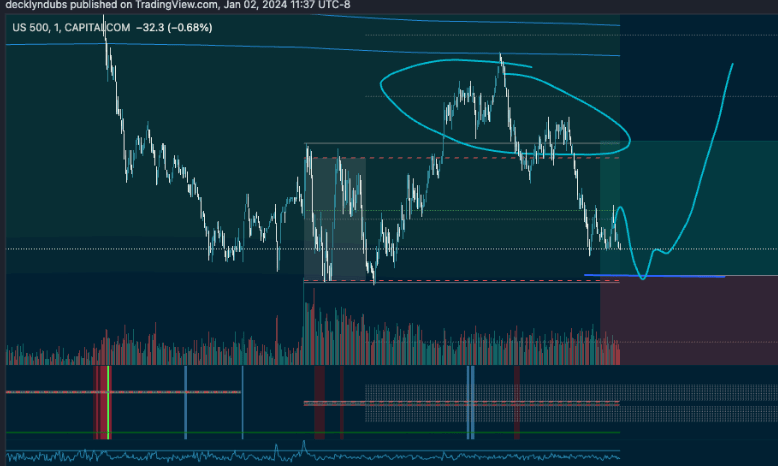

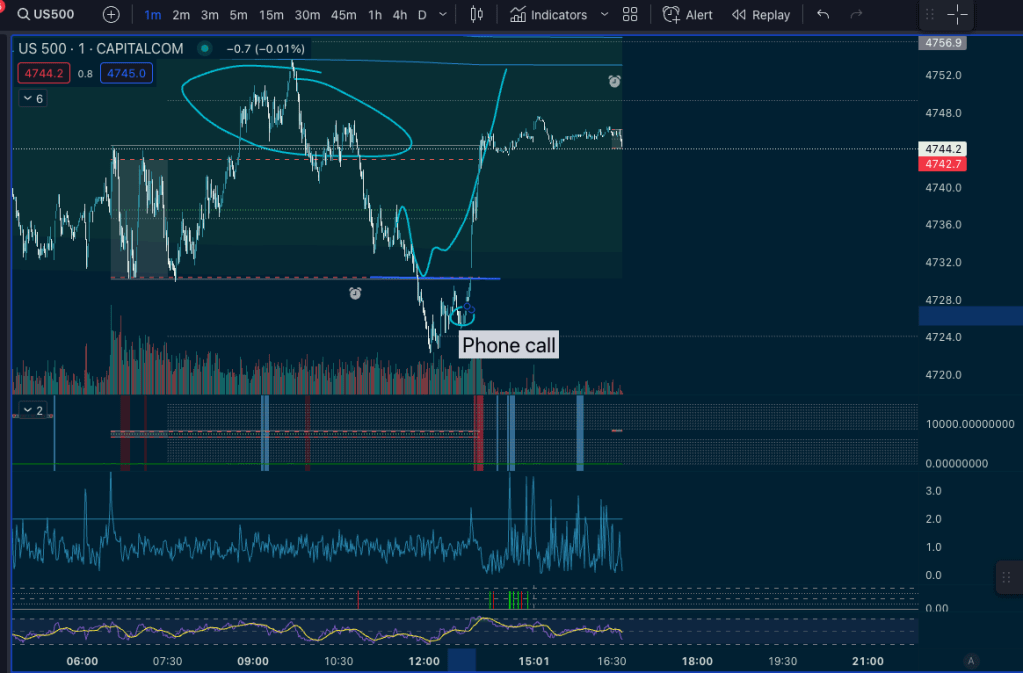

Finally, I found the crystal clear heavy trade of the day: Mast7r’s DR/IDR “Retirement Setup,” which looks like this image I captured from TradingView explaining my plan before the entry arrived:

With DR/IDR, which you’ll see on the chart during the NYSE hours as a parallel channel, the first hour is shown in the lighter color. The morning volatility draws the range in the first hour (DR+IDR – bodies+wicks). The price breaks over the ceiling drawn in the first hour. Now, if the price returns to the floor, you’ve got a really good chance to get a rebound at least into the range, potentially to the ceiling again. If this shows up at the end of the day, this setup is gold and will often draw the whole daily range with nothing but a wick under the floor. All in, max leverage, max bidding. Razor sharp stop. Just re-enter if it fails and you see it go. This is a banger of a setup with up to 87% probability of success in certain forex markets. It works best in more competitive markets (equity indices, BTC, forex.) Even on weekends and holidays.

Of course, the risk is that it doesn’t bounce, and you can get hung out to dry, so my plan was to enter close to the floor, and then watch for the confirmation for it to hold, or else eat loss and then catch it back up. I entered 5 contracts (notional $23k+) into the floor, just into my lunch hour.

Then my boss asked if we could catch up, so I hopped on a call. I left MT4 up to try to get a big fill, I was ready to enter all of my account on the setup once I could gather the stats. You can see in the screenshot from TradingView I had it planned.

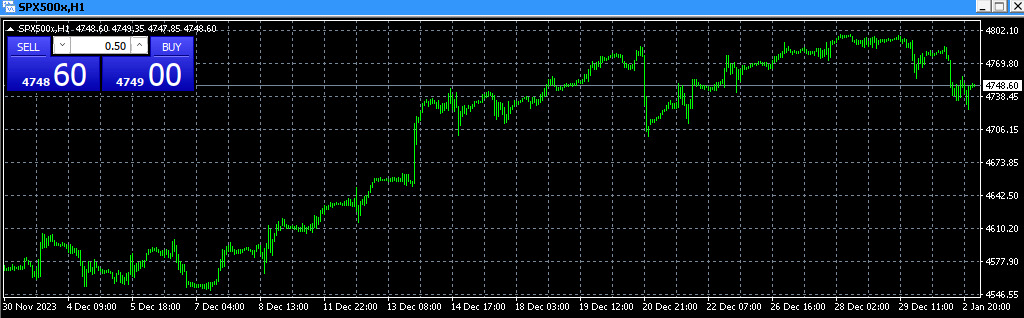

My boss and I were chatting and it dropped under the floor and all I could see was something like this in MT4 – not ideal!!

I had a plan but my focus was on the conversation so I knew the probability and that I was missing my opportunity to fill but I couldn’t see what was happening. I pressed the buy button a few times, which is 5 contracts a click * $4700, bringing the notional value to something like $94k. Totally blind, no focus or attention to spare, but the plan in my head, once I got off the phone I checked to see if it held and it had smashed down. Everything was falling. It looked bloody. Someone in TV kindly said to just hold it together and it’ll bounce but I know better than to keep a losing trade open. I have not had a big loss in almost a year. I hit the trade for about $200 loss right at the low of day. That’s okay, I had a plan to do this and to just catch it back up. This happens a lot! The loss was a lot bigger than I anticipated, but on a $50k prop account, it’s not a big deal – it’s a quick scalp to regain that. Holding a loser is where you bite it.

So I waited through a lot of my lunch hour, attentive and patiently. I became fairly convinced the daily ceiling wasn’t in the cards. It was approaching end of day now, and I don’t like to fade the last hour as a general rule.

Then another co-worker asked if we could catch up. For sure! Of course! I took the loss, the setup looked dead. I was ready for it, it didn’t come. So It’s okay, I’ll move on. Chatted with my buddy, we made a plan for the day, and I got off the phone and it played out, the floor was broken, I was too late to enter and I know to not chase it. I couldn’t believe the timing. I saw it reject the floor, then he called me, and then it ripped! It hit my target of the DR ceiling and I missed a most beautiful, banger of a trade in indices since 2023.

I get killer setups every week or so, and I have a good playbook. I can just see it all lining up and I know to enter HEAVY!!! But the market was fearful today, and my focus was split at the critical moments. Twice! How does that happen?!? These are minute candles. In a flash. After the holidays I’m used to having pure focus, so I got a reminder to stay humble, and to appreciate your focus when trading. I try to keep the trading before I start work (~6:30am-8am – “Killzone”) and to the end of day which is my lunch (12 noon to 1pm) which are exactly the first and last periods of the day where all the alpha is. I’ll watch the market and plan a bit but the mid-day isn’t profitable and I have work to do.

Can’t help but smile at this one.

It was “One Good Trade,” even as a loss. I learned an important lesson, and now I’ve processed the loss and let it sink in by writing about it. On to the next trade!

Leave a comment