I spent a lot of time playing with with retracement concepts and have a pretty good playbook for those setups, but the probability is so dependent on market conditions that I’ve switched my focus to a different setup: major move detection.

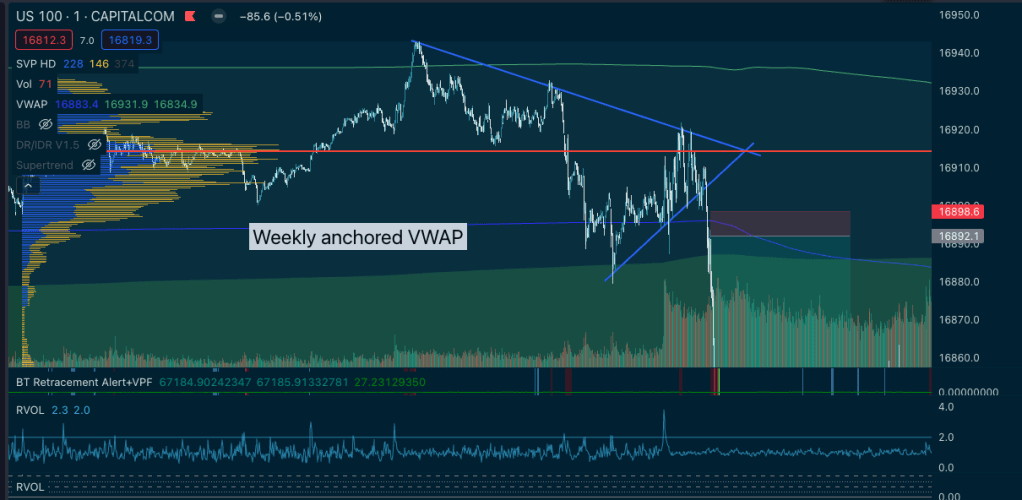

This setup has a few components and I’ve only been able to spot it and trade it a couple times so far. The quant is a bit tricky to codify but your eyes can see it. I traded this setup today on NAS.

The setup is as follows:

- Symmetrical consolidation on point of control (Session Volume Profile – the red line.). Symmetrical triangle, whatever you want to call it. I’m having a hard time getting quant to pick this setup up because the volatility drop isn’t significant enough for the Bollinger bands to contract to a statistic outlier – it’s easier to spot expansions so I’ll have to tune my alerting.

- Clean break. Watch for other levels like anchored VWAPs.

- Ensure VOLD is supportive of a directional break the way you’re trading.

- Check RVOL – you can validate these and not enter them too early if you keep an eye on the RVOL. You’ll usually see it spike +3 on the real move or just before it. I had an entry early on the setup that failed, so it took me a couple tries to get an entry to stick. Ultimately, waiting for the weekly VWAP to break was a safer signal for entry.

This setup and momentum should be extremely clear and low stress. This is a setup to take with an extremely heavy position. Personally, I take profit and try to catch the retrace at every pause, but it’s your game. You might give up a little profit but you’ll keep the gains. Using RVOL on indices is really tricky too – it’s easier to spot on crypto markets. I haven’t had a chance to test this out a lot but that was my observation when I was forward testing.

This play is from today, I caught most of the daily range. I entered this late as another day I tried it, it bounced into PoC/VWAP and that trade failed. Today’s setup you’ll note that RVOL has spiked +3 before the move, so this is of interest to me. It’s at market open, maybe not much here, but it’s a good confirming signal that there is enough eyeballs on the downward thrust. If I don’t see a solid +3 spike in RVOL during the consolidation, I know to be careful and risk it appropriately. VOLD was .3-.5 on NYSE metrics, which was signalling to me to play the day to the downside. But I waited for the VWAP to break as it was such a strong level. Both S&P and Nasdaq clocked a critical level in tandem, so it was a very easy trade and I was ready for it.

This setup works, and it hits way bigger trades than the retracement strategies I’ve been cooking up. I just need to figure out how to quantify and alert on it, as my current strategy of using BB contraction isn’t catching these setups in alerts as reliably as I’d like. This one occurs over market open though, so there is a large volatility expansion. This is a time of day I’d be watching the market anyway.

And so I evolve. This playbook entry marks a bit of a shift in focus as Nov/Dec taught me a lot of lessons about playing with the trend instead of looking for mean reversion all the time. I’ve been lucky enough to catch the last two major pullbacks with decent size.

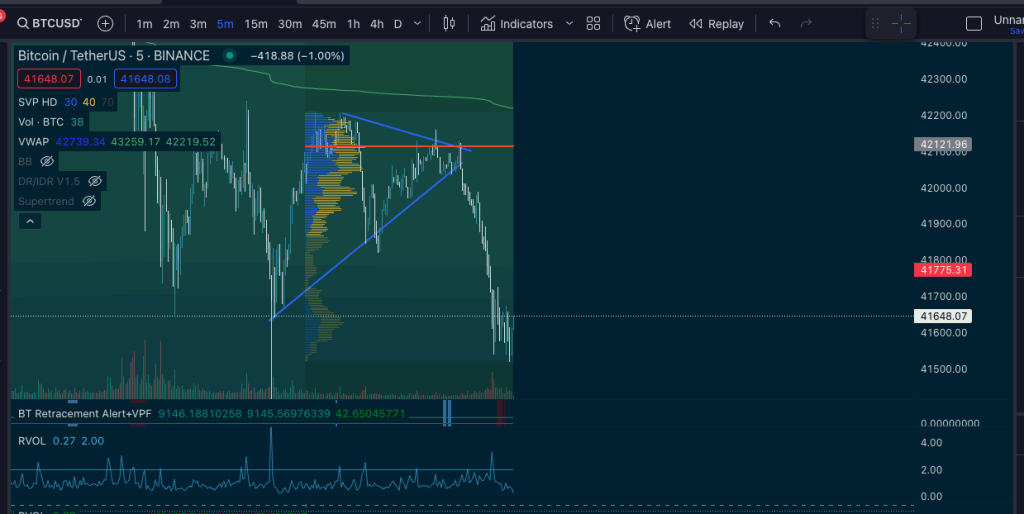

I just checked Bitcoin to see what happened today, and it printed a similar setup. This time my alerting catches the contraction tho. RVOL doesn’t spike but the setup played out. In this case, the expansion is in European open hour.

Leave a comment