Welcome back to my trading journal, where we’re going to attempt to 1000x a $500 investment utilizing technology and modern prop firms like FTMO to gain huge leverage on our dollars. On this second day of my journey, I’m focusing on a pivotal aspect of any successful trading strategy: backtesting. My tool of choice today: Freqtrade, an open-source trading bot that’s helping me navigate the waters quickly.

Today, I ventured deeper into the realm of strategy selection and backtesting, specifically targeting the crypto pairs offered by FTMO. My mission? To uncover strategies that not only promise high returns but also exhibit exceptional win rates, the kind that can turn the tide in the high-stakes environment of proprietary trading challenges.

In my quest, I scoured the digital expanse for strategies that stood out. One, in particular, caught my eye—a strategy boasting a near-mythical 94.4% win rate over the past year on large cap crypto markets that FTMO has access to. The strategy is a rare gem, offering setups that don’t come by often, but when they do, they’re golden.

As I prepare to broaden my testing to include a wider array of small-cap assets on platforms like BingX, as well as big-boy equity markets, my goal remains clear: to identify a strategy with a stellar win rate suitable for heavy-weight trades in FTMO‘s challenges, ensuring high probability outcomes.

Strategy Discovery and Backtesting

The digital world is a treasure trove of trading strategies, each promising its unique edge. After extensive research, I stumbled upon a strategy that piqued my interest due to its exceptional win rate of 94.4% over a year. The setups are rare, so I’ll keep working to find other strategies, but this one is a winner. When these setups land, it’ll be like finding a diamond in the rough – rare but invaluable.

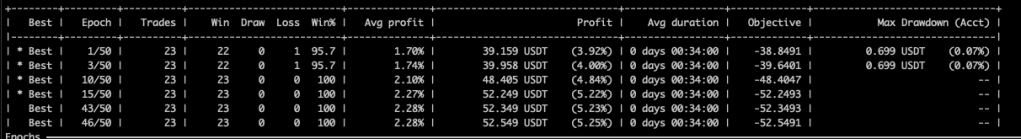

My approach to backtesting this strategy involves using Freqtrade to collect historic data for FTMO’s crypto pairs. I’m trying to validate different strategies in the market conditions in the last year to ensure that turbulent market conditions don’t wash profit. Many strategies fall apart in bearish conditions but this one stands up. This phase is crucial – it’s where theoretical strategies meet the hard reality of market unpredictability.

Update: I tried hyperopt tuning and was able to get improved results and find more trades across timeframes. I also started to work to be able to test with equity and commodity markets I have access to on the prop accounts. I’ll need this running on many markets to generate enough signal to trade while I’m in my trading hours (usually 6:30am PT or into Asian market hours ~5pm PT.)

Expanding Asset Pool

While the initial results are promising, I am conscious that a strategy’s success in one domain doesn’t guarantee universal applicability. Therefore, my next step is to test these strategies against a broader range of assets on platforms like BingX. This expansion is vital for two reasons: it tests the strategy’s robustness across different market conditions, and it prepares me for diverse trading opportunities, especially in the proprietary trading challenges offered by FTMO.

My goal is straightforward: to identify a set of strategies with a high win rate that are suitable for entering high-stakes trades with a higher probability of success. This strategy needs to be resilient, adaptable, and, most importantly, consistently profitable across various market conditions.

Retracement Strategies

In addition to the high-win rate strategy, I’ve also been testing several other retracement strategies. These strategies focus on identifying pullbacks within a prevailing trend, offering opportunities to enter trades at potentially advantageous positions. I’m hoping to dove-tail this on the research into market internals for trading equity indices. My preliminary backtesting results are showing promise, suggesting that these strategies could be effective in capturing profitable trades in most market conditions with minimal drawdown.

Alert Setup and Cross-Market Testing

The journey doesn’t end with finding promising strategies. The next crucial step is to set up efficient alerting systems for these strategies. My aim is to create a setup that notifies me of potential trades in real-time, allowing me to act swiftly on emerging opportunities. This is where the synergy between technology and trading acumen truly shines.

Moreover, I plan to extend my testing to encompass equity, forex, and commodity markets. While Freqtrade is primarily designed for crypto markets, its versatility allows for the integration of data from other markets. This cross-market testing is pivotal in understanding how my chosen strategies perform under different market conditions and asset classes, offering a more holistic view of their effectiveness.

Hyperparameter Optimization and Forward Testing

The next phase of my trading journey involves diving into the nuances of hyperparameter optimization. This process involves fine-tuning the strategy parameters to enhance their performance, adapting them to the unique characteristics of each market. It’s a delicate balance between overfitting and finding the optimal settings that offer the best predictive power.

Once the strategies are optimized, I’ll embark on forward testing them using a paper account. This will involve trading the signals by hand, simulating real trades without financial risk. Forward testing is crucial as it provides insights into how the strategies fare in real-time market conditions, further validating their reliability and profitability.

Conclusion

As Day 2 of my trading journey wraps up, I’m filled with a mix of anticipation and resolve. The path ahead involves rigorous testing, optimization, and adaptation. The goal is not just to find a strategy that works but to forge a robust, versatile approach that can withstand the unpredictable tides of the trading world.

In my upcoming updates, expect to hear more about the results of my forward testing, the challenges and triumphs of hyperparameter optimization, and the continuous evolution of my trading strategies. Whether you’re a fellow trader or simply an enthusiast, I hope my journey offers valuable insights and inspiration in the dynamic world of trading.

Stay tuned for the next chapter in this exciting venture, where theory meets practice, and strategies are put to the ultimate test.

Leave a comment