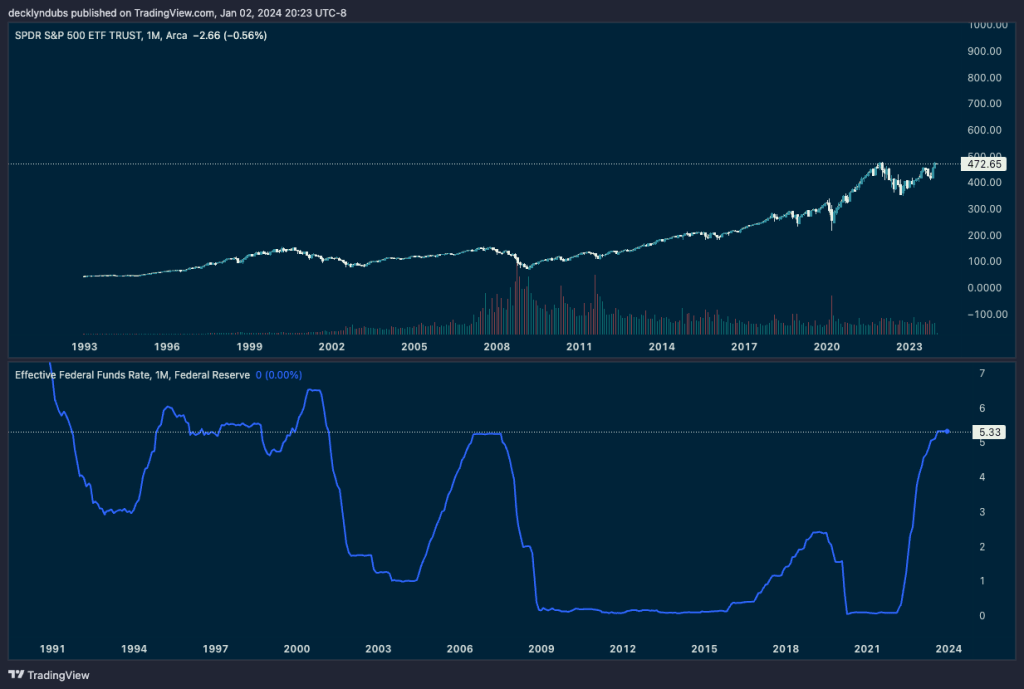

In the intricate ballet of financial markets, few relationships capture the attention of investors quite like the interplay between the S&P 500 Index and the federal funds rate. This connection, often seen as a barometer for broader economic health, is a critical component for machine learning and quantitative analysis enthusiasts at k-xs.com, who strive to leverage this dynamic to outperform the market.

Understanding the Federal Funds Rate: At its core, the federal funds rate is the interest rate at which depository institutions lend and borrow reserve balances from one another on an overnight basis. Controlled by the Federal Reserve, it’s more than just a number; it’s a powerful monetary policy tool that influences economic activity. When the Fed adjusts the rate, it’s essentially tuning the volume of economic activity, affecting everything from consumer borrowing costs to business investment decisions.

S&P 500 Index: A Market Mirror: The S&P 500 Index, comprising 500 large-cap U.S. stocks, is often regarded as a mirror reflecting the health of the U.S. economy. This index is a critical focal point for investors and quantitative analysts alike, as it offers a comprehensive snapshot of market sentiment and corporate performance.

Positive Correlation – The Long-Term View: Traditionally, a cut in the federal funds rate is perceived as a stimulant for economic growth. Lower interest rates translate to cheaper borrowing costs, spurring consumer spending and corporate investments. This economic stimulation, in turn, can be a boon for the S&P 500. Over the long haul, as the economy expands, corporate earnings often increase, potentially lifting stock prices and, by extension, the S&P 500 Index. This positive correlation is a key aspect for those at k-xs.com, as our quantitative models often factor in these economic shifts when analyzing market trends. However, the market’s immediate response to a rate cut can be counterintuitive. Often, a rate cut is a response to looming economic concerns. To the market, this can signal potential trouble, leading to a dip in the S&P 500. This reaction is a blend of investor psychology and risk reassessment. If investors perceive the rate cut as a red flag for economic weakness or declining corporate profits, a sell-off can occur. Additionally, with lower returns on safer assets post-rate cut, investors might reassess their risk tolerance, leading to a temporary shift away from stocks.

Understanding the nuanced relationship between the S&P 500 and the federal funds rate is pivotal. While the short-term market response to a rate cut can be a dip due to perceived economic weakness, the longer-term perspective often reveals a positive correlation driven by stimulated economic growth. In the realm of machine learning and quantitative analysis, decoding this complex dance is not just about understanding the steps but also about anticipating the rhythm and preparing for the next move in the ever-evolving quest to beat the market.

Leave a comment